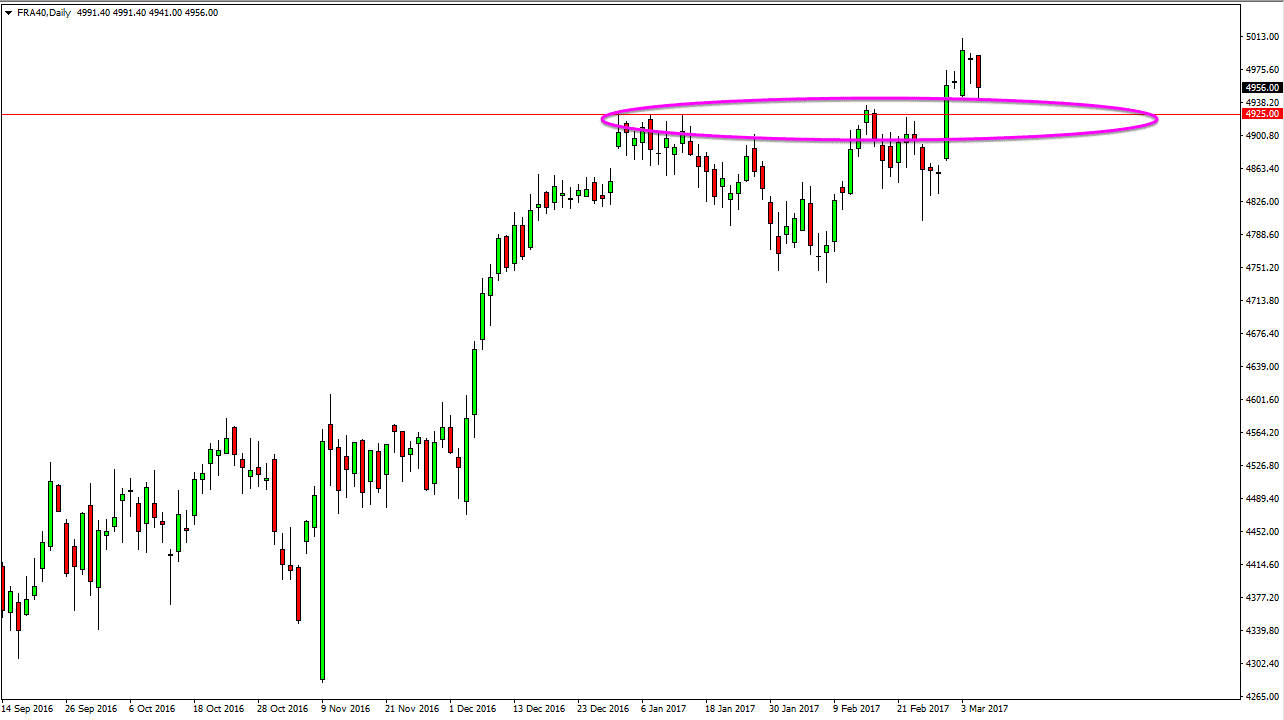

The Parisian index fell during the day on Tuesday, testing significant support near the €4950 level. I still see a significant support level at the €4925 level. I believe that given enough time buyers will return to this market and towards the end of the Tuesday session we did in fact see that start to be the case. Given enough time, I think that short-term traders will jump all over this potential buying opportunity as this is typical technical analysis, the market testing a previous area of resistance for support.

Quite often, when markets break out they will find the previous resistance barrier being supportive, and the need to test it to see whether there is a longer-term opportunity. I believe that the CAC falls within this category, as the Parisian stock market has been a bit of a laggard when it comes to the rest of the European Union.

Going forward, the one thing that I would point out is that the €5000 level offered resistance, but quite frankly that’s just a large, round, psychologically significant number. There’s nothing magical about it, and because of this I believe that the markets have simply reacted is a normally due to these large figures.

Going forward, the Euro continues to be very cheap and therefore it helps with exports. I believe that is part of the reasoning when it comes to Parisian stock traders, but also, we need to keep in mind that the bond markets are offering negative yields throughout the continent, and that forces money into riskier assets such as stock markets. Because of this, I think that money really doesn’t have anywhere else to go. This is the market that is getting the most attention currently, mainly because of the elections. However, I believe that it will simply move in lockstep with the DAX and other European indices, offering support at this area and more importantly: value.