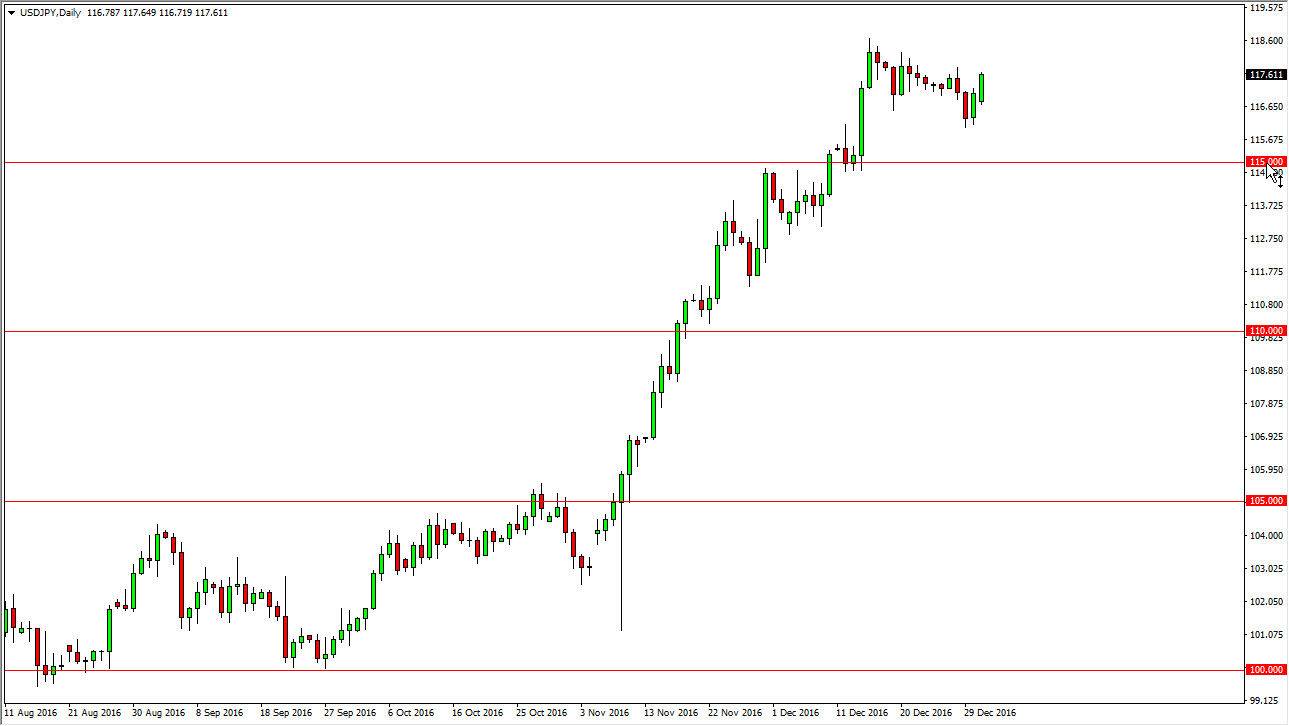

USD/JPY

The US dollar continues to see bullish pressure against the Japanese yen, and rose on Monday yet again. It looks as if the market is going to try to grind its way towards the 120 handle, as the Federal Reserve looks likely to raise interest rates, and at the very least raise the longer for the Bank of Japan well. I think the 115 level is supportive, and essentially acting as a “floor” now, and that pullbacks will represent short-term buying opportunities repeatedly as we grinder way to the upside. We are a bit “long in the tooth” when it comes to the trend, so explosive moves are probably not going to be seen anytime soon in this market. With this being the case, I have no interest in selling.

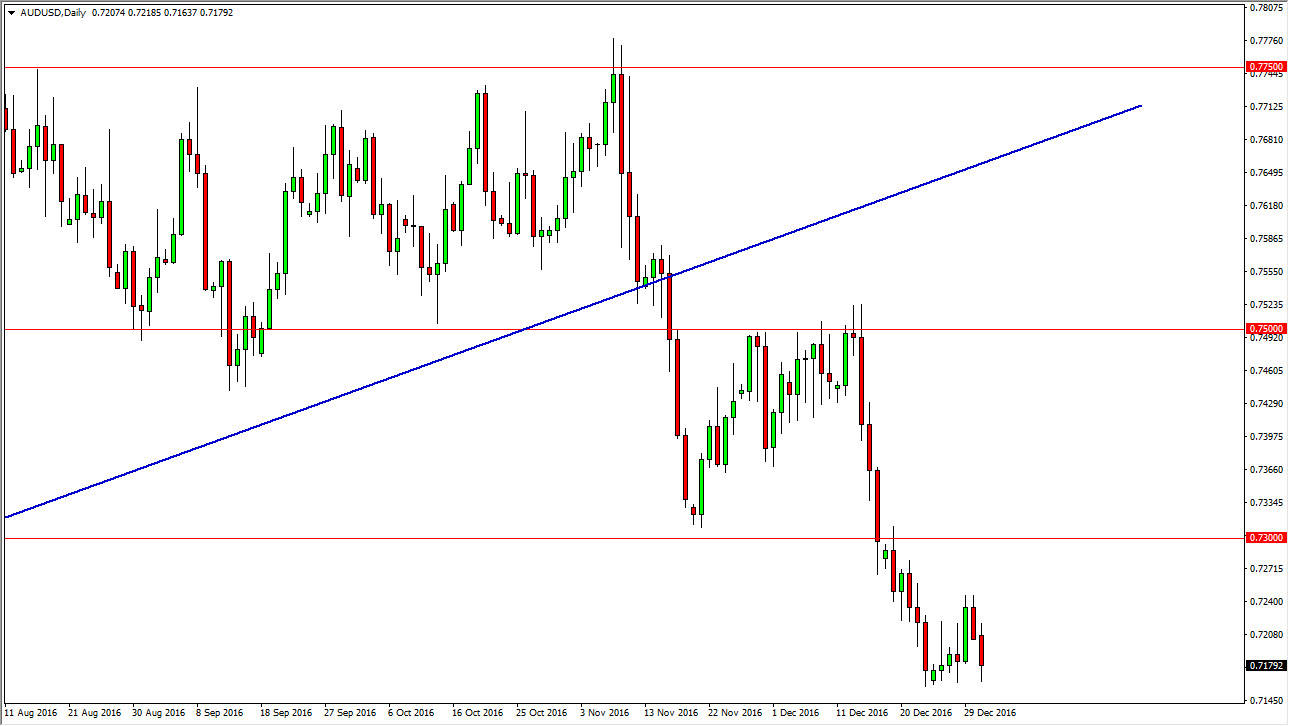

AUD/USD

The Australian dollar fell on Monday, reaching towards the 0.7150 handle. There is a bit of support in this area but I feel it’s only matter time before we break down below here reach towards the 0.70 level which has been my longer-term target for some time. I think rallies offer selling opportunities, and that this market is one that you cannot buying, at least not until we break well above the 0.73 handle. Keep in mind that the gold markets look very soft, so with that being the trend overall, it’s likely that the downward trend should continue due to headwinds in the gold pits.

The US dollar of course is favored against most currencies currently, so I believe that the market should continue to drop over the longer term. I think that it will be choppy and we will get bounces from time to time, but does bounces will only be a nice selling opportunity more than anything else. In fact, I don’t really see a scenario in which I would want to buying the Australian dollar anytime soon.