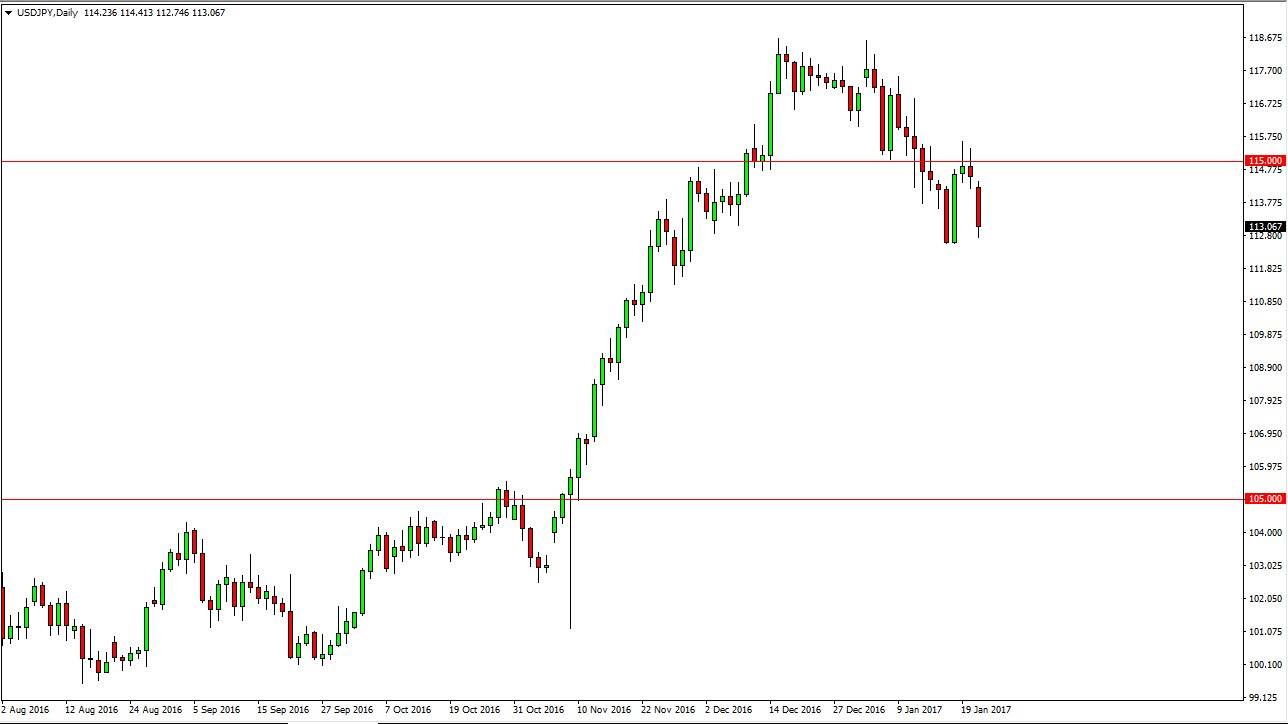

USD/JPY

The USD/JPY pair fell on Monday, as we continue to see bearish pressure. After forming a couple of shooting stars at the 115 handle, this isn’t necessarily going to be a major surprise. However, I think there is more than enough support below to turn things around and eventually we will get a support candle the we can start buying. When we do, I will let you know I’m going long, but in the meantime, I think short-term traders will continue to sell. Somewhere near the 111.50 level there is a massive amount of support, and although we have pulled back rather significantly, when you look at the longer-term move it certainly is well within the parameters of a normal pull back. I think this pullback will offer value, and eventually I plan to take advantage of it.

AUD/USD

The Australian dollar initially rallied on Monday but gave back quite a bit of the gains to show that we are going to continue to grind sideways overall. After breaking above the psychologically important 0.75 level, the market should continue to try to consolidate as we will need to build up momentum to finally go higher. If we broke down below the 0.7450 level I would be willing to sell however. At this point, though, it looks as if we are going to continue to see quite a bit of support underneath so although we are a bit overextended, I believe it’s only a matter of time before the buyers get involved.

Ultimately, i.e. will not trade this market against the gold market, which looks to be doing the same thing now. If it breaks to the upside though, I’m willing to buy the Australian dollar just as I would be willing to sell the Australian dollar on a breakdown accompanied by bearishness in the gold market.