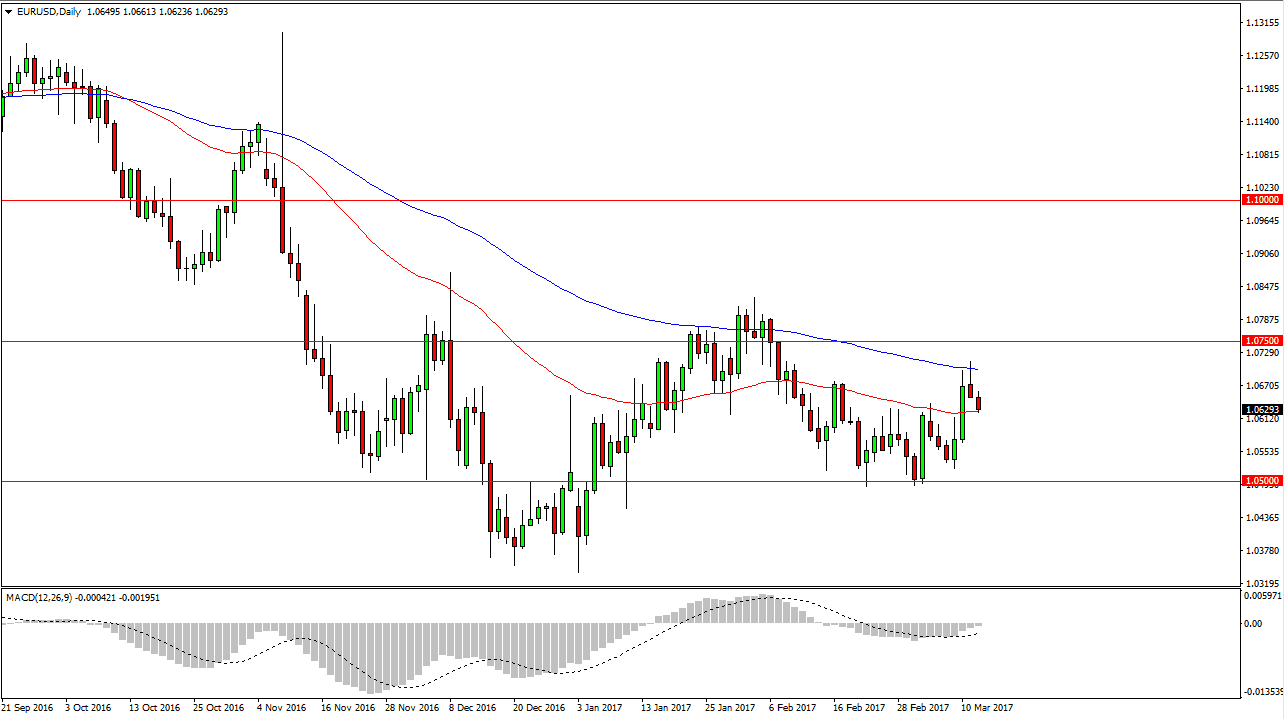

EUR/USD

The EUR/USD pair fell slightly during the day on Tuesday as we continue to see a bit of a roll over in this pair. With the FOMC Statement coming out today, it’s likely that we will continue to see negative pressure. This is because I believe that the Federal Reserve is going to sound rather hawkish, and it should push this market down to the 1.05 handle. Alternately, if we break above the top of the shooting star from the Monday session that is bullish, but there is a significant amount of resistance near the 1.0750 level. I believe that it is going to be choppy regardless, but longer-term I still believe in the downtrend.

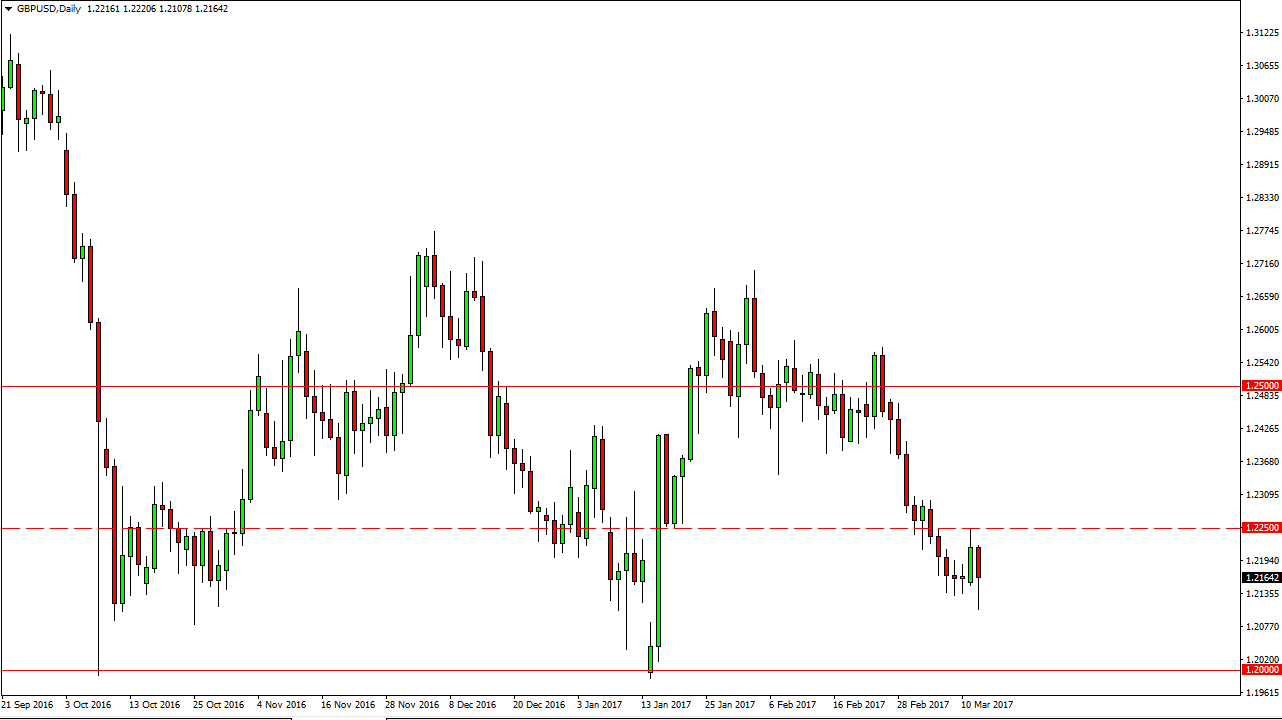

GBP/USD

The GBP/USD pair fell significantly during the day on Tuesday, as the 1.2250 level has offered enough resistance to turn things around. In fact, we sliced through the recent support, but bounce back above it. I think this shows that it is going to be rather choppy, so having said that I think it’s likely that a lot of back and forth short-term trading will be the case. It’s not until we break above the 1.23 level that I feel comfortable buying. If we break down below the bottom of the candle for the session on Tuesday, the market should then reach towards the 1.2050 level. The 1.20 level below should be supportive. If we can break down below there then we can really start to pick up momentum. This could be triggered by the so-called “article 50”, but I think that will be the zenith of bearish pressure in this market and it would only be a matter of time before the buyers come back looking for value.

I think it’s only a matter of time before we have to make a long-term decision that we are still very much stock in consolidation. Ultimately, this is a market that shows quite a bit of indecision, because I think a lot of people don’t know how to deal with all of the potential changes coming.