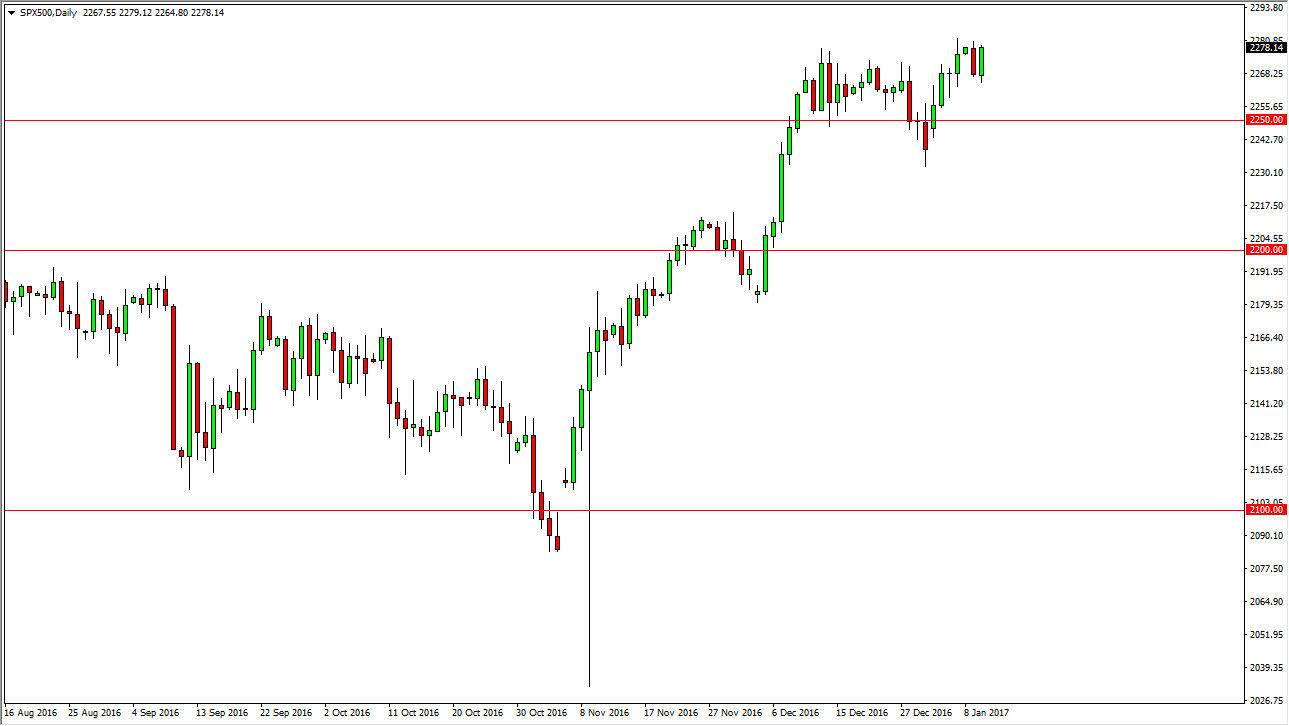

S&P 500

The S&P 500 rallied on Tuesday, as we found plenty of support just underneath. I believe that the area just below is massively supportive, and the 2250 level below is essentially a “floor” in the market. I think the given enough time, the market should continue to go much higher, perhaps reaching towards 2300 next. You should keep in mind that the US economy is doing better than most others, and of course we have announcements such as the small business confidence numbers and came out today showing massive surges to the upside. Economic confidence in the United States continues to climb, just as the labor market is starting to look better. Ultimately, I believe that US indices continue to go higher and the S&P 500 will be no different.

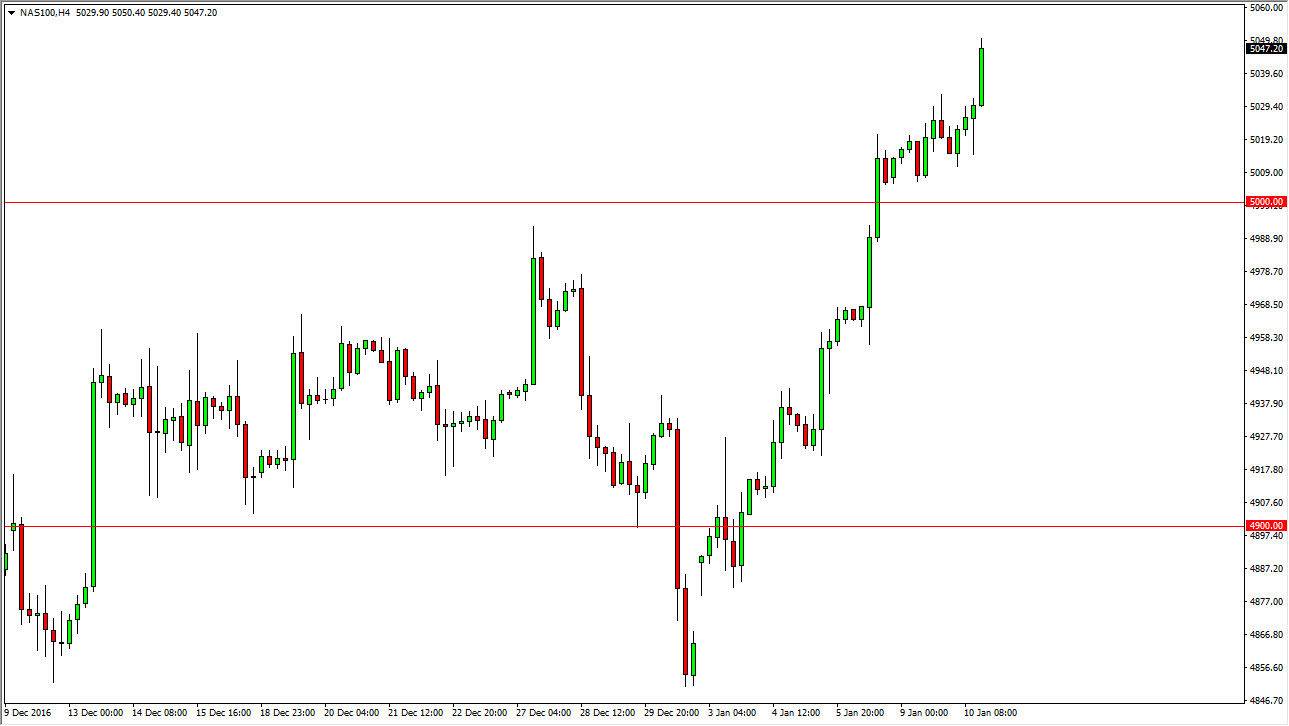

NASDAQ 100

The NASDAQ 100 broke out to the upside on Tuesday, showing signs of significant strength. The 5050 handle above is resistive, but only psychologically so. Because of this, I believe that a pullback shows signs of health in this uptrend, and I believe there is a massive amount of support at the 5025 level, and of course a “floor” at the 5000 handle. This is a market that continues to go much higher, perhaps starting the next leg higher on the longer-term charts.

I have no interest in selling this market, and I believe that the NASDAQ 100 is starting to show signs of leading the rest of the US indices higher. It’s not until we break down below the 5000 level that I would even remotely consider selling this market, as it’s obvious to me that US stock markets are charging higher. Now that we are starting to get more liquidity, it’s likely that we are going to continue to go much higher.