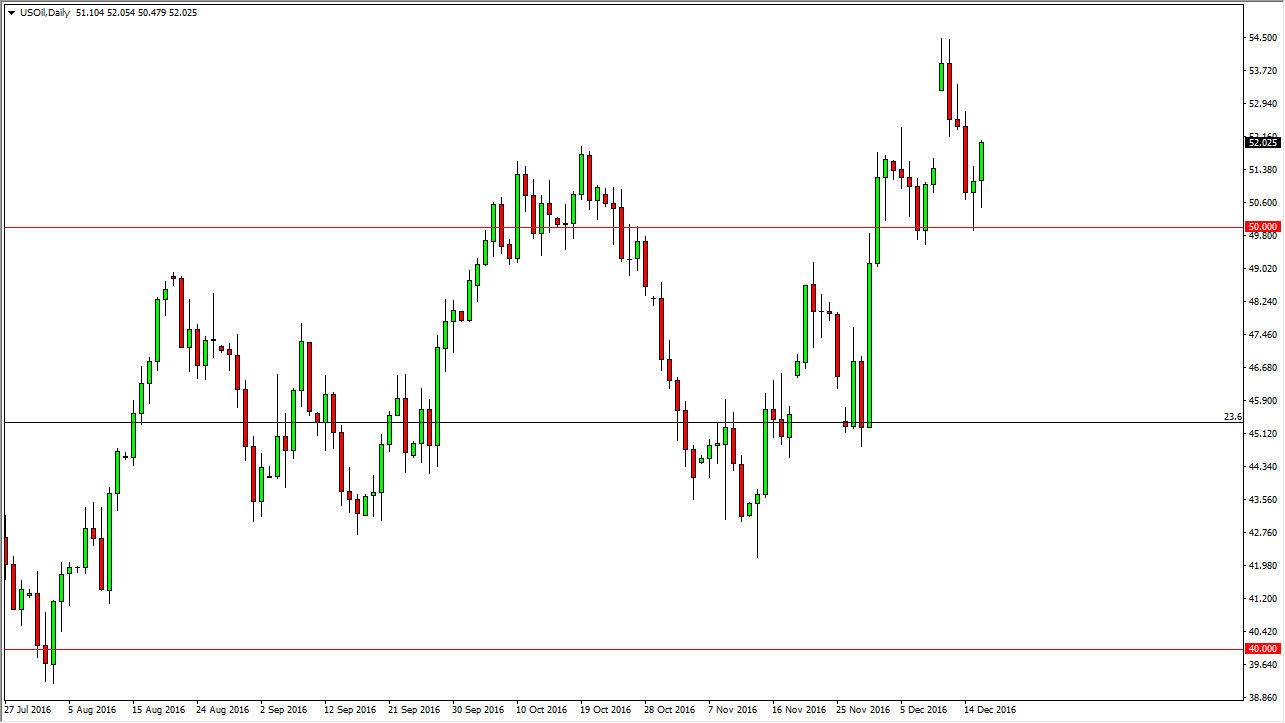

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday, but just as we had seen on Thursday, buyers came in just above the $50 level to push the market higher. We closed at $52, and I now feel that we will probably continue to bounce towards the $54 level. I don’t necessarily believe that we are ready to take off to the upside, especially with Christmas coming next weekend. I think the markets will be fairly quiet, but will tend to favor a bit of a drift higher. If we do break down below the $50 level, the market should continue to drop from here and reach towards the $46 handle. Either way, I’m not expecting sudden moves.

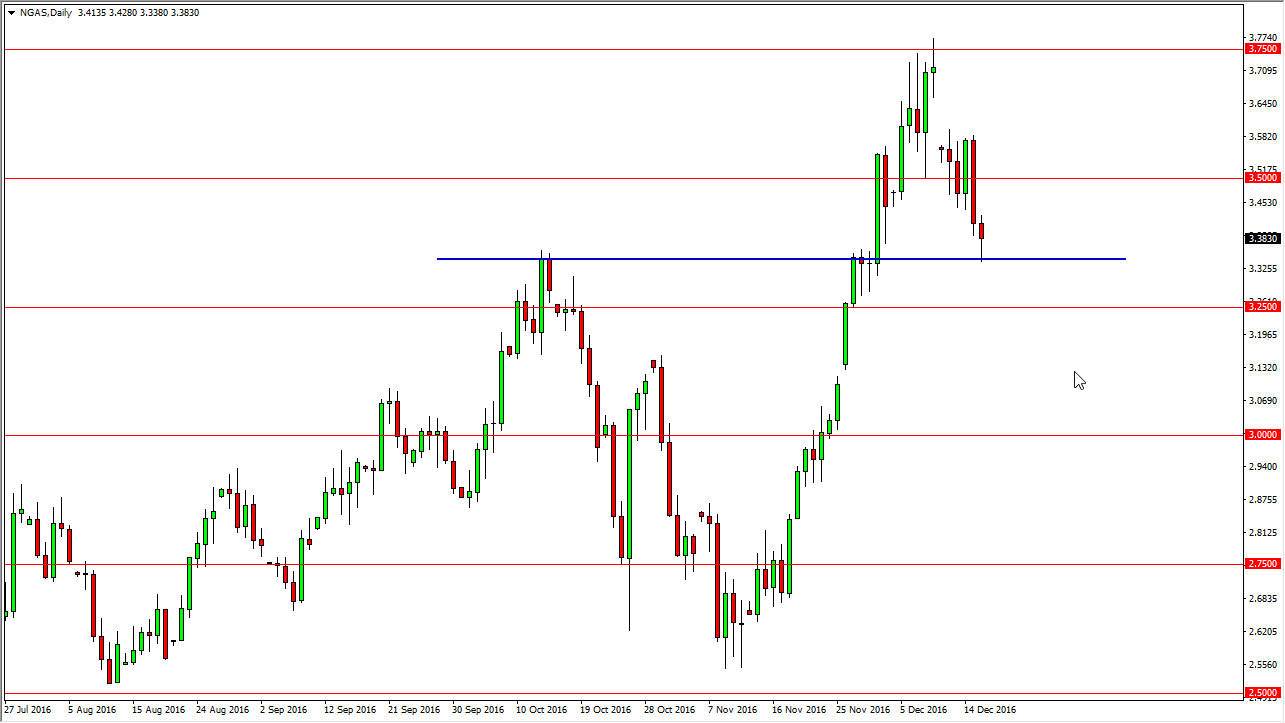

Natural Gas

Natural gas markets fell slightly during the session on Friday but found enough support near the $3.30 level to turn things around and form a hammer. A break above the top the hammer would send this market higher, and I believe we could very well find ourselves trying to reach towards the top of the. After all, gaps get filled, and it would make quite a bit of sense that the market would do just that. If we break down from here, I think there is still a fairly significant amount of support below at the $3.25 level, so it’s not until we get below there that I am comfortable selling. I think this offers a nice short-term buying opportunity, but I’m not expecting any major breakout above the $3.75 level above, especially in a week that can be relatively illiquid.

The natural gas markets have been very strong, especially over the last couple of weeks, however, I also recognize how much bearish pressure there is longer-term so I don’t have any interest in placing a longer-term trade at the moment. Nonetheless, I think the buyers will be rewarded.