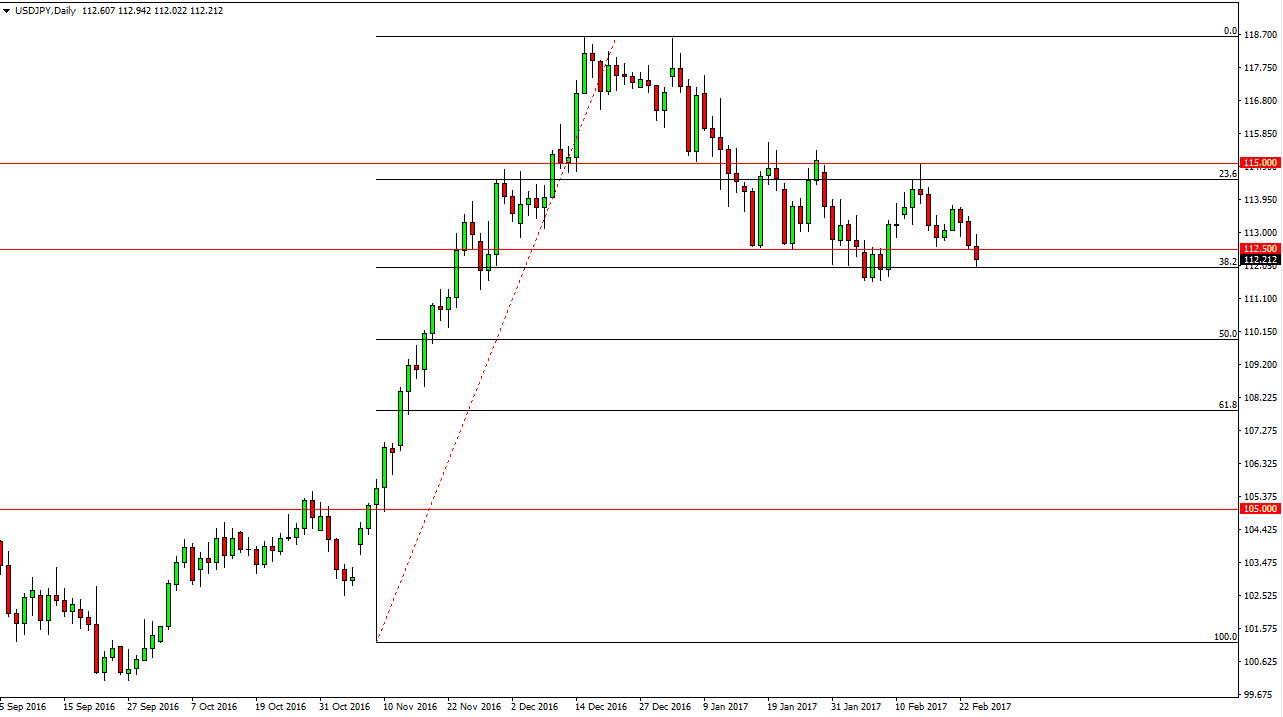

USD/JPY

The USD/JPY pair initially tried to rally on Friday but gave back all of the gains and ended up falling towards the 30.2% Fibonacci retracement level. This is a market that has a lot of support just below there though, so we can break down below the 111.50 level, the US dollar will more than likely fall to the 50% Fibonacci retracement level at the 110 handle. Alternately, if we can break above the top of the candle for the Friday session, the market should then reach towards the 115 level. I believe longer-term that this pair does continue to go higher, but there is obviously a bit of bearishness and volatility at the moment.

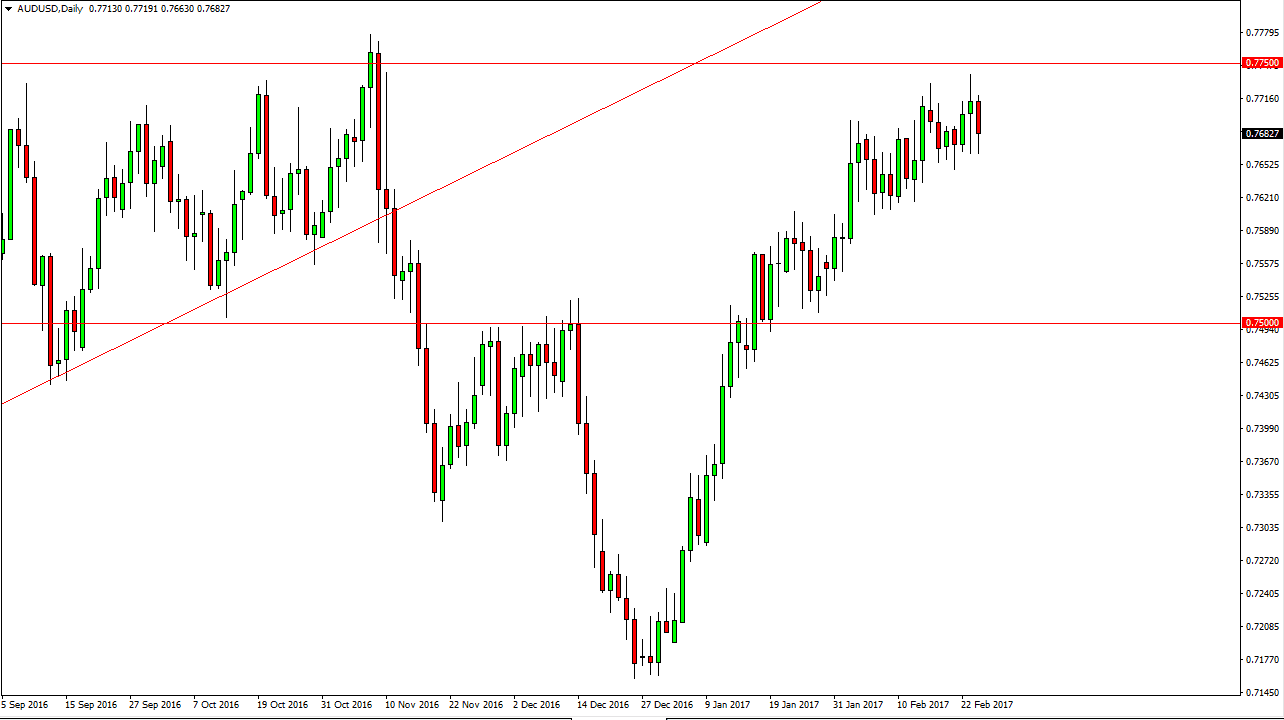

AUD/USD

The AUD/USD pair fell during the day on Friday, as we continued to see a little bit of a “risk off” type of move. Alternately though, the gold markets have shown a bit of strength and they are continuing to go to the upside. If that’s the case, the Australian dollar typically gains, and I believe that will continue to be the case. This market should see a bit of support at the 0.7650 level below, and perhaps even lower than that. I think that the 0.7750 level above is resistive and if we can break above there, we should then reach towards the 0.80 level. The fact that gold is breaking out suggests that it’s only a matter of time before that happens but I believe there’s going to be a lot of choppiness between now and then.

Ultimately, there is a lot of volatility in this pair but I think if you take a longer-term approach, you can see that the buying pressure certainly seems to be increasing. At the very least, every time we dip it seems as if the buyers are willing to come in and buying more. Obviously, that’s a very healthy sign.