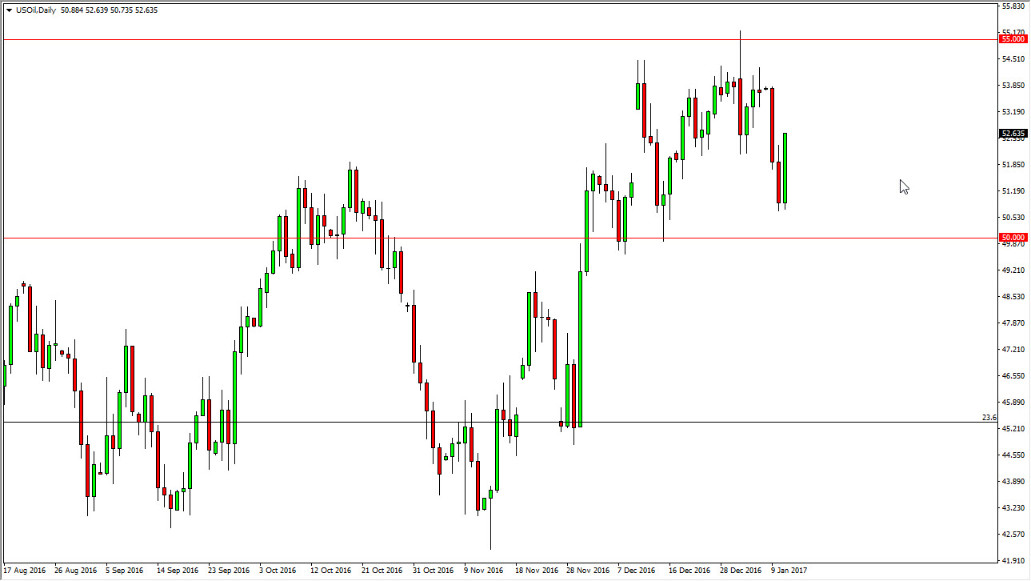

WTI Crude Oil

The WTI Crude Oil market bounced significantly during the Wednesday session, which was a bit ironic considering that the oil markets produced a very bearish inventory number coming out of the United States. Because of this, it appears that the market had already priced a bearish number and, and perhaps this was a bit of a “sell on the news” situation. Ultimately though, I still think there is a significant amount of resistance above, especially near the $55 level. At this moment, it looks as if the market is ready to continue to consolidate between the 50 and $55 handles, meaning that short-term traders continue to push things around. Longer-term, I believe that the oversupply becomes an issue again, just as the strengthening US dollar will be.

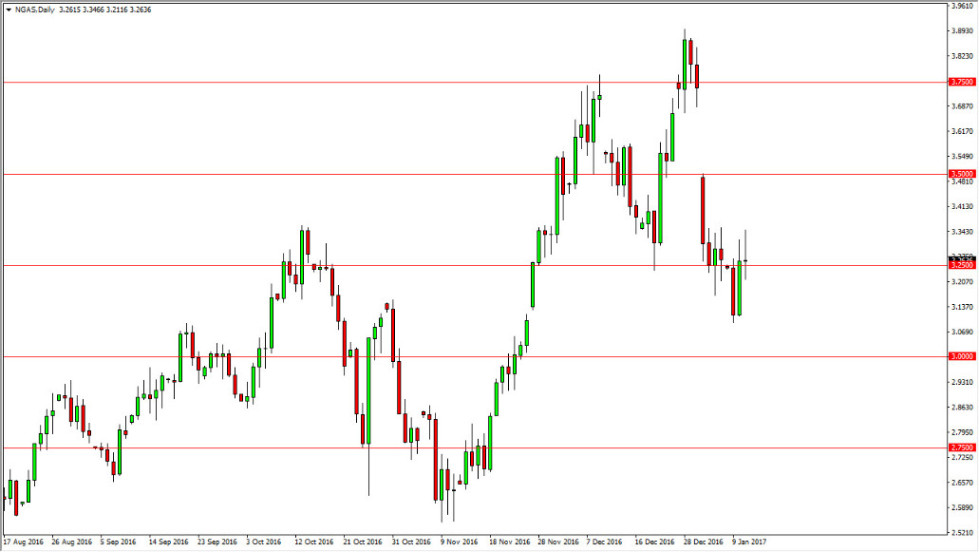

Natural Gas

Natural gas markets had a volatile session as well, as we ended up essentially unchanged. We did form a bit of a shooting star though, so that suggests that there is still more than enough bearish pressure in this market to make any rally difficult. However, I do think that we need to rally, to fill the gap from the previous trading. We have come a little bit too far to the downside in a short amount of time as far as I can see, so I believe that exhaustive candles after a slight move higher will be the best way to get involved.

I think the market is going to reach down to the $3 handle, but Hollywood much rather sell at a higher level if I get the ability to. The gap above hasn’t been filled as mentioned previously, and that means we could bounce as high as $3.74 and still have a valid sell signal. The massive oversupply continues to be an issue, and I think longer-term the sellers will continue to push.