Gold rose slightly on Thursday as uncertainty regarding the economic policies of new U.S. President-elect Donald Trump offset pressure from strength in the dollar. A series of strong economic data reinforced expectations that the Federal Reserve is likely to stick to its plan of raising interest rates, though investors remained cautious ahead of Donald Trump’s inauguration. Data released by the U.S. Labor Department revealed the number of first-time applicants for jobless benefits decreased 15K to 234K and the Federal Reserve Bank of Philadelphia reported that its manufacturing index climbed to 23.6 from 21.5 the prior month.

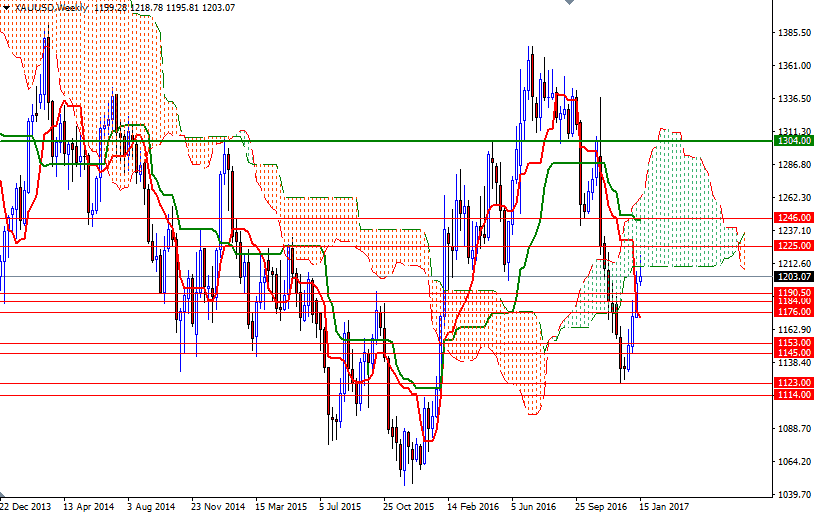

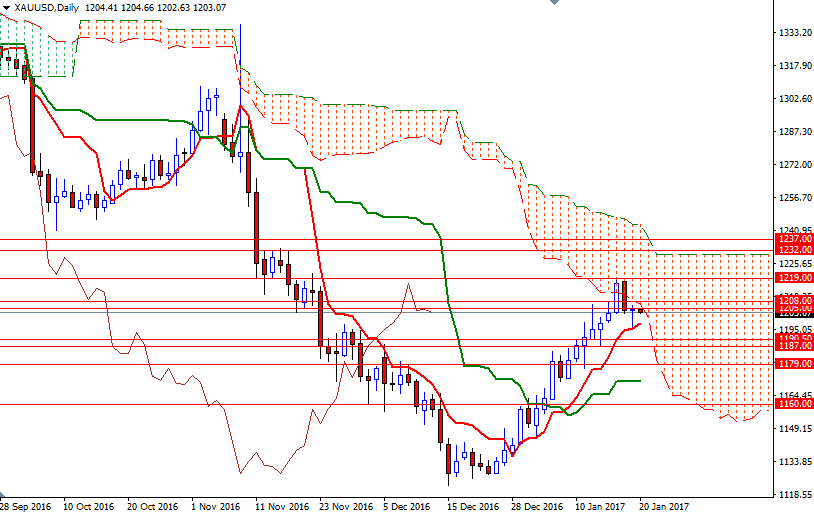

From a technical point of view, there are two things that catch my attention at first glance. Firstly, the market is trading above the Ichimoku cloud on the 4-hourly chart, plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on the daily chart. Secondly, despite a positive near-term outlook, the area where the weekly and the daily Ichimoku clouds overlap acts as a strong resistance.

The first hurdle gold needs to jump is located around the 1208 level. If the bulls successfully push prices above 1208, there is a possibility that we will revisit 1212. I think the bulls will have to push prices beyond the 1212 level so that they can make an assault on the 1220/19 zone. Once above that, XAU/USD will be targeting 1225. The initial support level stands in the 1205/4 area. Dropping through this support would open up the risk of a move towards the 4-hourly Ichimoku cloud. In that case, the bears may have another chance to test 1200 and 1195. Breaking below 1195 implies that 1190.50-1187 zone will be the next stop.