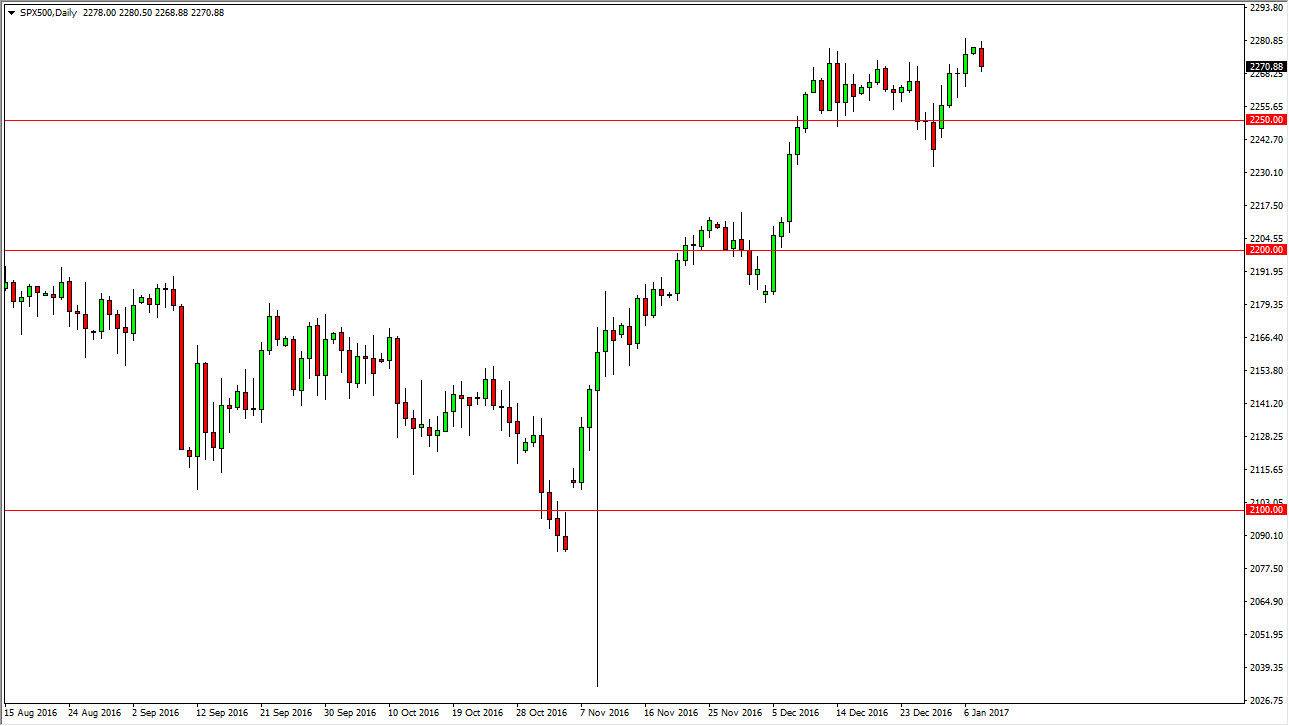

S&P 500

The S&P 500 fell on Monday, pulling back from a recent breakout. I believe that there is plenty of support all the way down to at least the 2250 level, so I’m waiting to see a supportive candle that I can serve buying. On a supportive candle, I am more than willing to go long as the longer-term uptrend should continue to extend the gains in the S&P 500 over the longer term. I believe that we will reach towards the 2300 level, and then far beyond there. I have no interest in selling, I believe that the US stock indices are all very positive. The US economy is one of the stronger economies in the world, so having said that it’s likely that the S&P 500 will reflect that.

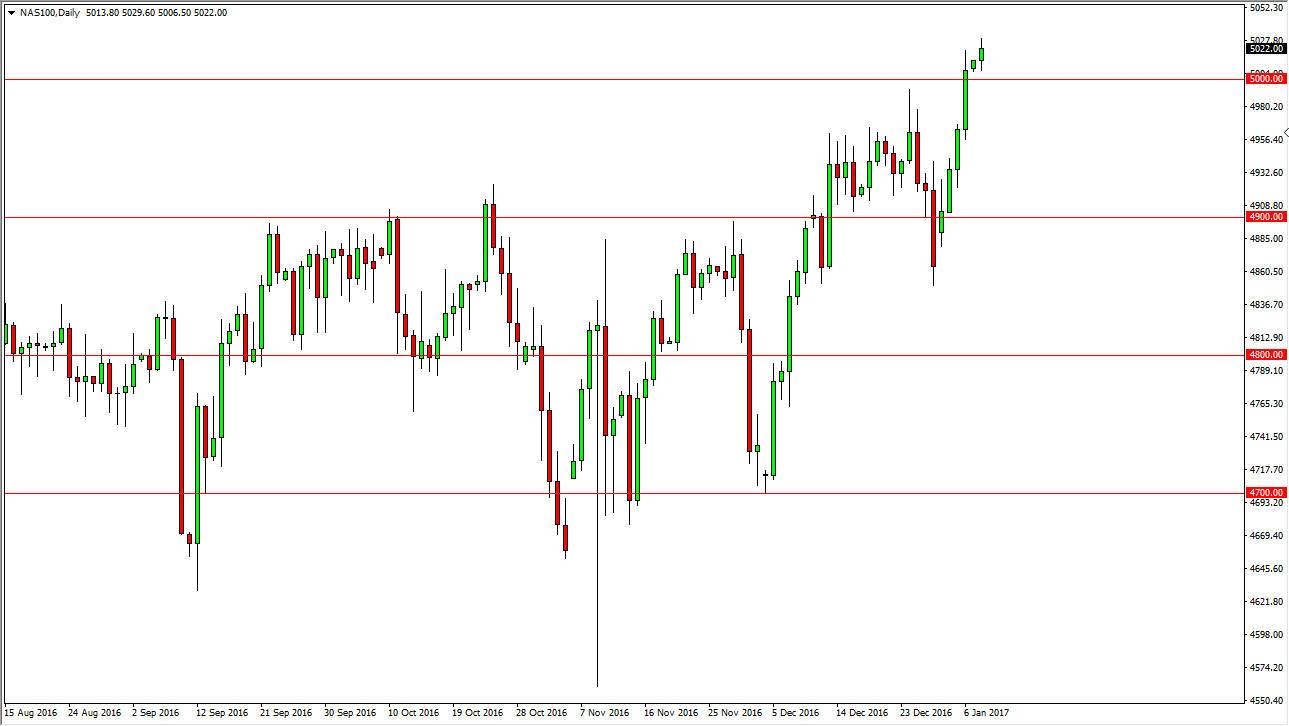

NASDAQ 100

The NASDAQ 100 broke above the 5000 handle, and continued going higher on Monday. This is a market that should have plenty of support at the 5000 handle, perhaps extending down to the 4900 level. With this, I’m waiting for short-term pullbacks to go long, as we should then reach towards the 5100 level. I believe that this market is going to leave the way forward for the other US indices today, and into the short-term future. I have a target of 5250 at the moment, but I believe we probably go much higher than that. The NASDAQ 100 will perhaps be the harbinger of higher pricing for the S&P 500 and eventually the breakout of the Dow Jones 30 above the 20,000 handle.

I have no interest in shorting the NASDAQ 100, I believe the strength is obvious, and the last couple of sessions have been truly remarkable. This market has caught up with the rest of the US indices, which is something that I have been waiting for as we had been lagging behind the other US indices.