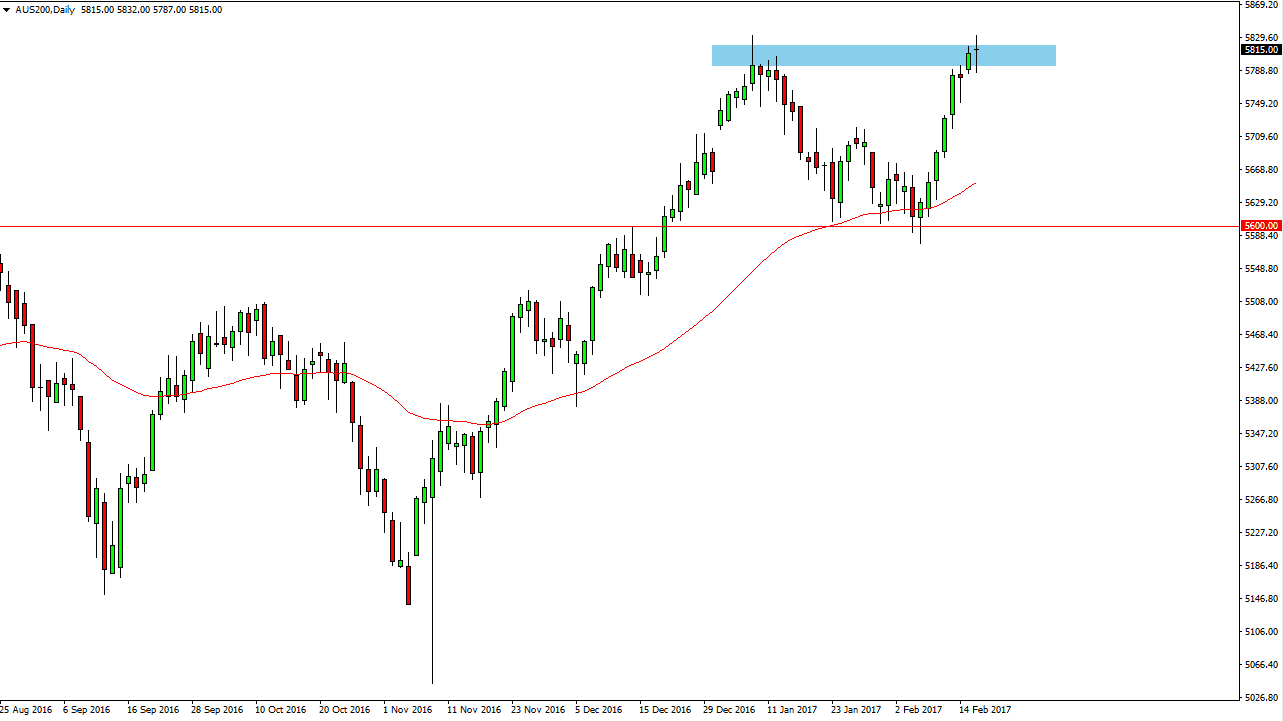

Australian stocks initially fell during the day on Thursday, but found enough support to turn around and form a hammer. The hammer sits right at the top of the range that the market has been trading in, so this could be a vital trading session. A break above the top of the hammer is a very bullish sign, but a breakdown below the bottom of it is very negative. I think that the negative move could be a short-term buying opportunity given enough time, as we should go looking for support underneath. The market is a little overbought, so it wouldn’t surprise me at all. However, you will hear words and whispers of a “hanging man”, and although that is a very negative technical signal, I think the momentum and the strength in Australia overall will continue to show itself in the marketplace.

Once we do breakout to the upside, I think that the target will be 6000, as it is the next psychologically important number, and the latest consolidation range has been 200 points. A break above the candle sends this market looking for another 200 points, so the math all adds up. On top of that, gold markets and other minerals continue to do fairly well, and that drives up the value of Australian companies that do mining and the like.

The 50-day exponential moving average offered support the last time we got down to it, so even if we pull back I think eventually there will be a convergence between price and that average, and the buyers would get involved. If you have the ability to trade this CFD, by all means you should be looking at this market as it could offer significant profits. You can see that we have been in a nice uptrend since November 2016, and that should continue to be the case.