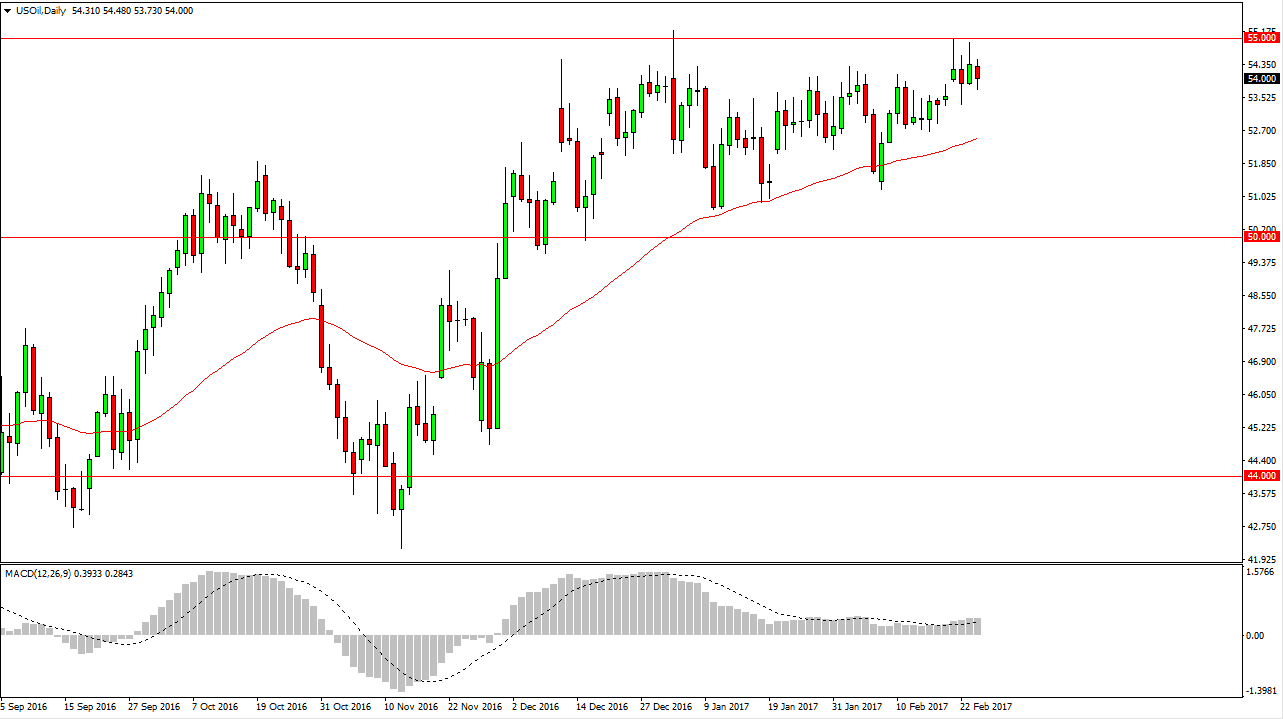

WTI Crude Oil

The WTI Crude Oil market fell during the day on Friday as we continue to see a significant amount of volatility just below the $55 level. Even though the markets got a better than expected inventory number this week, the reality is that we are still seeing the inventories grow, and that of course continues to put a bit of weight upon the market. The $55 level has been massively resistive to begin with, so having said that I think if we can break above there, the market will then reach towards the $60 handle. However, in the meantime I think we are very likely to find sellers jump in. If we can break down below the $53.50 level, the market could continue to go much lower. Longer-term, I believe in the selling story but right now I think it’s still a bit early.

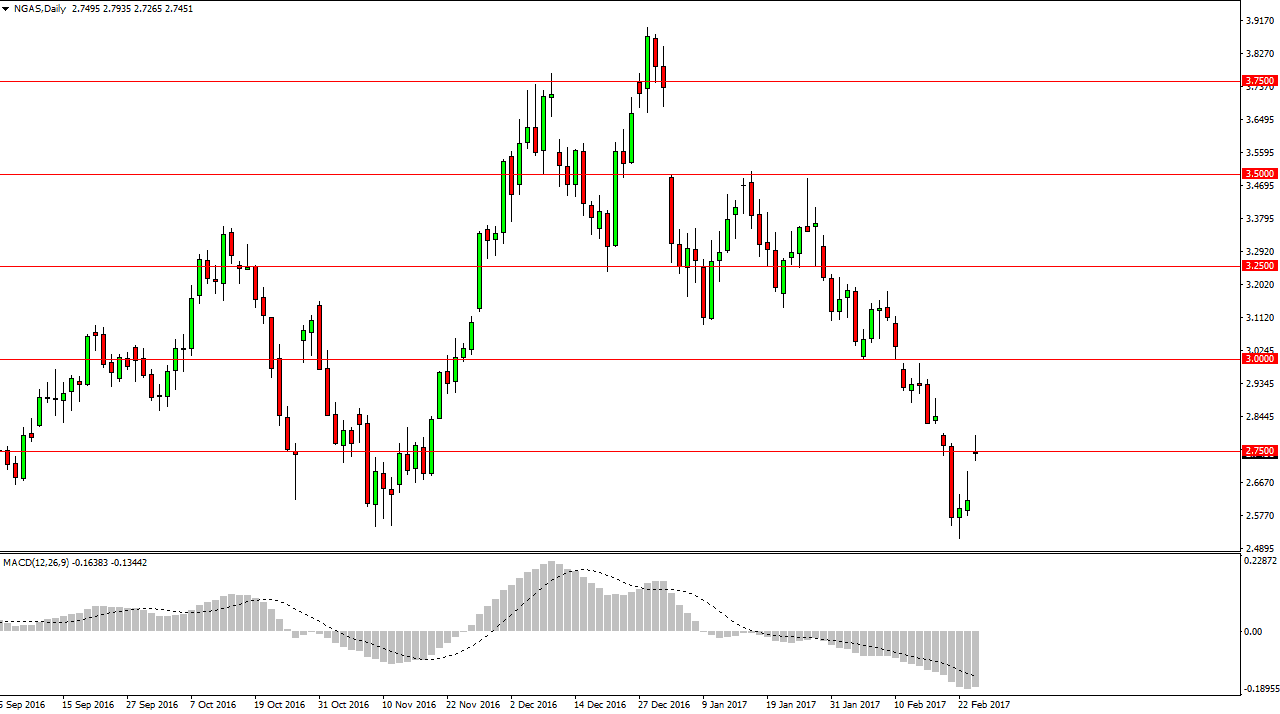

Natural Gas

Natural gas markets gapped higher on Friday, and then peaked above the $2.7500 level, but found enough resistance to turn things back around to form a shooting star. The gap of course is bullish, and if we can break above the top of the shooting star that would be bullish as well as it is touching the previous gap. However, there’s no way to argue that we are in a downtrend so I think that a breakdown below the bottom of the shooting star for the Friday session is a selling opportunity as we should then at least fill the gap that form from the Friday morning. Either way, even if we rallied from here rather significantly, I believe that only offer a selling opportunity as the markets have been so horrifically bearish, and it has been so warm and some of the largest markets for natural gas recently. I have no interest in buying this market.