WTI Crude Oil

The WTI Crude Oil market fell on Wednesday as the Federal Reserve raised interest rates. This of course put a lot of bullish pressure on the US dollar, which in turn puts a lot of bearish pressure on the crude oil markets. What I find interesting is that we not only filled the gap from the open of the week, but we went below it. At this point, the market is looking a little exhausted and I have to wonder whether or not the OPEC and non-OPEC countries coming to a production cut agreement will have longer-term lasting effects anyways. After all, the higher prices will attract shell drillers in the United States and Canada, which of course are not bound at all by OPEC’s demands. With this, I think we're in real danger of a breakdown.

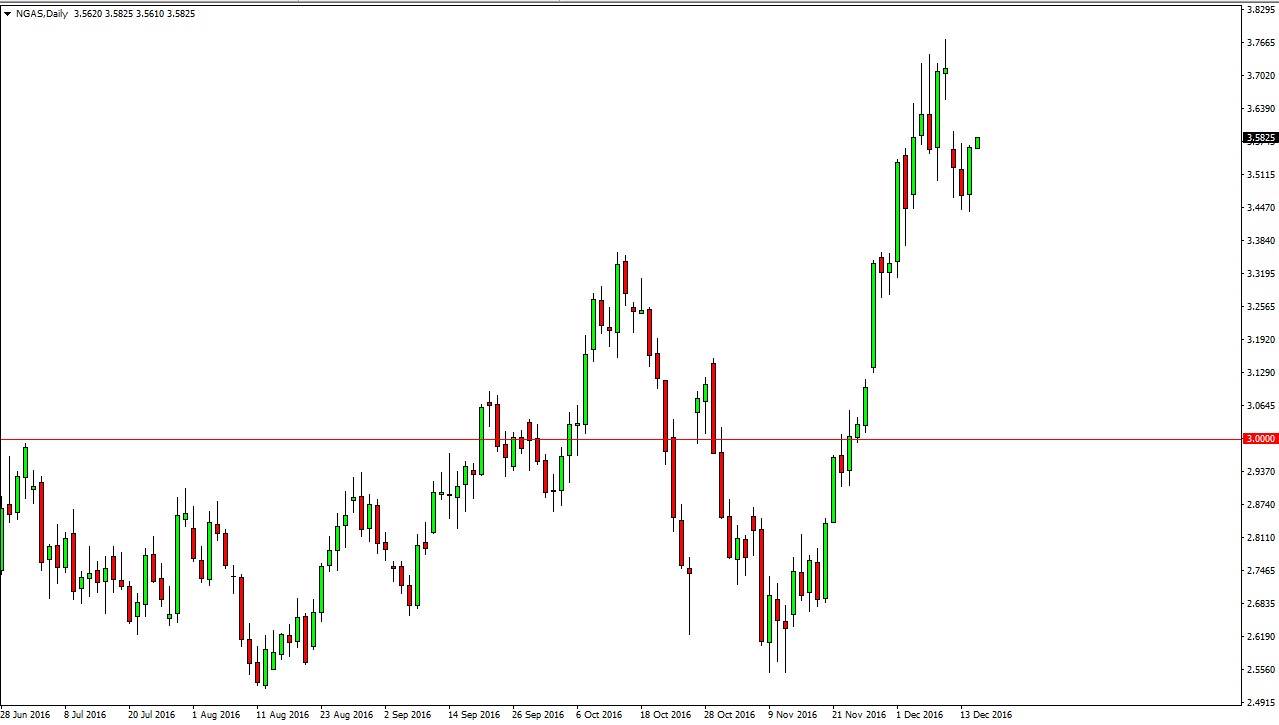

Natural Gas

Natural gas markets had a slightly positive session during the day on Wednesday, and have yet to fill the gap from the weekend. This of course is something that you can typically rely on, and as we are starting to roll over into the Thursday session it looks as if the market will try to do so. Obviously, there’s a lot of bullish pressure in this market and I think we probably will continue to see buyers return. However, it is a bit parabolic so I have to wonder whether we won’t get a couple of violent pullbacks. Longer-term, there are major issues when it comes to pricing of natural gas, as the United States and Canada have more than three centuries worth of power just waiting to be extracted. Because of this, I believe that longer-term natural gas will continue to have major problems. In the meantime, though, it’s obviously a market that wants to go higher and therefore you have to be looking for buying opportunities.