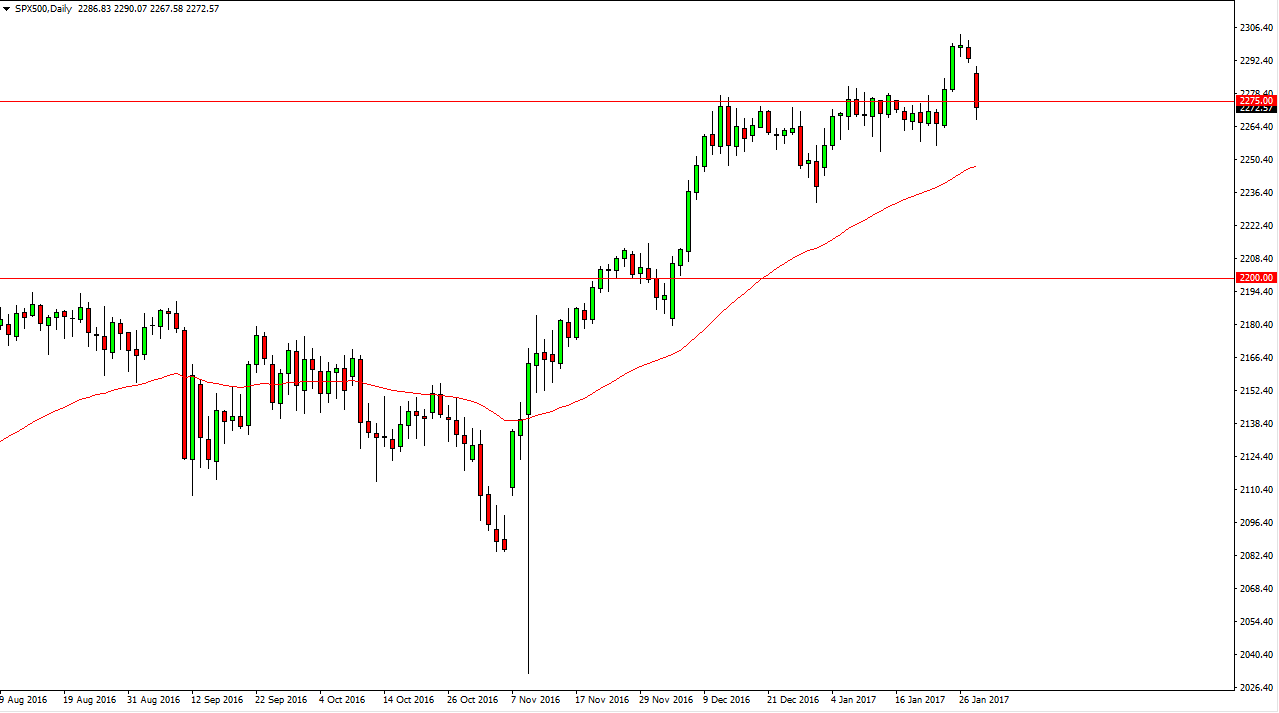

S&P 500

The S&P 500 gap lower at the open on Monday, breaking through the 2275 level later in the day. However, I see a significant amount of support just below, and I believe it extends down to at least the 2250 level underneath. The 50-day exponential moving average underneath continues to offer dynamic support, and I believe it’s only a matter of time before the buyers step back into this market, forming a supportive candle. That supportive candle has me buying the S&P 500 going forward, or a daily close above the 2275 level. I have no interest in selling this market and believe that the S&P 500 will continue to go much higher, driving other US indices to the upside as well. US stock indices lead the world right now, and I believe that will continue to be the case.

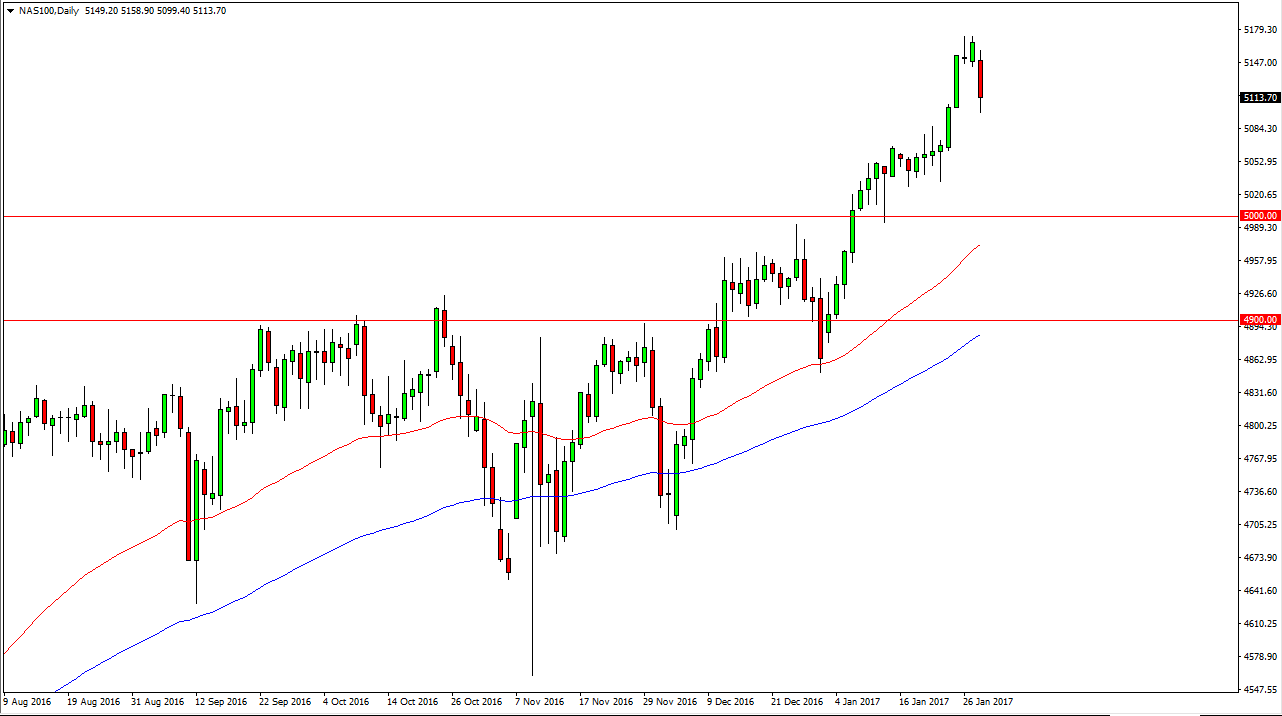

NASDAQ 100

The NASDAQ 100 broke down during the day on Monday, but at this point I believe that the biggest feature of this market is the fact that it is just a bit overextended. I see plenty of support at the 5050 level, and of course at the 5000 level which I have as the “floor” in the market. Although I feel that the market is probably going to fall from here, it’s only a matter of time before the buyers get back into the marketplace and continue to drive the NASDAQ 100 higher. The NASDAQ 100 has led the US indices higher overall, and I think that will continue to be the case going forward. I believe that we will reach towards the 5250 level, and possibly even higher than that. The US stock markets lead the world, and the NASDAQ 100 leads the US stock indices.

Selling isn’t even a thought until we breakdown below the 4900-level underneath, which isn’t going to happen anytime soon.