The pair tends to follow risk appetite, as the CAD is heavily influenced by the oil markets, while the CHF is considered a “safe haven” currency. Because of this, we often see nice trending moves in this pair. Unfortunately, a lot of newer traders don’t pay attention to this pair – missing out on nice opportunities.

Risk 0.66%

Trade can be taken until 8 am NY time.

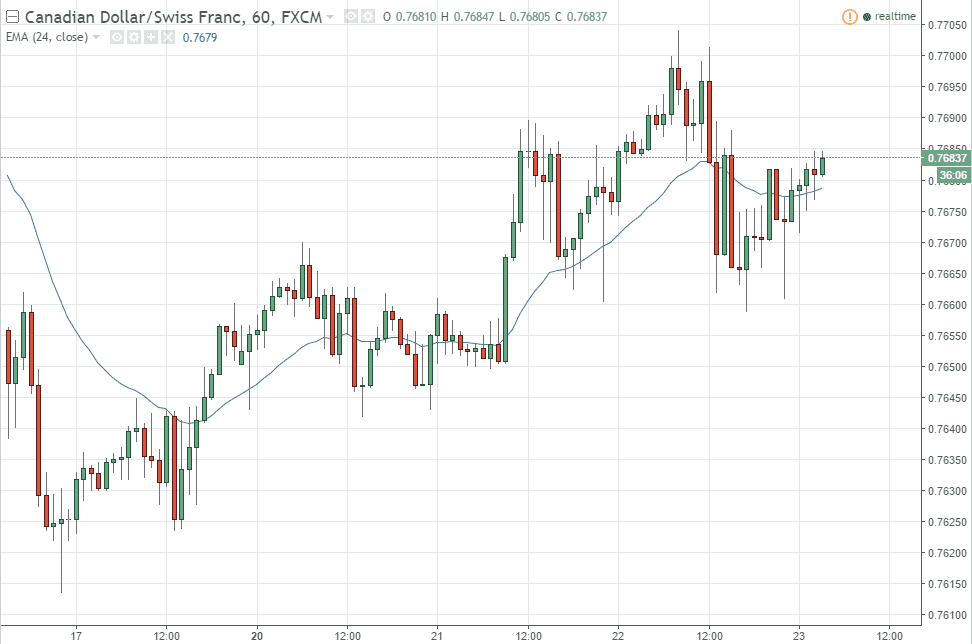

Long Trade 1:

Buy CAD/CHF above the 0.7690 level

Stop loss at 0.7670

Take profit at 0.7750

CAD/CHF Analysis:

The pair tends to follow risk appetite, and this certainly has been the case as of late. After all, you should think that the oil markets will have something to say about what happens here. The market will continue to be one worth watching, as the oil markets have been so volatile lately. Also, the Swiss franc is hurting, mainly due to the potential problems in the European Union – it’s largest export market.

The Crude Oil Inventories number comes out today, so be aware of this. It is because of the influence on the Canadian dollar that the oil markets have that this signal should be ignored once the Americans are onboard.