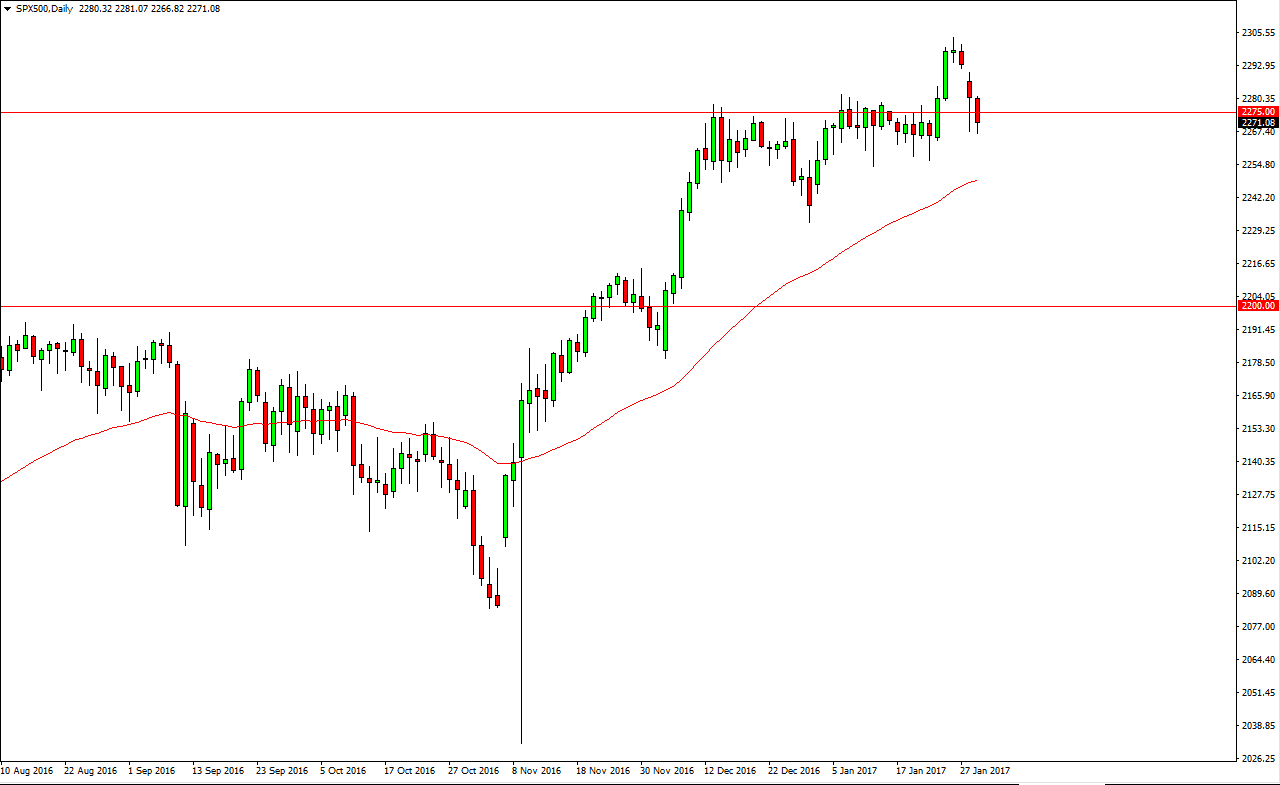

S&P 500

The S&P 500 falling during the session on Tuesday shows that we still have a bit of exhaustion in the market, but I think there is more than enough support all the way down to the 2250 level to cause a bounce sooner rather than later. Once we break above the 2275 handle, I feel that the market will continue to reach towards the 2300 level I don’t know to in the text above, and with that being the case could go much higher than that. The 50-day exponential moving average has been offering dynamic support, and it is coming close to the bottom of the trading range currently. I have no interest in selling the S&P 500, I believe that US indices overall will do much better than global indices.

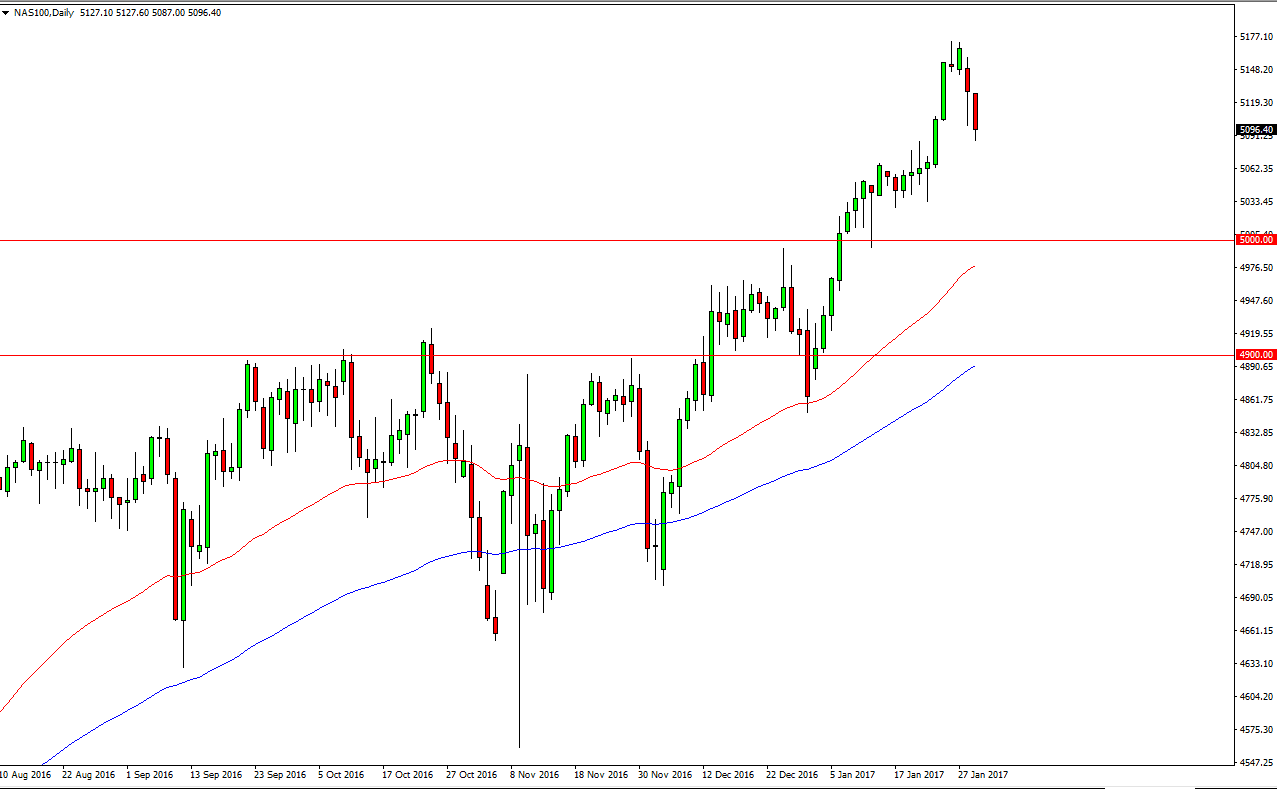

NASDAQ 100

The NASDAQ 100 fell during the day on Tuesday, breaking the bottom of a hammer from Monday. While this is a very negative sign, I see a lot of support at the 5050 level, and of course at the 5000 level underneath their which should be the “floor” in the market. I believe that a supportive candle is a buying opportunity, and should continue to give people who may have missed the surge higher an opportunity to get involved.

Pullbacks should offer value the traders want to take advantage of, because quite frankly this has been an explosive moved to the upside. Nonetheless, I believe that given enough time we go to the 5200 level, and then much higher. The market certainly seems to be following the NASDAQ 100 in general, as it has led US indices higher for several weeks. I believe that not only is this market going to turn around, but it’s probably going to drag all the other major indices around the world higher with it. I have no interest in selling.