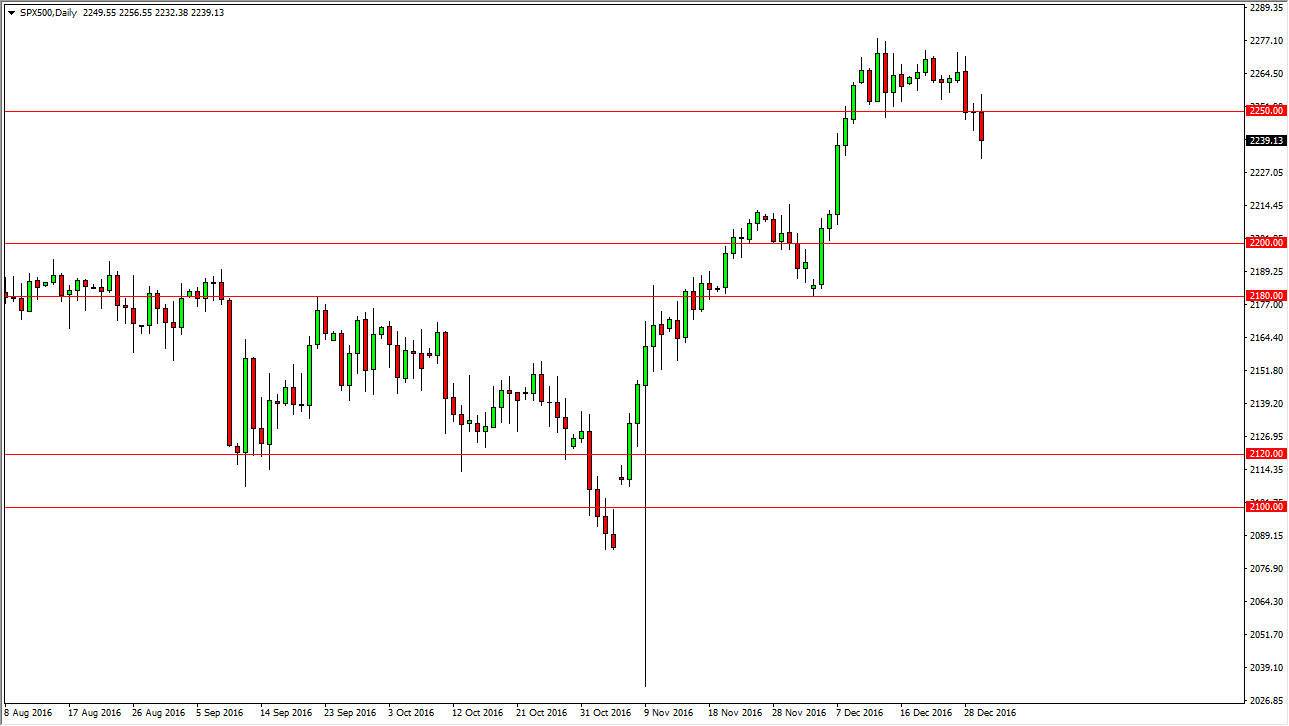

S&P 500

The S&P 500 was closed on Monday, as banks continue to celebrate New Year’s Day. However, the pullback was a bit telling, as I believe the market will now have to go lower to look for significant support. Eventually, that support should take over, and the buyers will continue to go higher. I think that the 2200 level below is essentially the “floor” in this market still, so at this point I don’t have any interest in shorting this market. I recognize that short-term traders may make a decent amount of money, but the reality is that the longer-term trend is still to the upside. Ultimately, I still have a target of 2300, and when we pullback, that offers value that I’m willing to take advantage of.

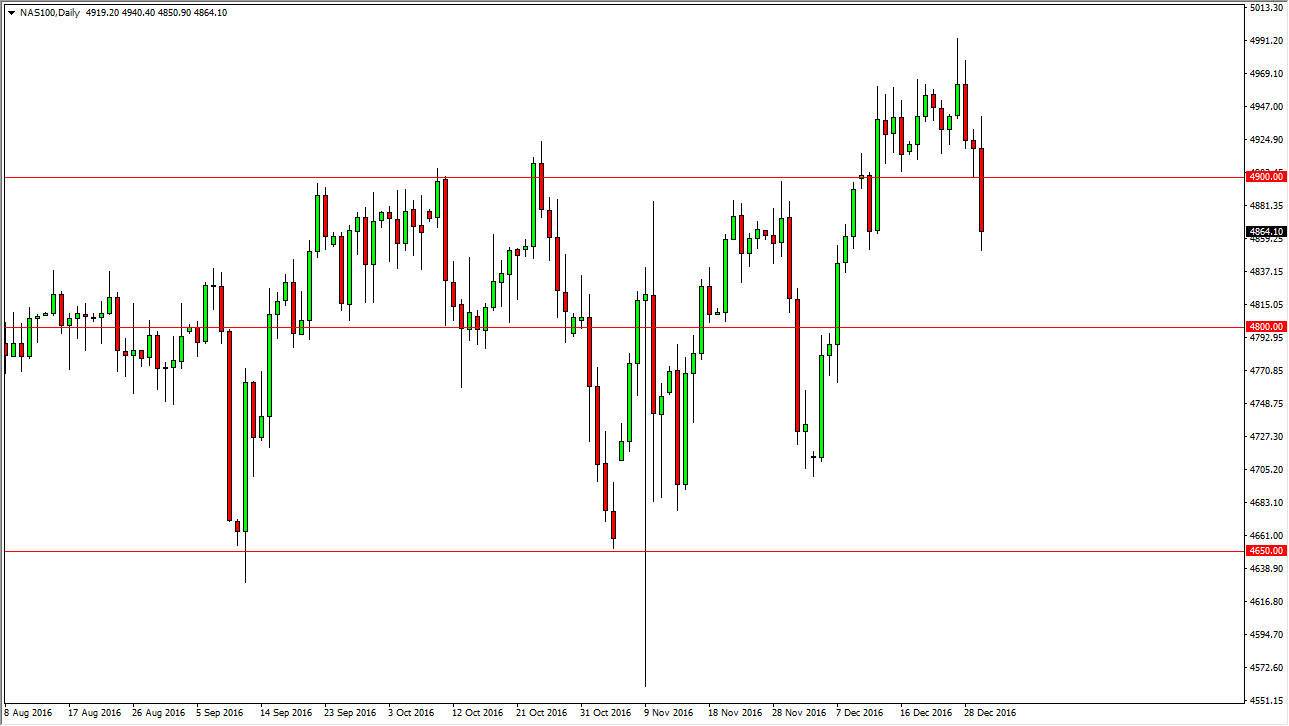

NASDAQ 100

The NASDAQ 100 and a very negative Friday, but of course was closed on Monday. The market should have plenty of support underneath, so I’m waiting to see whether or not we either get a bounce or some type of supportive candle that I can start buying. I have no understand selling, I believe that the 4800 level will be massively supportive, and with that being the case it’s only a matter of time before he bounce and reach towards the 5000 handle but which is my longer-term target. We trying to get up there several days ago, but I believe that the time of year was simply far too thin for buyers to take over.

Ultimately, I believe that we will break above the 5000 handle, but we need to see liquidity pickup to reach to even higher levels. I do think that happens given enough time, but as I can happen in the next several sessions. The meantime, I think sooner or later the buyers come back in and start drifting to the upside.