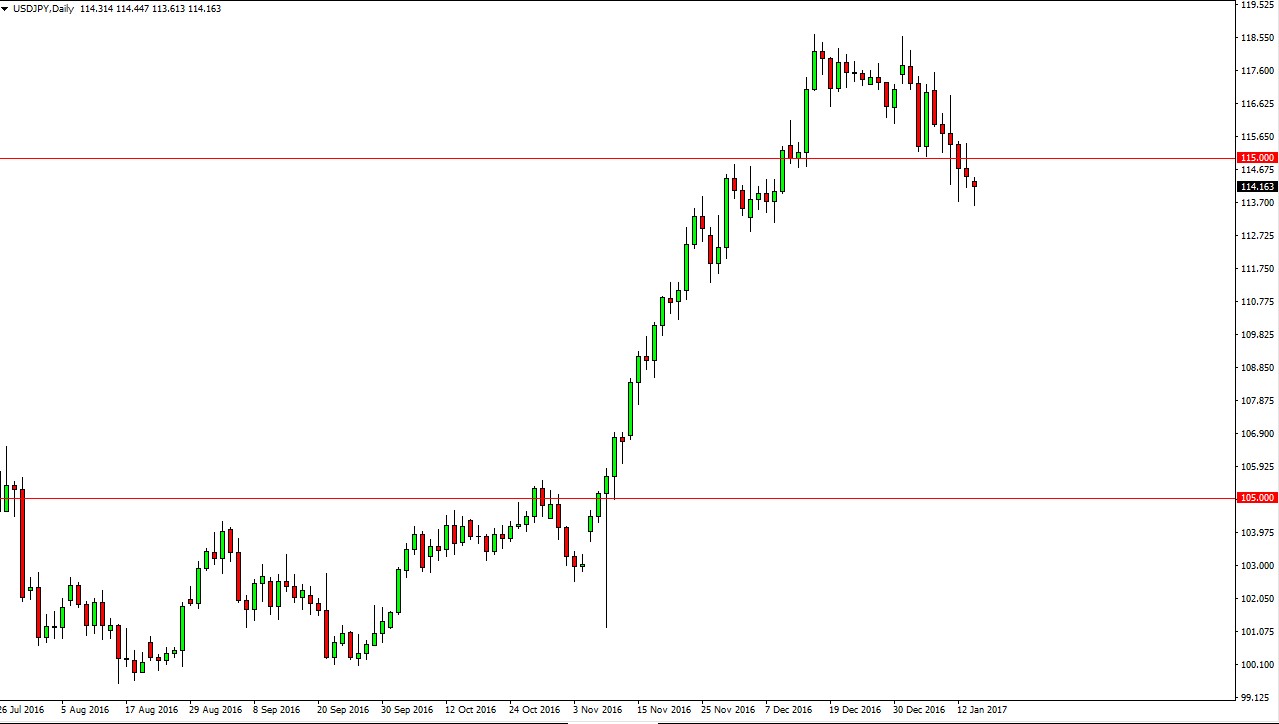

USD/JPY

The USD/JPY pair initially fell on Monday, but found enough support just below the 114 level to form a hammer. If we can break above the 115 level, I feel that we will continue the longer-term uptrend and reach towards the 118.50 level above there. Given enough time, we continue to reach towards 120 in my estimation, as the uptrend is most certainly the way to go now. I believe that the market is in a longer-term uptrend anyway, so I’m not even paying attention to short signals. I believe that if we can stay above the 111.50 level, there’s no need to do anything but buy.

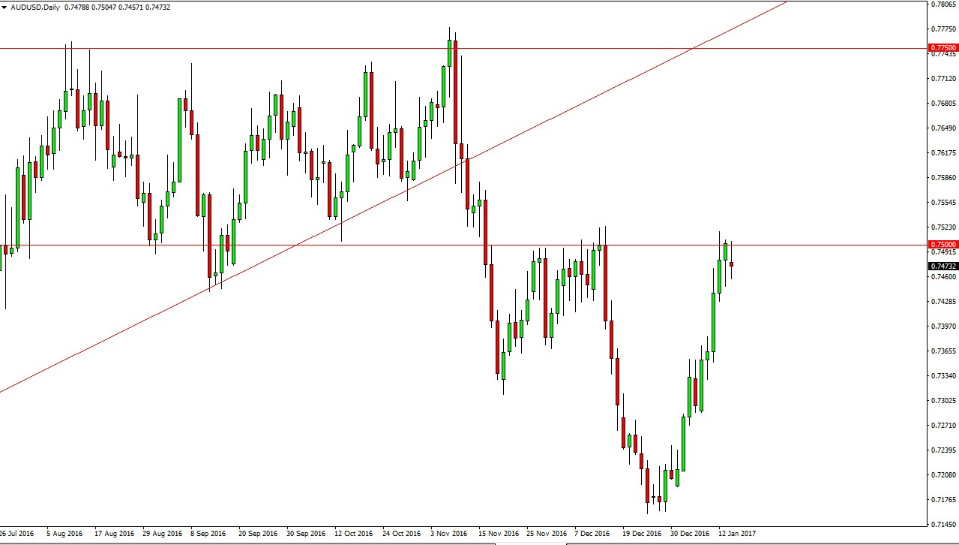

AUD/USD

The Australian dollar had a volatile session during the Monday session, essentially settling on a neutral candle. The 0.75 level above continues to be massively resistive. If we can break above there, and more importantly the 0.7525 level, I think the buyers will continue to jump into this market and push it towards the 0.7650 handle above there. If we can break down below the bottom of a hammer during the session on Friday, I think at that point the market will drop from there and reach towards the 0.73 handle underneath. Alternately, I think the one thing that you should pay attention to is the gold markets, as they have such a massive influence on the Australian dollar itself.

The US dollar of course is strengthening in general, so a breakdown to the downside would make quite a bit of sense. However, I don’t want to jump in front of the market, so because of this I feel that it is likely to be best to simply wait for the other participants to decide what to do, and follow. Not looking to be a hero, as that is the quickest way to lose money in the Forex markets.