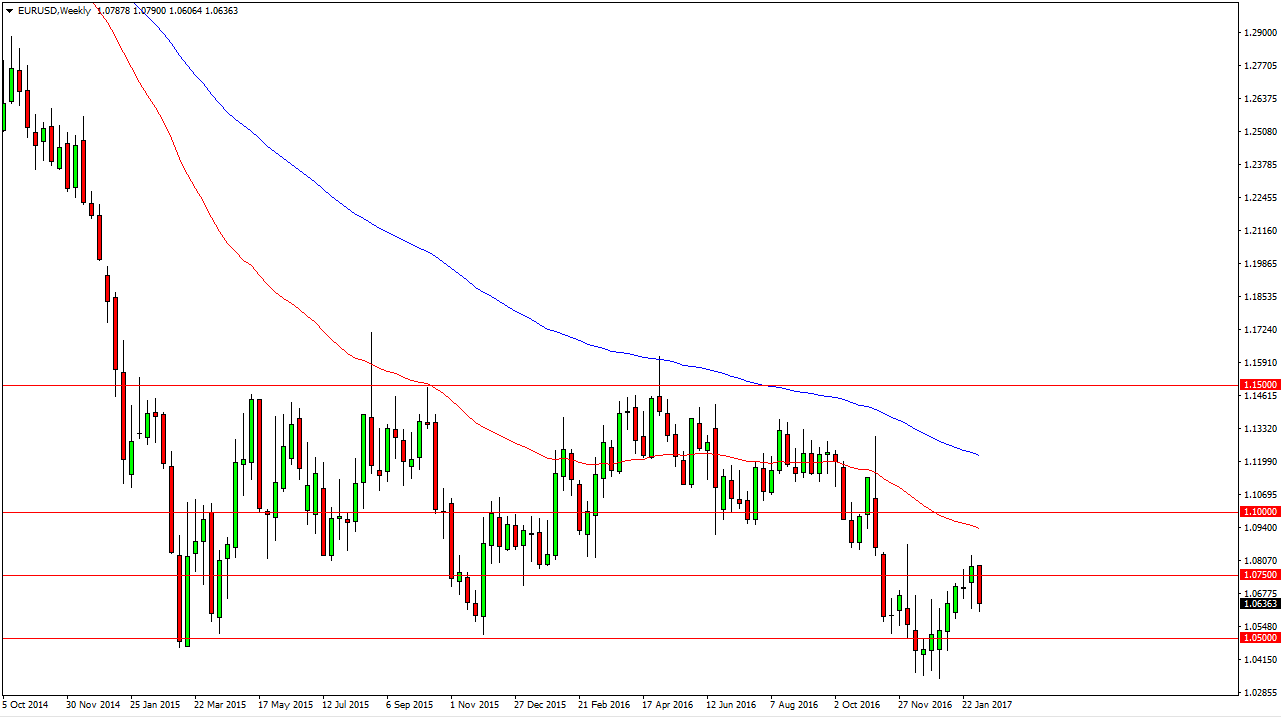

EUR/USD

The EUR/USD pair fell during the course of the week, but the most important candle that I saw was the hammer that formed on Friday. I believe that the market will more than likely find buying at the beginning of the week, followed by selling as we reach towards the 1.0750 level to the upside. Ultimately, it is going to be volatile regardless what happens next.

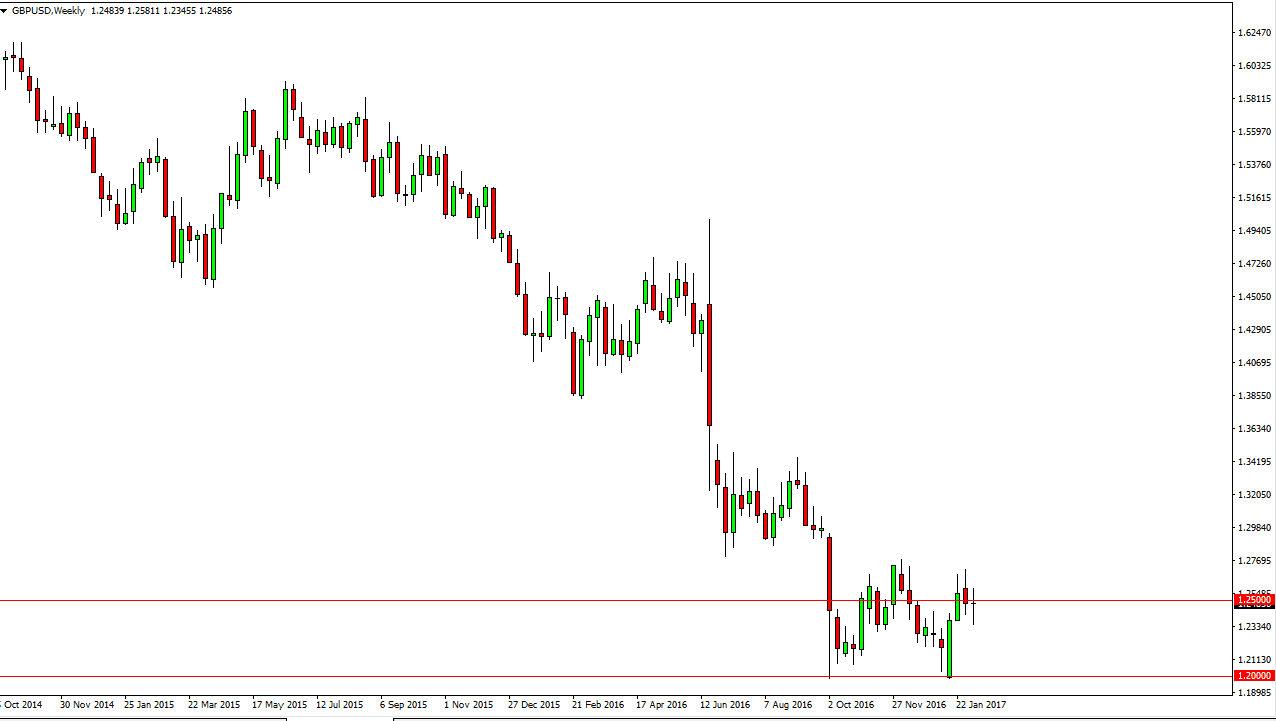

GBP/USD

The British pound went back and forth during the week, as we continue to hover around the 1.25 level. If we can break above the high from the Friday session, I think that will probably try to grind towards the 1.27 level. If we can break down below the bottom of the range for the week, then the market will probably reach towards the 1.2250 level below which has minor support.

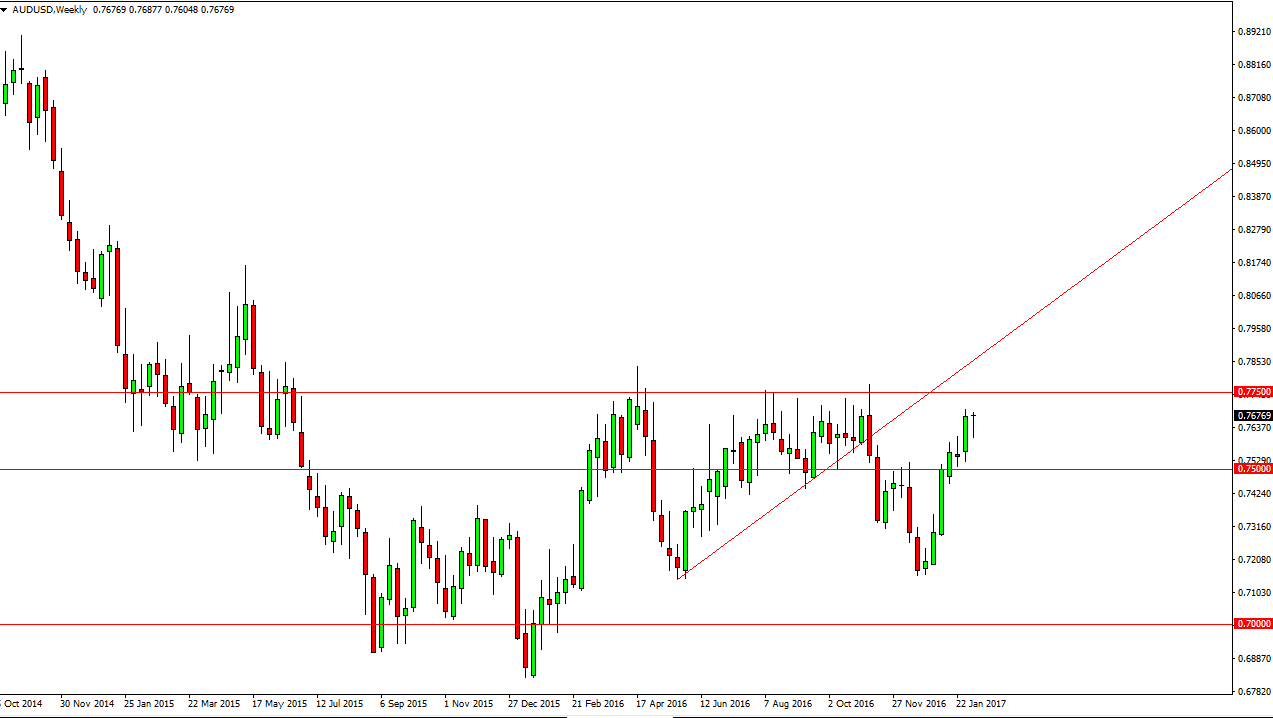

AUD/USD

The Australian dollar initially fell during the week, but found enough support to turn around and form a dragonfly doji. Because of this, looks as if the market is going to press up against the 0.7750 level above. Once we break above there, I feel that the Australian dollar can continue to go much higher. Pay attention to the gold markets, if they rally at the same time I think that will continue to be yet another reason to see this market grind to the upside. Short-term pullbacks could very well end up being nice buying opportunities.

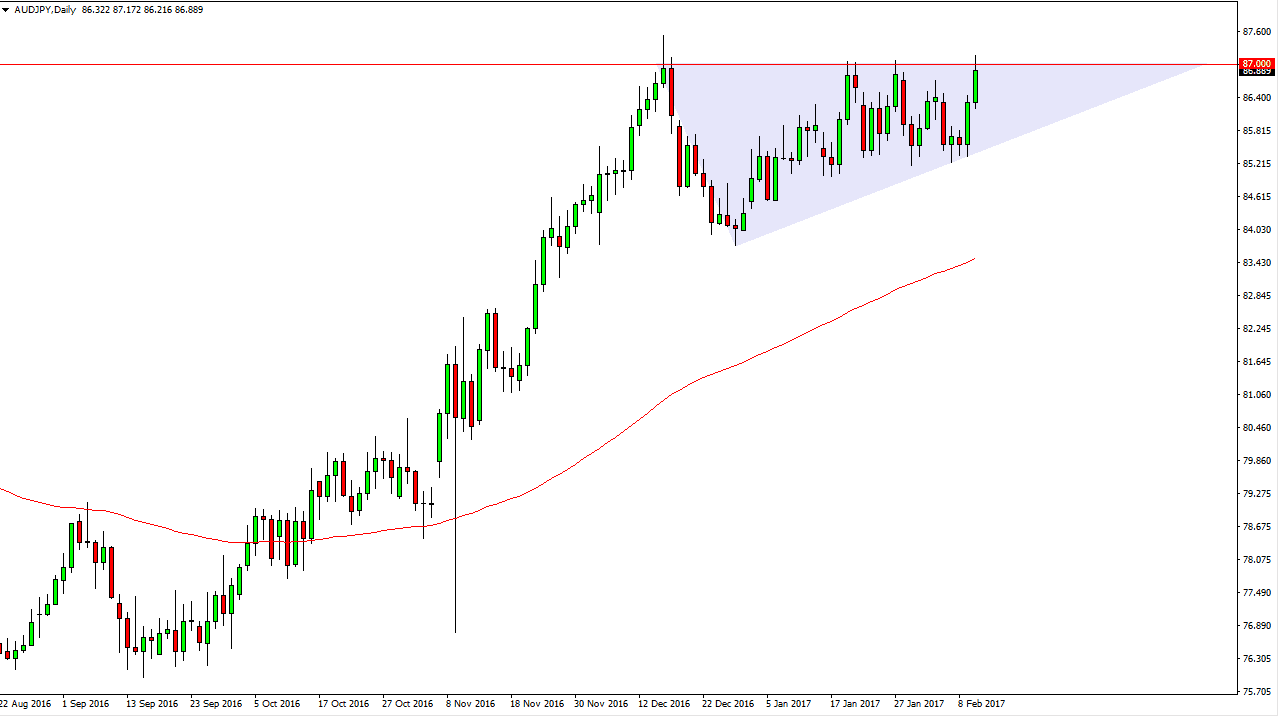

AUD/JPY

The Australian dollar had a very strong week against the Japanese yen, testing the 87 level. It’s an area that has a lot of noise just above a, but we can break above the top of the range for the week, I believe that the market will continue to grind much higher. Pullbacks should be thought of as buying opportunities, as the Japanese yen is on its back foot against most currencies anyway.