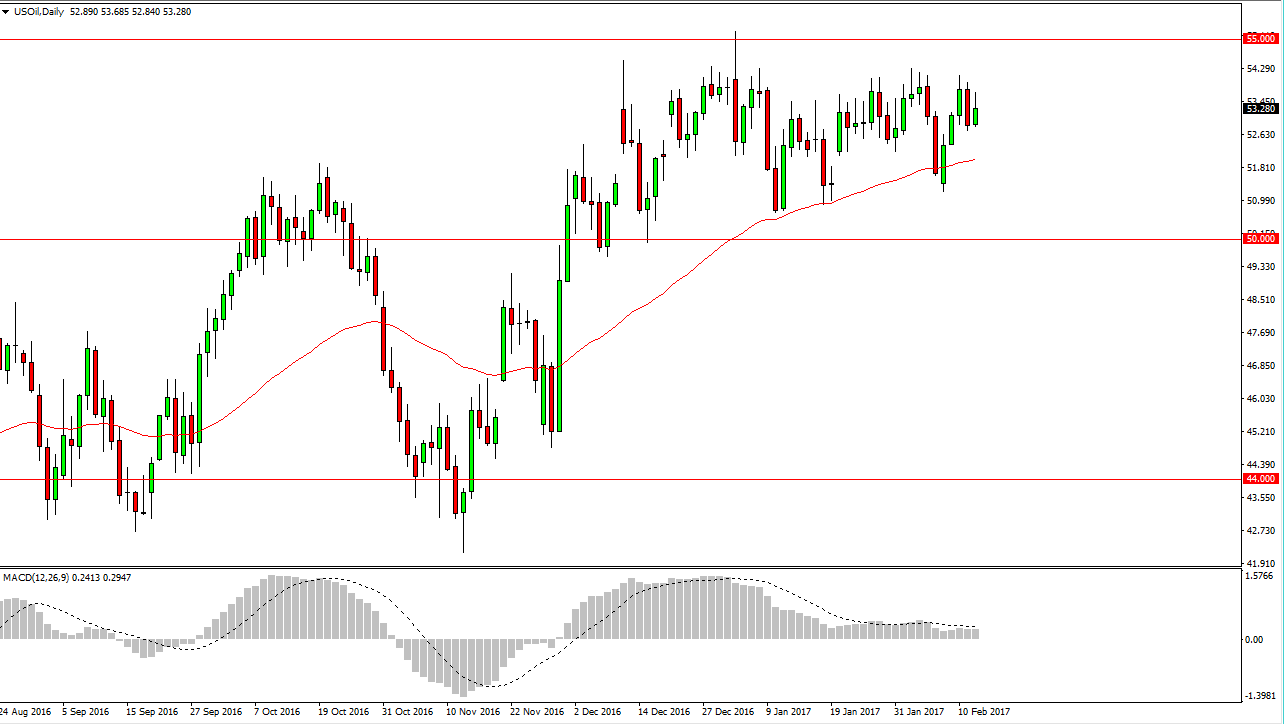

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the day on Tuesday, bouncing off the $53 level. The market then reach towards the $54 level above, but pulled back slightly. With the inventory numbers coming out today, I believe that the market will continue to pay attention to oversupply, but at the same time we have people paying attention to the OPEC production cuts. Because of this, it’s likely that we will see a lot of back and forth and the 50-day exponential moving average level has been supportive. Ultimately, I believe that this market continues to go back and forth but eventually the sellers get involved. Once the sellers push lower, I think we will reach towards the $51 level, and then reach down to the $50 level. A breakdown below there, the market should continue to go much lower. However, if we break above the $55 level, then we could reach towards the $60 handle.

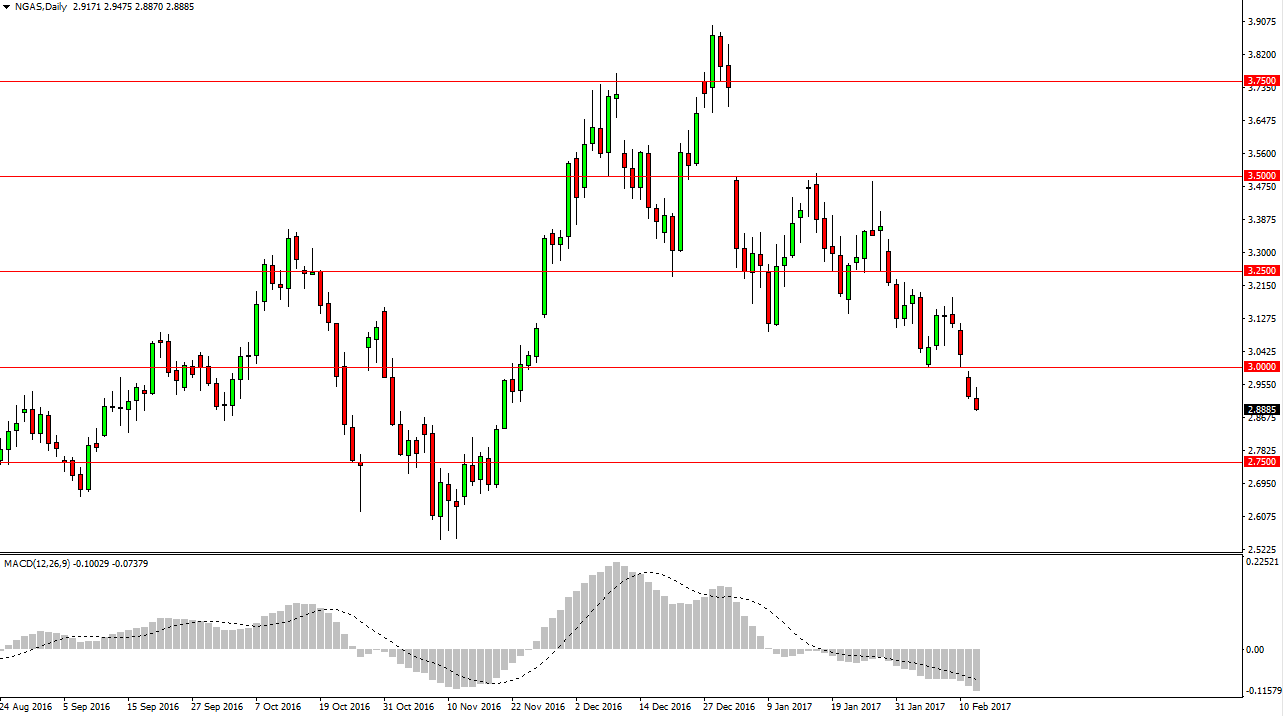

Natural Gas

The natural gas markets initially tried to rally during the day on Tuesday, but then turned around to form a negative candle. This of course suggests that we are going to continue to go lower, perhaps reaching towards the $2.75 level. That’s an area that of course has quite a bit of psychological significance, and with this being the case it’s likely that a short-term rally will only offer selling opportunities. The $3 level above gives us an opportunity to test significant resistance, and gives us an opportunity to start selling longer term. The market has been in a downtrend for some time, and I think a continues to do so as the temperatures have been reasonably warm in the United States, and of course the US is the largest consumer of natural gas in the world. Because of this, it’s likely that the market will continue to be very volatile but negative.