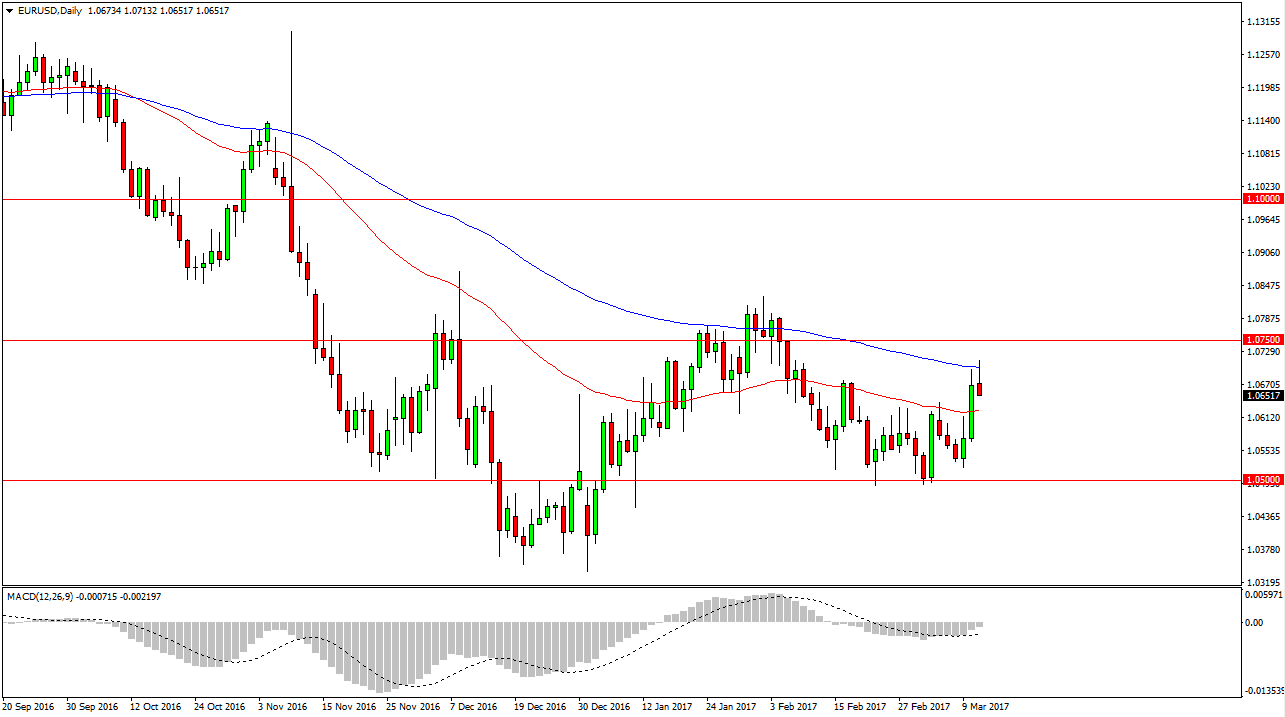

EUR/USD

The EUR/USD pair initially tried to rally on Monday but found the 100-day exponential moving average to be dynamic resistance. Because of this, we turned around to form a shooting star and it looks as if the pair will continue to drift a bit lower. Ultimately, I think that the 1.05 level underneath should continue to be supportive, but I think it will also serve as a bit of a target. I also believe that the 1.0750 level above is going to be resistance, so I believe that this pullback makes quite a bit of sense. Volatility will be the mainstay of this pair, as we weigh the difference between the 2 central banks.

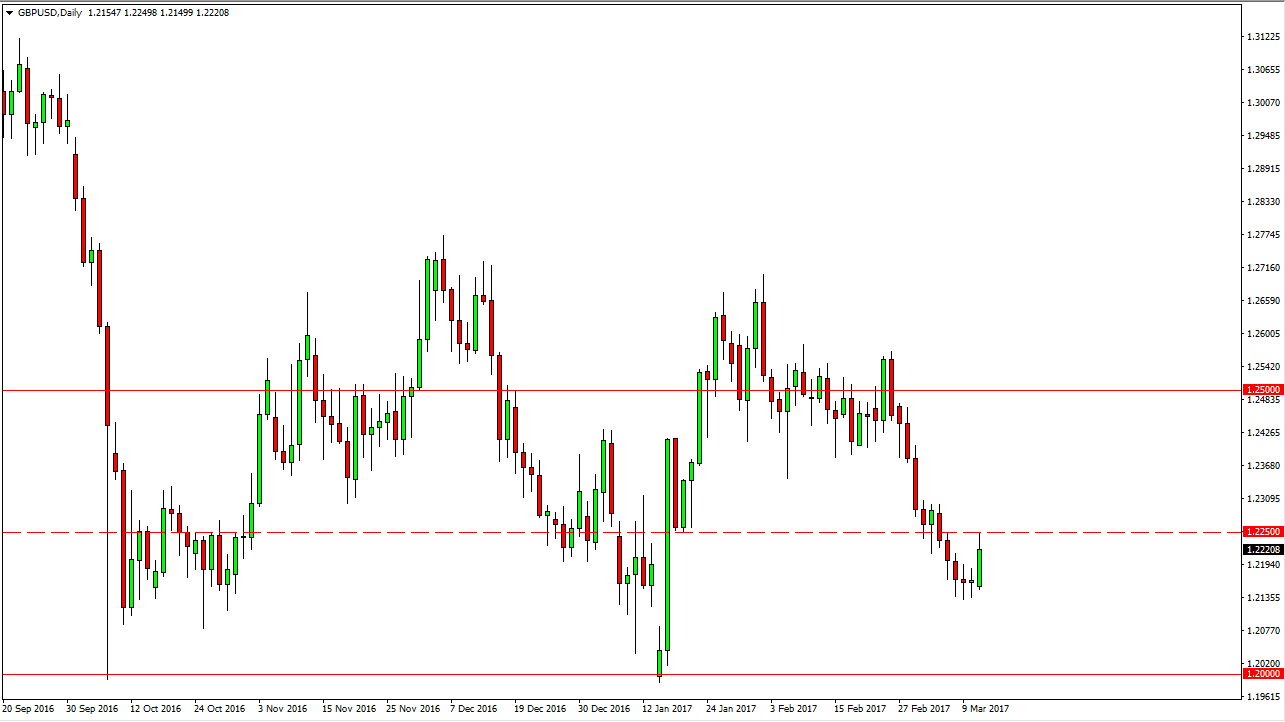

GBP/USD

The GBP/USD pair rally during the day on Monday, testing the 1.2250 level. Because of this, it looks as if there is a lot of interest in this area, and thus it looks like we could continue to go lower but I need to see and exhaustive candle to do so. Having said that, if we can break above the 1.23 level, we should continue to go to the 1.25 handle. However, and exhaustive candle should send this market back around to look towards the 1.2150 level, and then eventually the 1.2050 level. There is a lot of volatility in this pair and will more than likely continue to be as the Article 50 continues to make headlines. Ultimately, this is a market that will massively move lower upon that announcement, but that could very well be the end of the downward pressure. In fact, it’s likely that the market will “bottom out”, and perhaps offer a nice opportunity for longer-term buyers to take advantage of a massive turn around. After all, that will be the absolute zenith of negativity when it comes to the British pound.