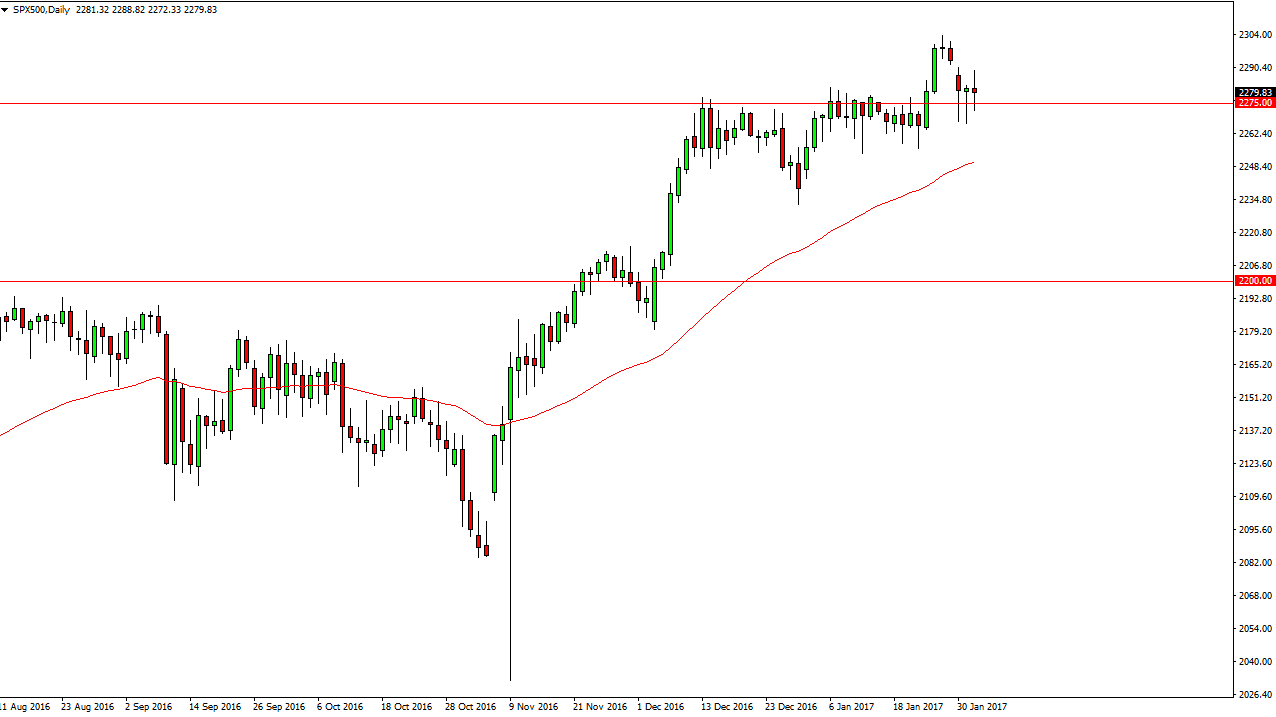

S&P 500

The S&P 500 went back and forth on Wednesday, as we continue to see support at the 2275 handle. I think that the market is trying to build up enough momentum to continue the uptrend, but we obviously have quite a bit of difficulty to deal with right now. The 50-day exponential moving averages just below, and it does offer dynamic support. Besides that, there’s a lot of noise between here and 2250, so I think it’s only a matter of time before the buyers get involved anyway. I have no concerns about buying here, but I also recognize that I’m going to have to deal with choppiness in the short term to realize my profits. I believe that the 2300 target still will be reached, and then possibly even higher than that.

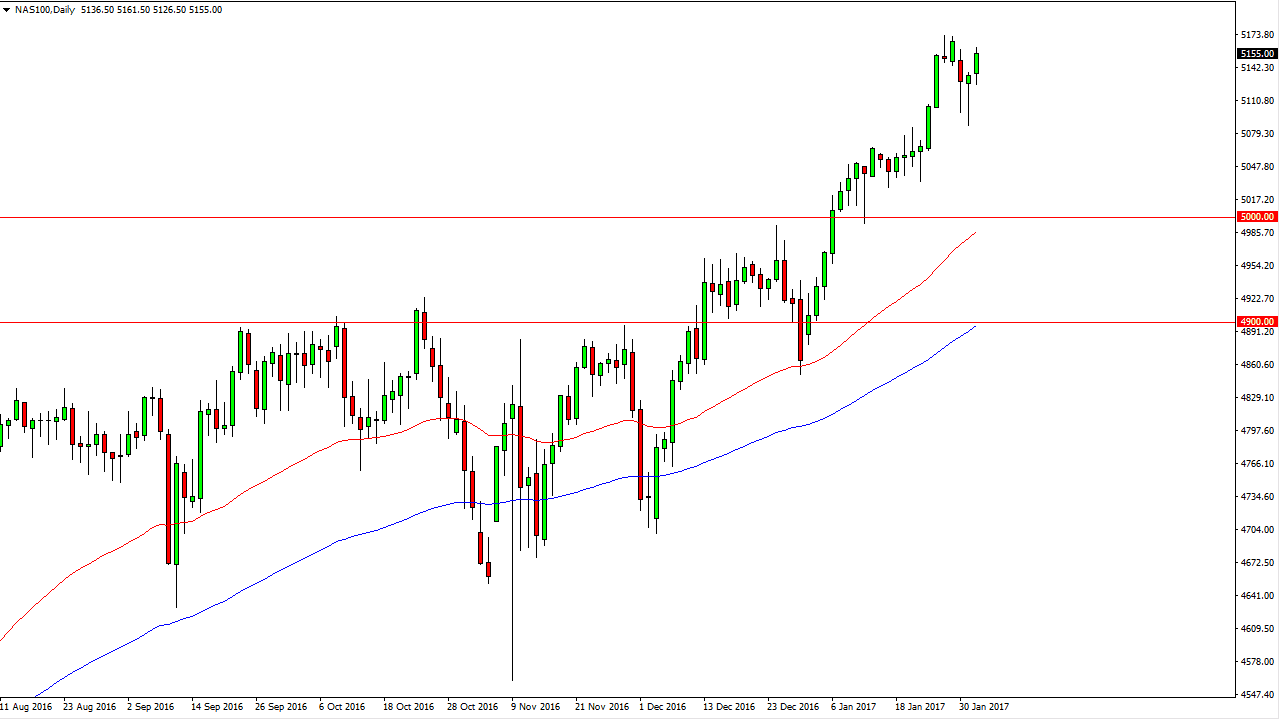

NASDAQ 100

The NASDAQ 100 rallied during the day on Wednesday, breaking the top of the hammer that had formed on Tuesday. This is very bullish sign and as usual looks as if the NASDAQ 100 is going to pull the rest of the US indices higher. I think that the market will make a fresh new high relatively soon, and every time it pulls back there will be plenty of buyers underneath looking to take advantage of perceived value in the market. We are bit overextended of the moment, but I think that we are starting to see a bit of a return to quality here, as the NASDAQ 100 has been so much better than the others.

I think that there is a floor at the 5000 level, and right now I have a target of 5250, but quite frankly that’s only because it’s a large round number. There’s nothing special about that number, beyond that. I think that it is a longer-term buy-and-hold type of market, so this is almost more like an investment than a trade.