EUR/USD

The Euro rallied on Wednesday, slamming into the 1.05 level. This is an area that has proven to be rather resistive, so I believe that selling will probably ensue in short order. Short-term charts are already starting to show a bit of a roll over, and I think sooner rather than later the sellers will jump into the market. Even if we rallied, I have a hard time believing that the markets going to break above the top of the massive shooting star that formed last week. Because of this, I am a seller and do not have any interest whatsoever in buying this pair. I think that we will fall towards the 1.0350 level.

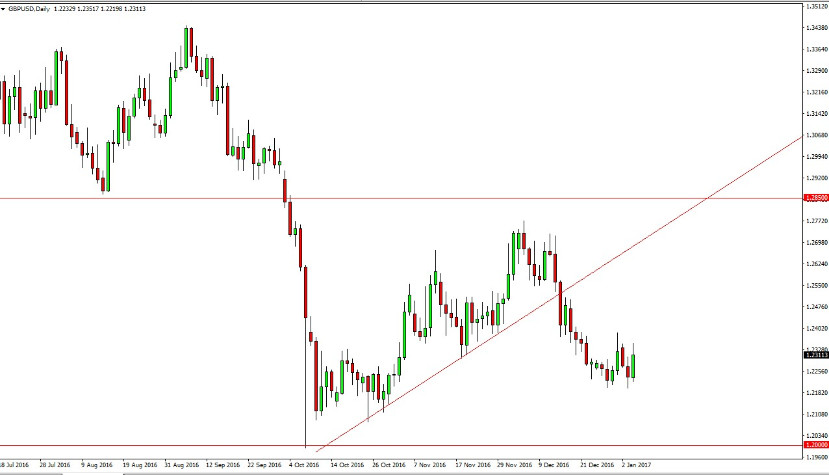

GBP/USD

The British pound showed signs of resiliency on Wednesday, as we broke above the 1.23 level during the day. However, I think there is more than enough resistance above the keep this market rather flat, if not sell off overall. I think an exhaustive candle on a short-term rally is a selling opportunity in the market should then reach towards the 1.21 handle below and then eventually the 1.20 level. I have no interest in buying the British pound, there are far too many issues when it comes to that currency due to the exit vote and of course all the uncertainty that we have with the British economy. Don’t get me wrong, personally I believe that the British economy will be fine, but I know that the market is rather nervous.

This will be especially true against the US dollar as it is the favored currency in the world right now, and as a rule I’m not willing to sell it against anything. This will be especially true against European currencies, and the British pound won’t be the exception. I am a seller on short-term rallies that show signs of failure but recognize we may get some choppiness in the short term.