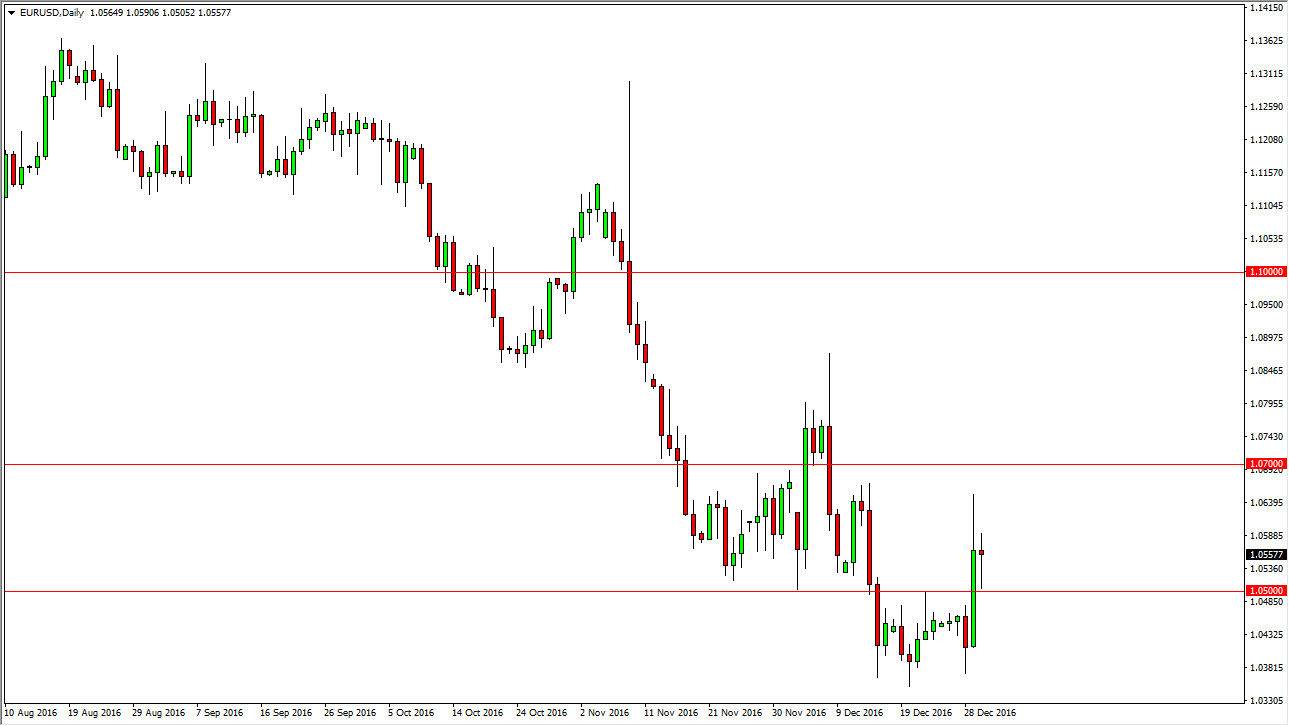

EUR/USD

The EUR/USD pair went back and forth during the day on Friday, as end-of-the-year position squaring took center stage. The 1.05 level did offer support, but I believe that there is enough resistance all the way to the 1.07 level above that anytime we show signs of exhaustion, it could be a nice selling opportunity. The European Central Bank extended quantitative easing by 9 months, and possibly even longer given enough time. At the same time, the Federal Reserve looks likely to raise interest rates, so this means that the market should continue to go lower. With this in mind, I still believe that the EUR/USD pair will reach towards the 1.03 level underneath, and then eventually parity.

GBP/USD

The British pound rallied on Friday, but remains well below the resistance above, as the previous uptrend line should now offer quite a bit of selling pressure. On top of that, the 1.25 level above should be resistance also, so having said that I believe that selling on signs of exhaustion it will be the best way to go forward. I think that we will eventually reach down to the 1.21 handle underneath, and then of course the 1.20 level below that. I believe in the bearish story overall, but I recognize that there is a lot of choppiness. Ultimately, short-term trades will probably be the best way to approach the market longer-term, and as a result I think that you will get several opportunities all the way down to the 1.20 level.

The 1.20 level underneath it should be massively supportive, but eventually we could break down below there and reach towards the longer-term support at the 1.15 handle on the monthly charts. Ultimately, this is a market that I have no interest in buying until we break above the 1.2750 level, something that doesn’t look very likely to happen anytime soon.