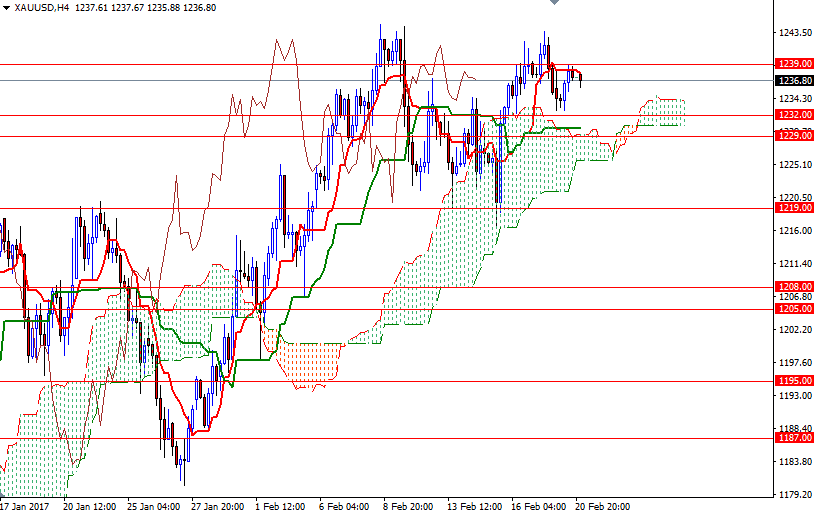

Gold prices ended slightly higher Monday but the trading range was relatively tight as the U.S. markets were closed for a public holiday. The XAU/USD pair swung between the $1232 and $1239 levels. The rising political risks across the globe lend some support to the market but steadily climbing world stock markets and a firming U.S. dollar continue to work against the precious metal. It appears that the market will remain range bound as investors turned their focus to the release of minutes of the Federal Reserve’s latest policy meeting.

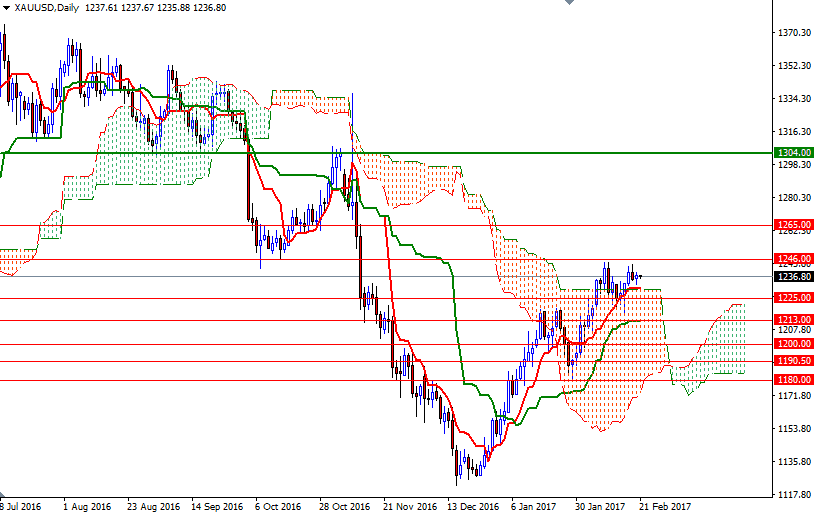

The market is trading above the daily and the 4-hourly Ichimoku clouds and we have positively aligned Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses. Despite positive short-term outlook, flat Tenkan-sen and Kijun-sen indicate there is a lack of momentum. Unless prices break up above 1239, the market will have a tendency to return to the daily cloud - in other words, the support in the 1232/29 will be tested. The bears will need to capture this strategic camp so that they can increase pressure and drag the market towards 1225. If XAU/USD falls through 1225, then 1220/19 will be the next target.

Breaking through 1239 would be a positive sign and help the bulls push prices towards the 1247/6 zone, which is the first significant barrier ahead. I think clearing the resistance in this area is essential for a continuation towards 1252. A daily close beyond 1252 suggests the bulls are getting ready to challenge 1261.