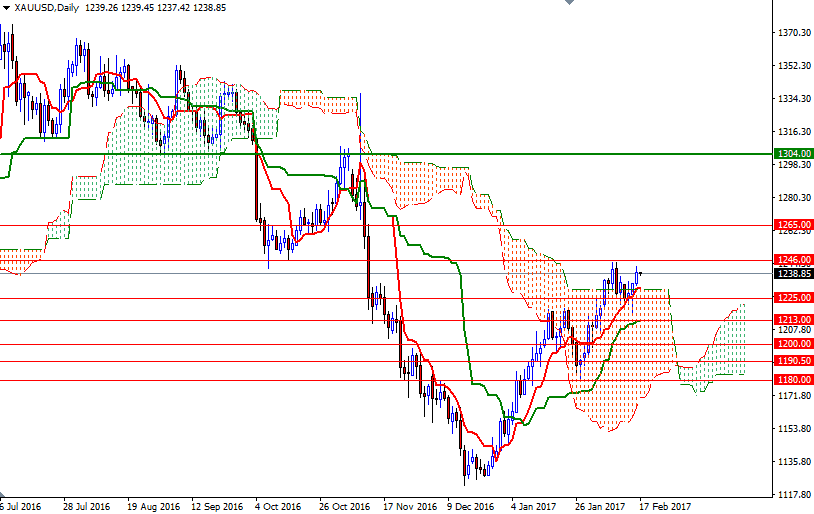

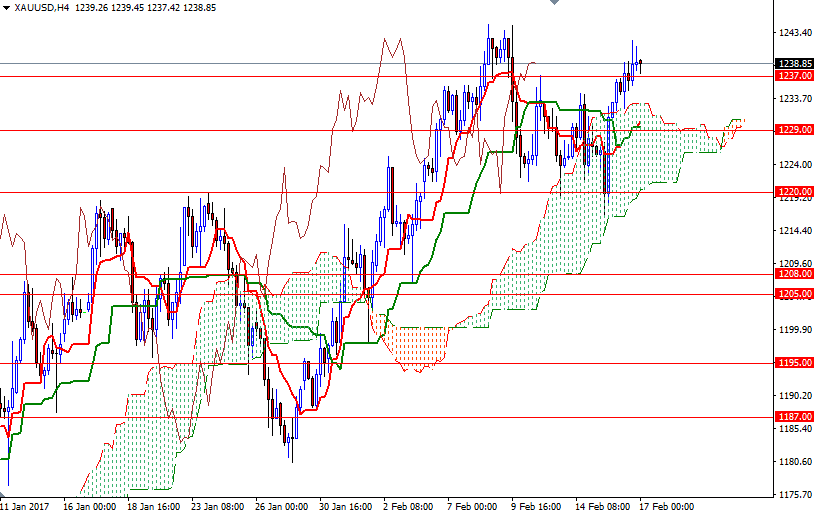

Gold prices ended Thursday’s session up $5.84, supported by a lower U.S. dollar index and a slide in U.S. equities. The pauses in global equity markets were also a positive element for the yellow metal. The XAU/USD pair initially pulled back the $1232/29 area but bounced up from there and eventually broke through $1237/5. The market is currently at $1238.85, slightly lower than the opening price of $1239.26.

The short-term technical charts remain bullish, with the market trading above the Ichimoku clouds. In addition to that, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. If the market continues to stay above 1237/5, then prices will probably approach the first barrier standing in the 1247/6 area. A break through there could trigger a push up to the key technical resistance at 1252.

However, if the bears increase downward pressure and drags prices below 1237/5, we may revisit 1232/29. A break down below the 1229 level could encourage sellers and increase the possibility of an attempt to test 1225. Closing below 1125 on a daily basis indicates the bears are aiming for 1220/19.