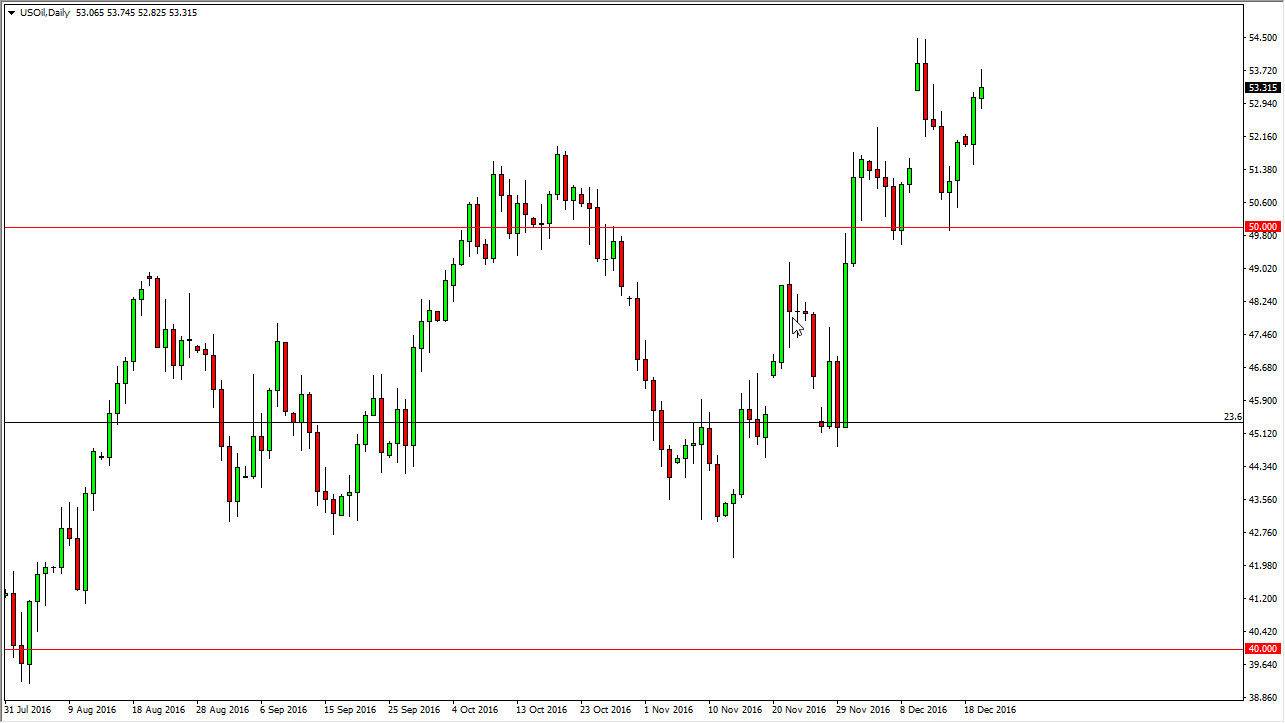

WTI Crude Oil

The WTI Crude Oil market had a slightly bullish candle on Tuesday, as we continue to grind towards the highs. I think that somewhere near the $55 level we will begin to see quite a bit of resistance. If we can break above the $55 level, the market should continue to go much higher. In the meantime, I am willing to buy pullbacks every time we see some type of supportive candle, all the way down to the $50 handle. If we were to break down below there, then I think that the WTI market will fall significantly. We do have the Crude Oil Inventories announcement coming out today, so expect volatility.

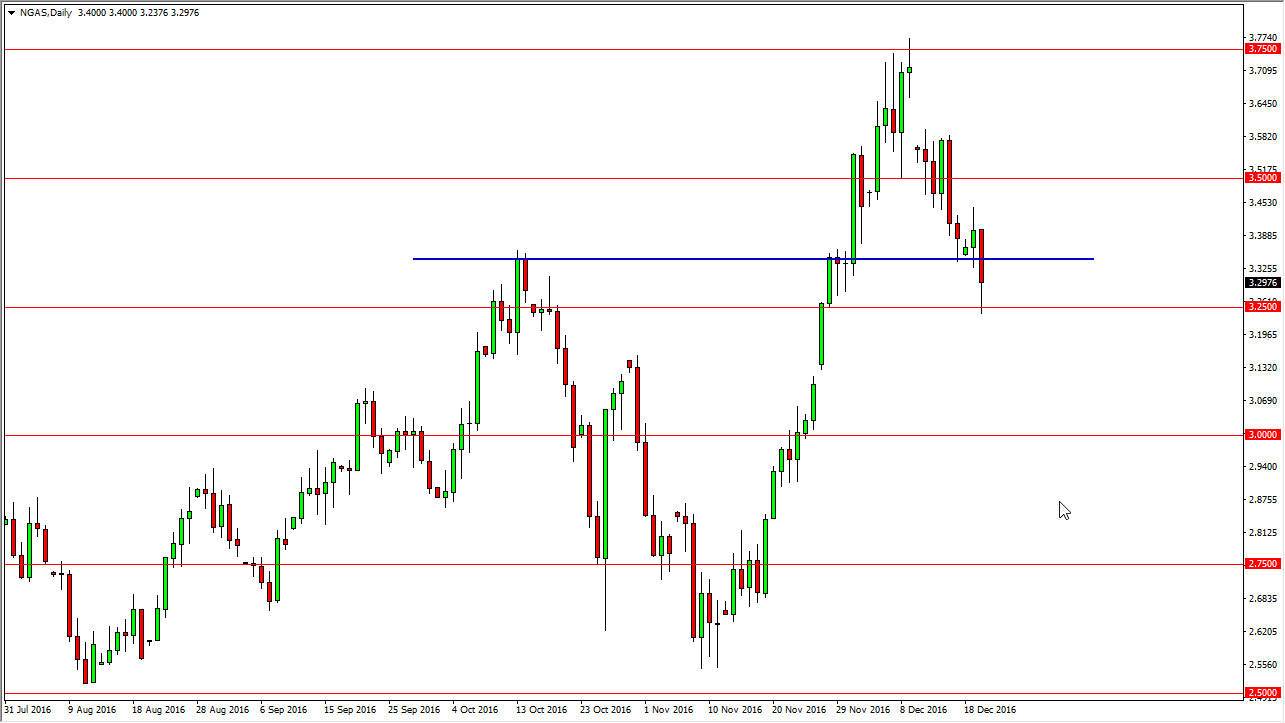

Natural Gas

The natural gas markets fell rather hard during the Tuesday session, slicing through the $3.30 level. That was an area that had been supportive in the past, and of course resistance as well. Because of this, the sellers got aggressive and we went all the way down to the $3.25 handle. As an area where I thought there could be buyers, and the fact that we bounced later in the day suggests to me that we will eventually bounce higher and perhaps reach towards the $3.45 level again. On a supportive candle, I’m willing to buy, but I also recognize that a break down below the bottom of the range for the session on Tuesday would be a very negative sign. If that happens, the market should then reach down to the $3.00 level, which of course is a large, round, psychologically significant number.

Because of this, the market should continue to see quite a bit of volatility but with the lack of liquidity I think that it’s can be difficult to trust these moves for any real length of time. Ultimately, I think short-term trading is about as good as it gets at the moment.