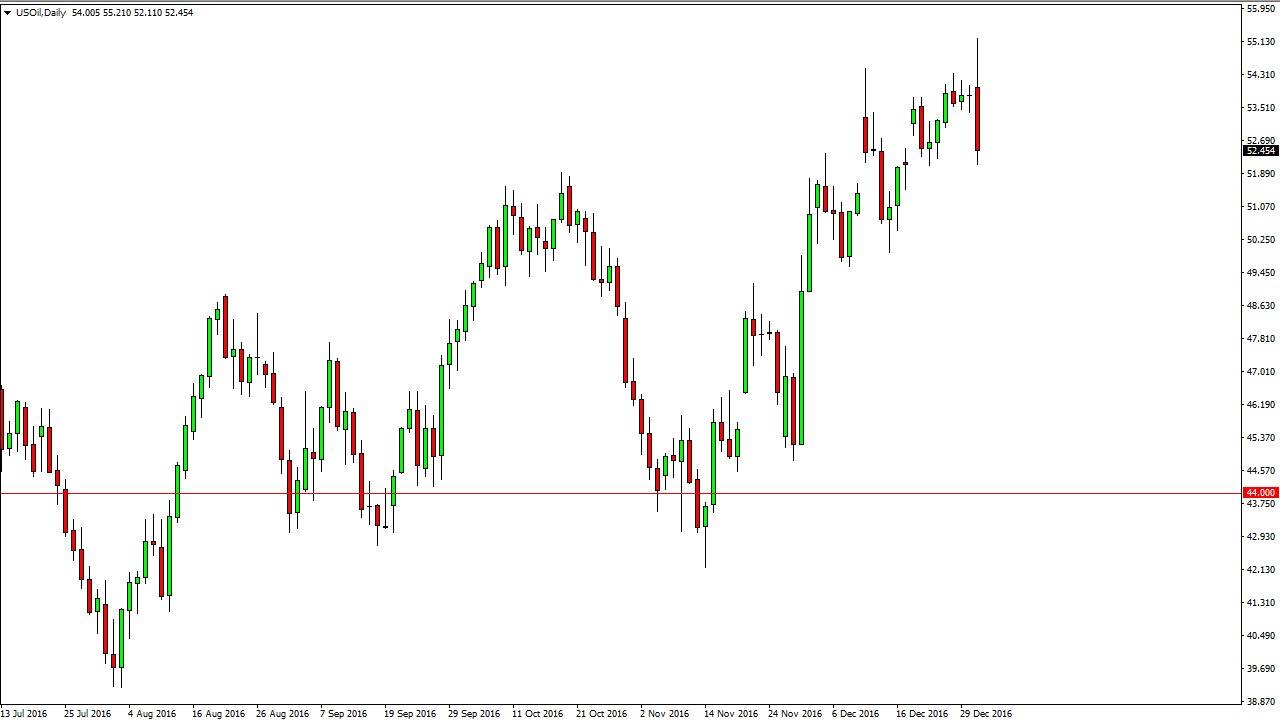

WTI Crude Oil

The WTI crude oil initially rallied on Tuesday as traders came back from the holidays, but found the area above the $55 level as far too resistive. We turned around to form a negative candle, and fell significantly. While I’m not ready to declare that the rally is over, I do recognize that this candle could be significant. After all, we witnessed a significant fall. Also, I still don’t believe the longer-term prospects for oil are good, especially considering that OPEC has a long history of having members cheat production cuts. Compound that with higher pricing dragging more American and Canadian shell oil into the market, and you have the potential for a turnaround in the overall trend. I’m looking for exhaustion after rallies to start selling.

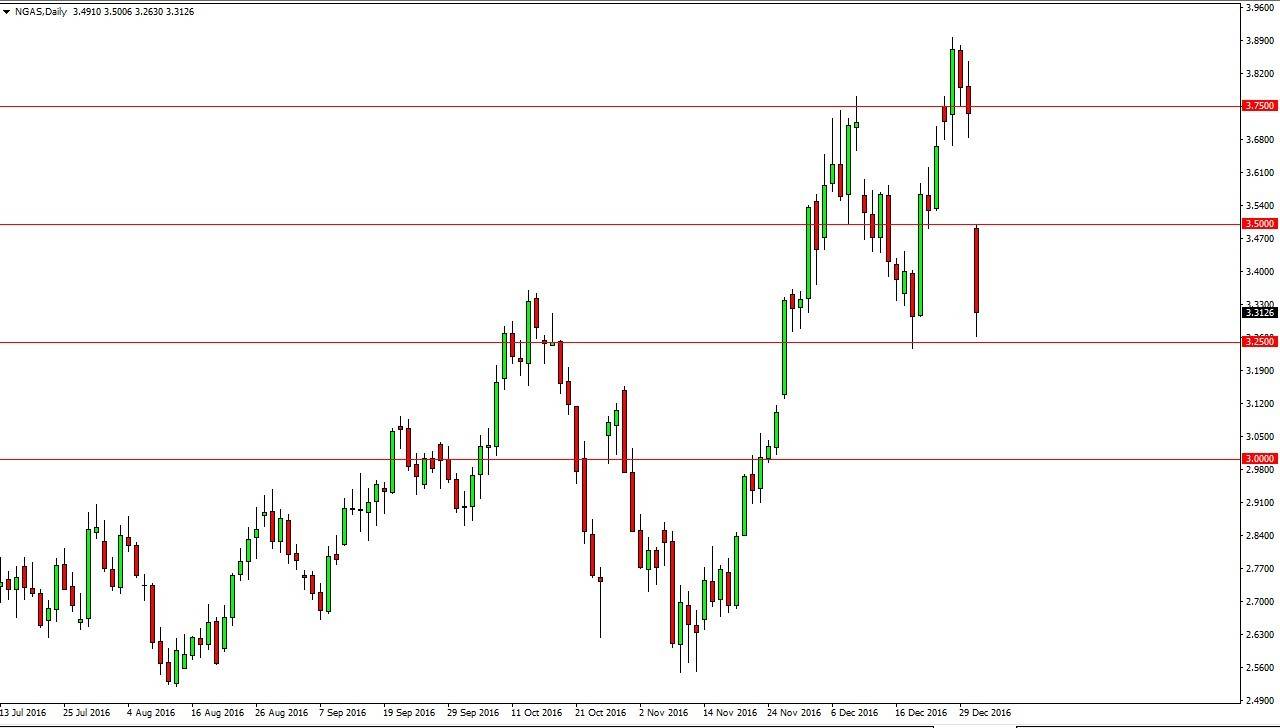

Natural Gas

Natural gas markets fell apart on Tuesday, and right from the start. We gapped below the $3.50 level and fell all the way to $3.25. This was predicated mainly upon warmer forecast for the northeastern part of the United States in January. On top of that, this is a market that had been overbought for some time. After this nasty looking candle, I believe that rallies offer selling opportunities yet again. There is a lot of noise above the $3.75 level, and extending all the way to the four dollars handle. Those of you who follow me know that I have been bearish in this market for some time, and that I live in an area that is overflowing with natural gas deposits. Quite frankly, natural gas is overabundant in this part of the United States, and some estimates suggest that the United States by itself has enough natural gas to power the rest the world for 300 years. This doesn’t even take into consideration Canadian deposits, which are expected to be even larger.

Because of this, I think that we may bounce to fill the gap above but it’s only a matter of time before the sellers return. Alternately, we could break down below the $3.25 level which would be a negative sign to say the least. However, Tuesday saw loss of 8%, which is a bit overdone for the short term.