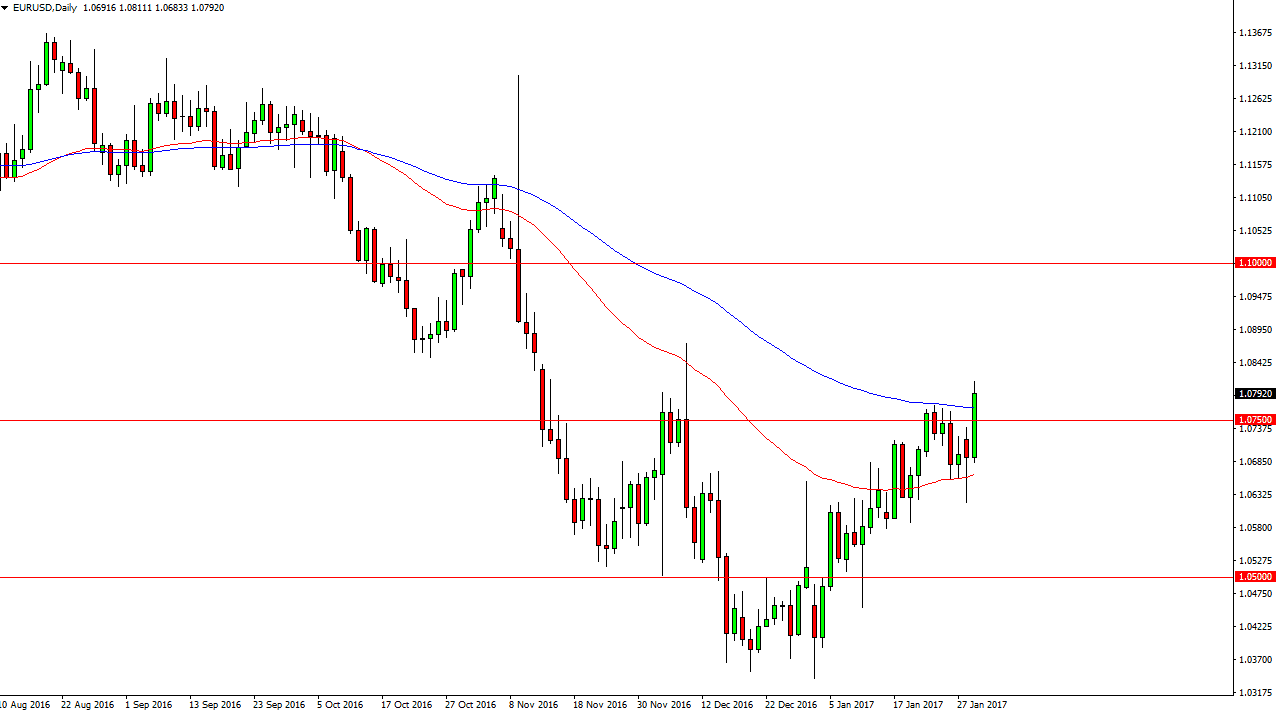

EUR/USD

The EUR/USD pair broke higher during the session on Tuesday, clearing the 100-day exponential moving average. A break above the top of the candle should then send the market towards the 1.10 level above which is resistance as well. Currently, I’m paying attention to the hammer from the Monday session should continue to be massively resistive, and with that being the case it’s likely that the buyers will return in the short-term, and having said that I think that it will be choppy but it looks as if the Euro is going to continue to be relatively levitated against the US dollar. The candle of course looks very strong, so this is another reason I feel that the market should continue to show bullishness.

GBP/USD

The British pound fell significantly at the beginning of the session on Tuesday, but found enough support near the 1.24 level to turn things around and formed a bullish candle. A break above the top of the candle should be a signal that the market is reaching towards the 1.2750 level above. If we can clear there, the market should then go much higher. Ultimately, this is a market that continues to show choppiness, and as this being the case, I think that you must be a short-term trader but it looks to me as if the British pound has tried to form a bottom, and with that being the case is going to be very choppy going for but I think longer-term traders will continue to hang on to the British pound. I have no interest in shorting this market into we get well below the 1.24 level, if not the 1.2250 level under there.

The 1.25 level should be somewhat magnetic, but I believe that it signals the beginning of relatively strong support for the British pound.