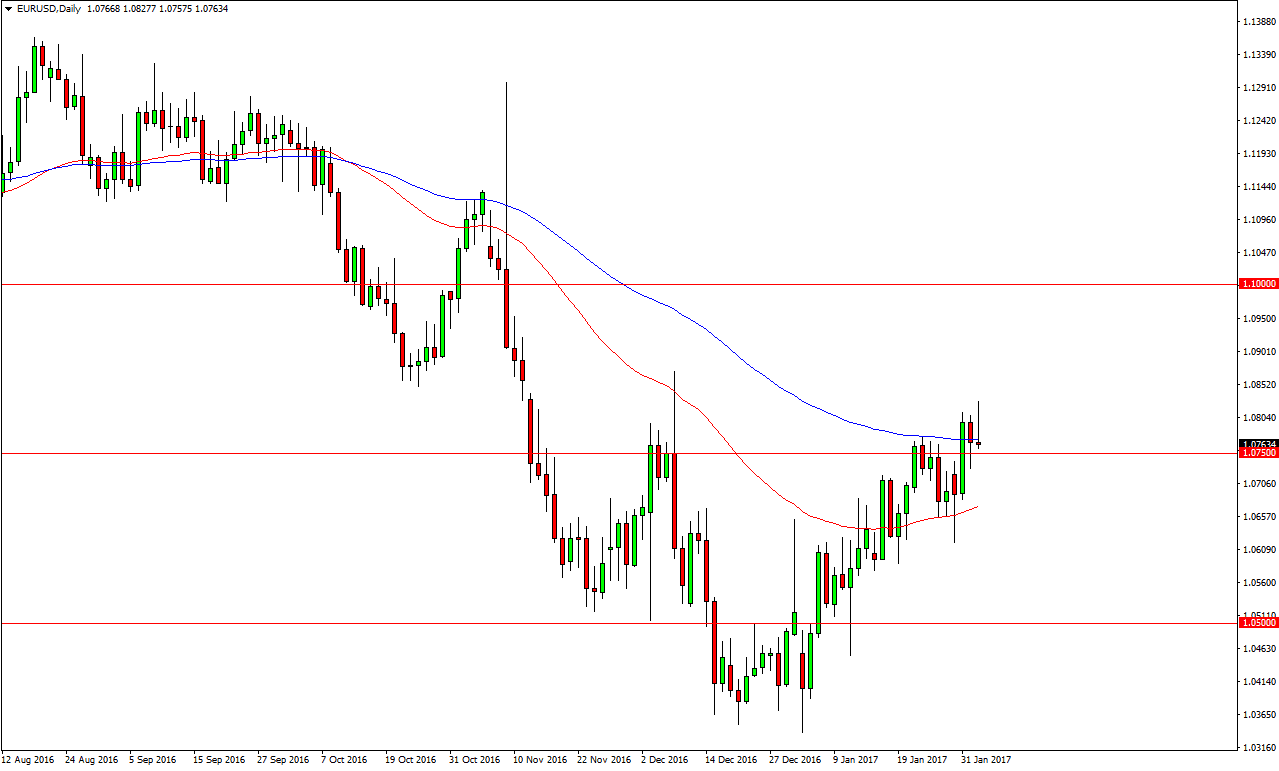

EUR/USD

During the Thursday session, the EUR/USD pair rallied initially during the day but turned around to form an exhausted looking candle. Because of this, it looks like the market is a little bit skittish ahead of the jobs number tomorrow, but I still see a significant amount of support underneath, and if we can break above the top of the shooting star for the day on Thursday, that’s a very bullish sign and should continue to push this market to the upside. Even if we pull back from here, I believe is not until we breakdown below the 50-day exponential moving average that we can start selling. With this, it’s a very likely that the market will continue to see quite a bit of choppiness at of the jobs number.

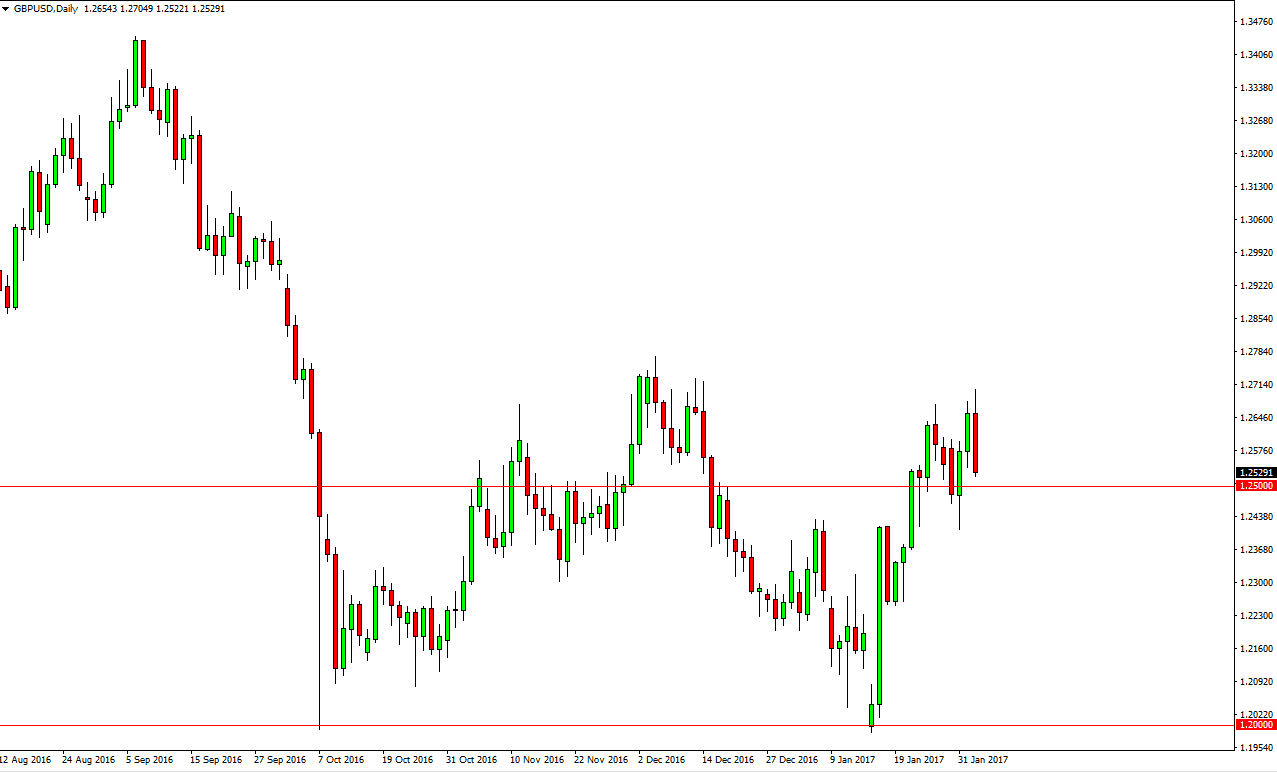

GBP/USD

The British pound initially tried to rally during the day on Thursday as well, but also fell as we reached towards the 1.25 handle. I see a significant amount of support just below the 1.25 level and extending down to the 1.24 handle, so it’s likely that the market should continue to find buyers just underneath, and thus I believe it’s only a matter of time before the buyers get involved and start pushing higher again. Ultimately, this is a market that should then reach to the 1.2750 level. The jobs number of course will add a lot of volatility, so expect that. However, in the end I think that the British pound has started to form a bit of a bottom, and longer-term it’s likely that the buyers will return repeatedly. However, we breakdown below the 1.24 level then that gives me pause for concern. Anytime we see a potential trend change, things get choppy and volatile and that’s essentially what I’m looking at right now.