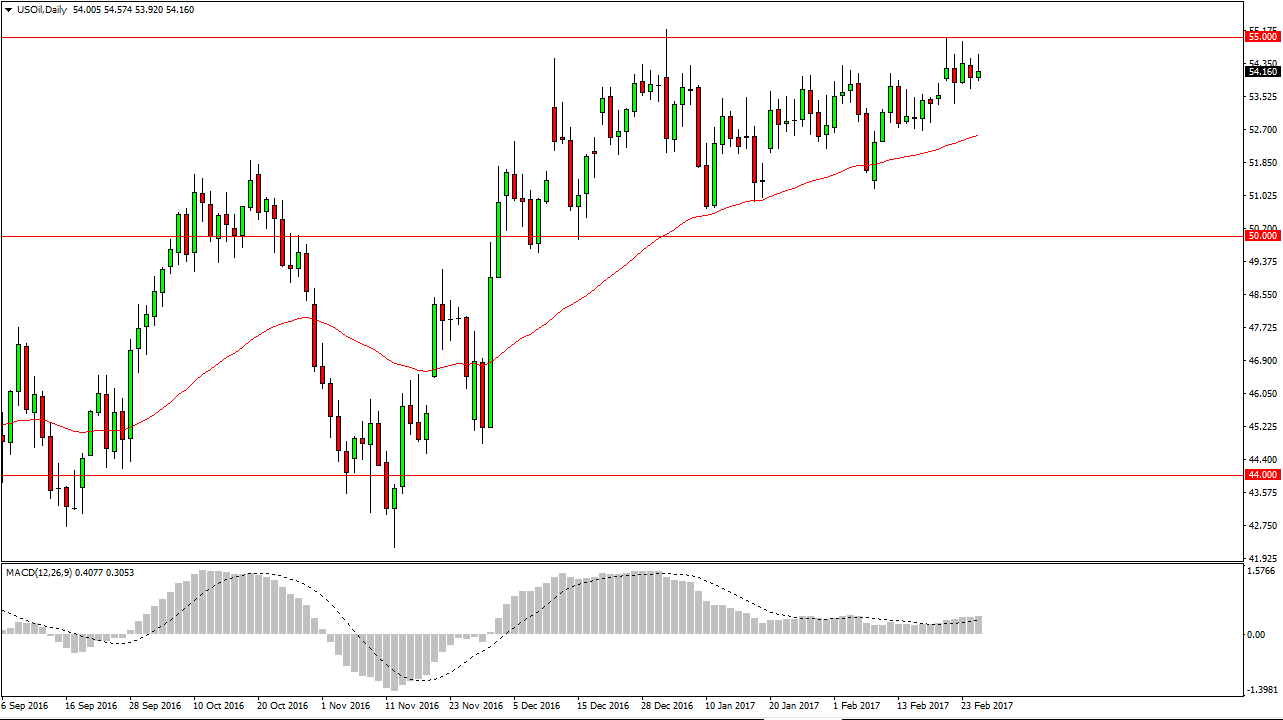

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday but failed again. Because of this, it looks as if every time we reach towards the $55 level it’s probably going to be a selling opportunity. I believe that a break above the $55 level would of course be very important, and would have buyers flooding into this market. Currently though, it does not look as if we have the momentum to get above that barrier, so therefore I continued to short this market on short time frames. A breakdown below the 50-day exponential moving average would be very negative, but we are a long way from doing so. Ultimately, I believe that the market will continue to struggle going forward as the oversupply continues to be a major issue.

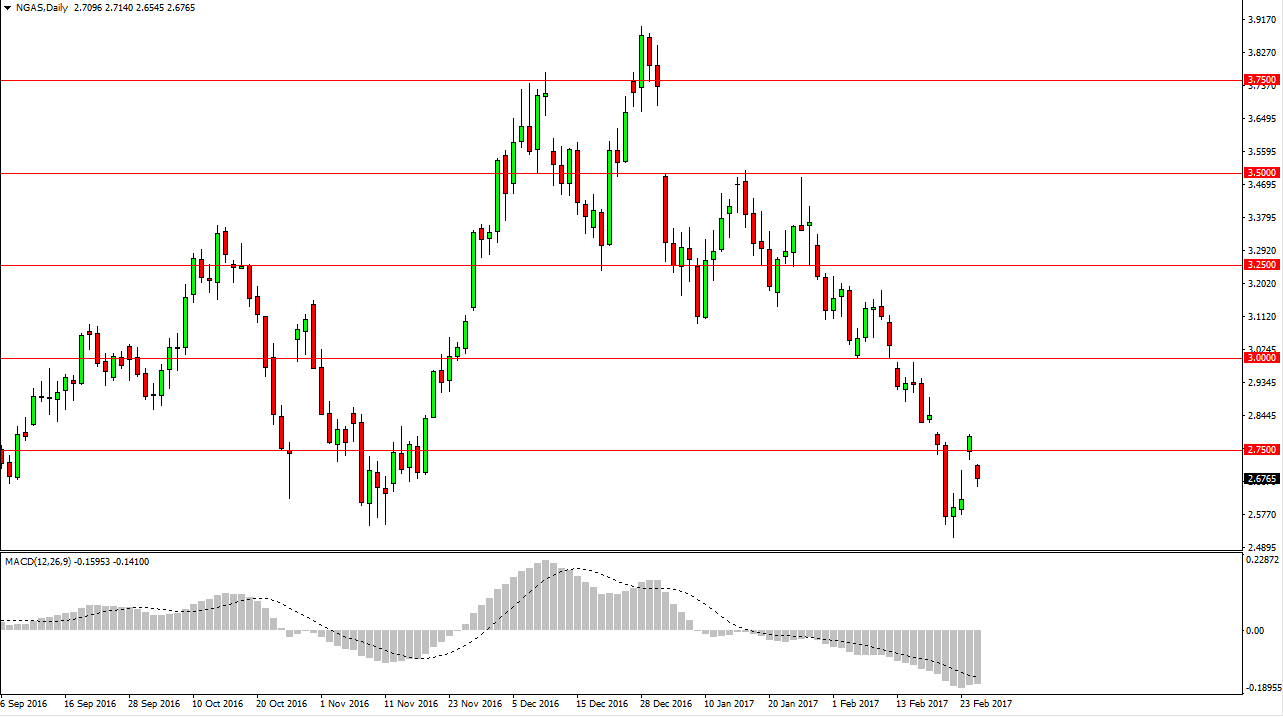

Natural Gas

The natural gas markets gapped lower at the open on Monday, as we continue to see bearish pressure in this market. I have no interest in buying this market, and every time we rally I think it’s only a matter of time before we can start selling. The $2.75 level above continues to be the beginning of serious resistance, so I believe that an exhaustive candle in that area should be a nice opportunity. I have no interest in buying this market because the oversupply should continue to be a massive issue. In fact, it seems as if the supply is only growing. With the warmer temperatures in the United States, the market should continue to lack any serious demand, so it’s only a matter of time before the sellers get involved.

If we can somehow breakdown below the $2.50 level, the market will continue to go much lower. I think that happens given enough time, but we may have some work to do before we can see those types of moves.