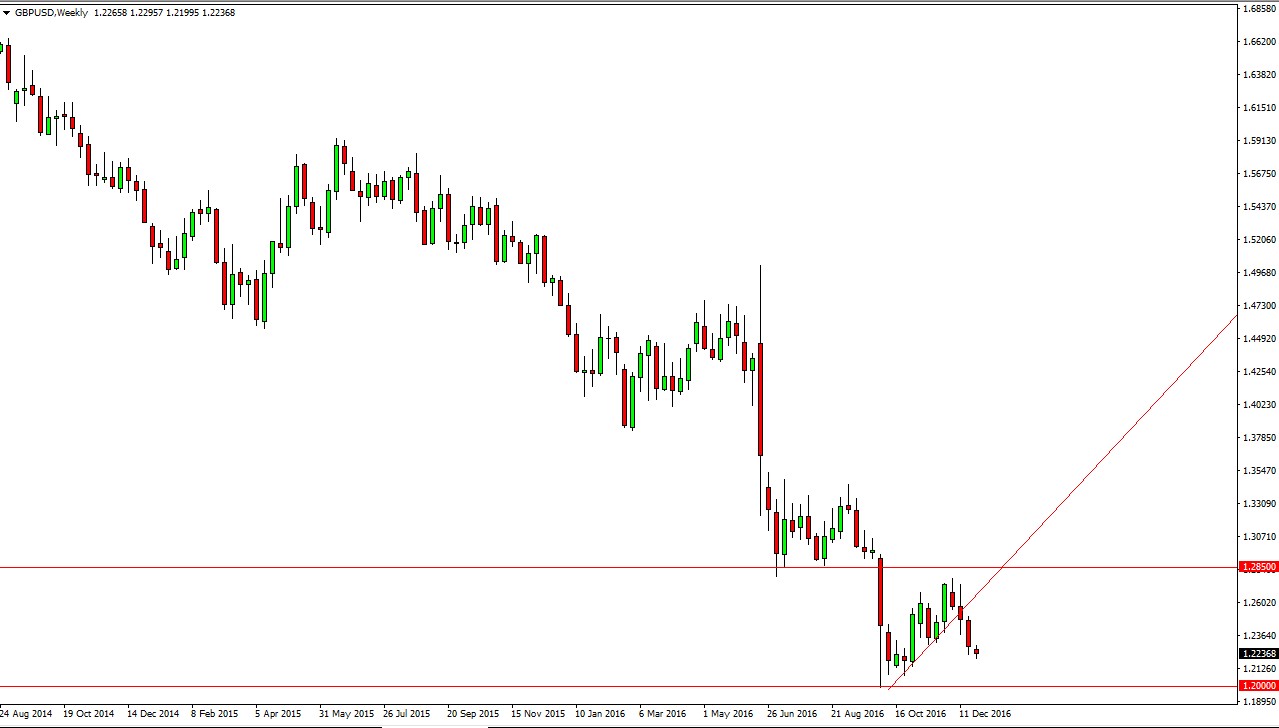

The British pound continues to find sellers going forward, as we have broken down below the uptrend line that had been so supportive over the last couple of months. The market continues to look very negative, and I believe that eventually we will reach towards the 1.20 level. In fact, I think it probably happens during the month of January but don’t look for any clean moves to that level. I think that the choppiness will continue, as the “easy money” has already been made selling the British pound due to the exit from the European Union.

Longer-term malaise

I think that given enough time, the overall attitude of the British pound will be soft, as we have to wait and see what the effects of leaving the European Union will be. Ultimately, I think that it’s been a bit of an overextended decline in the value the British pound, but until the rest of the market is convinced of this, I’m not coming anywhere nearby in the British pound. I believe that breaking down below the 1.20 level is probably going to be the reality, but the great thing about that is that when you look at the monthly charts, the 1.15 level below is massively supportive, so I think somewhere near there we may eventually “bottom out.”

Any rally now is a selling opportunity as far as I can see, so I have no interest in buying and I believe that the Federal Reserve raising interest rates will continue to put demand on the United States dollar, as we continue to see the greenback outperform most other currencies around the world as the Federal Reserve is the only major central-bank looking to raise rates that I am aware of. The rallies going forward should offer trading opportunities again and again.