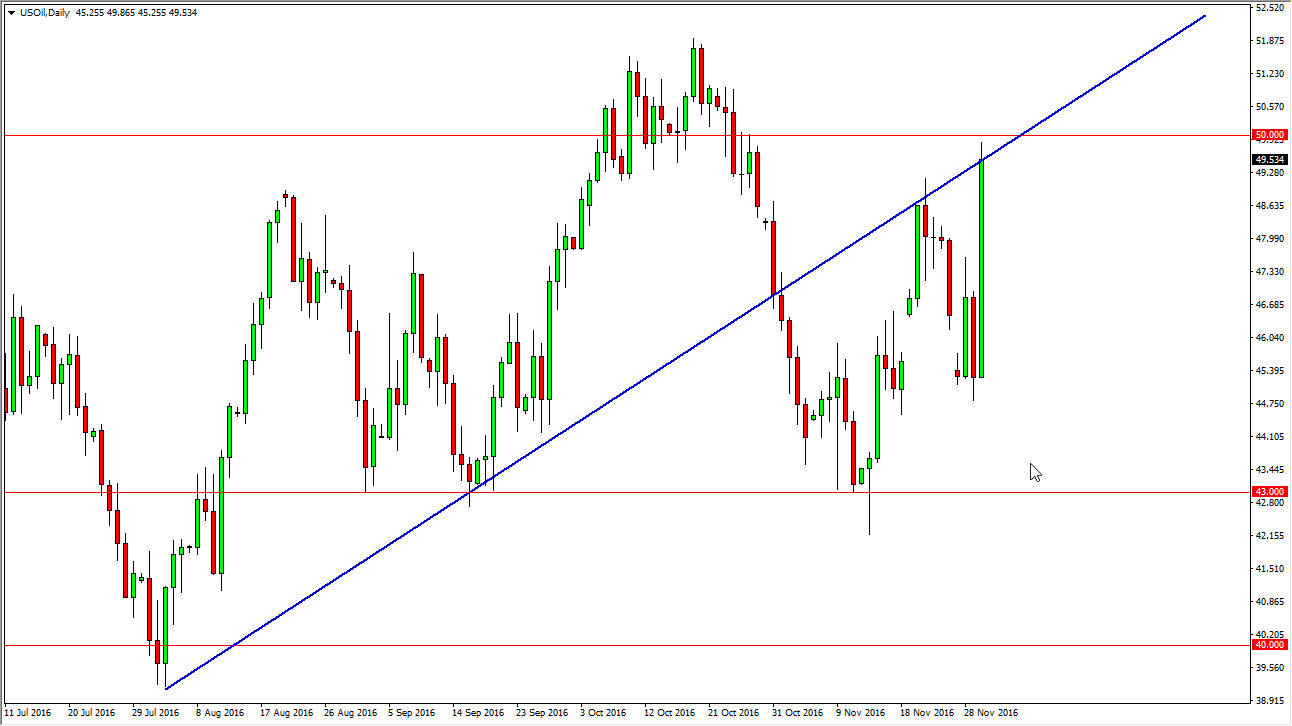

WTI Crude Oil

The WTI Crude Oil market broke higher during the day on Wednesday as it was revealed that OPEC had come to an agreement as far as output production is concerned. The production type should help with some of the oversupply, but ultimately I believe that the oversupply is far too much in the way of bearish pressure to be overcome for the longer term. After all, the higher the pricing goes when it comes to the oil market, the more interested the Americans and Canadians will be as far as drilling is concerned. The $50 level above has offered resistance, and of course the bottom of the uptrend line has as well. Because of this, waiting to see whether or not we get some type of exhaustive candle after a failed break out in order to start shorting. I think there is a significant amount of resistance all the way to the $52 handle.

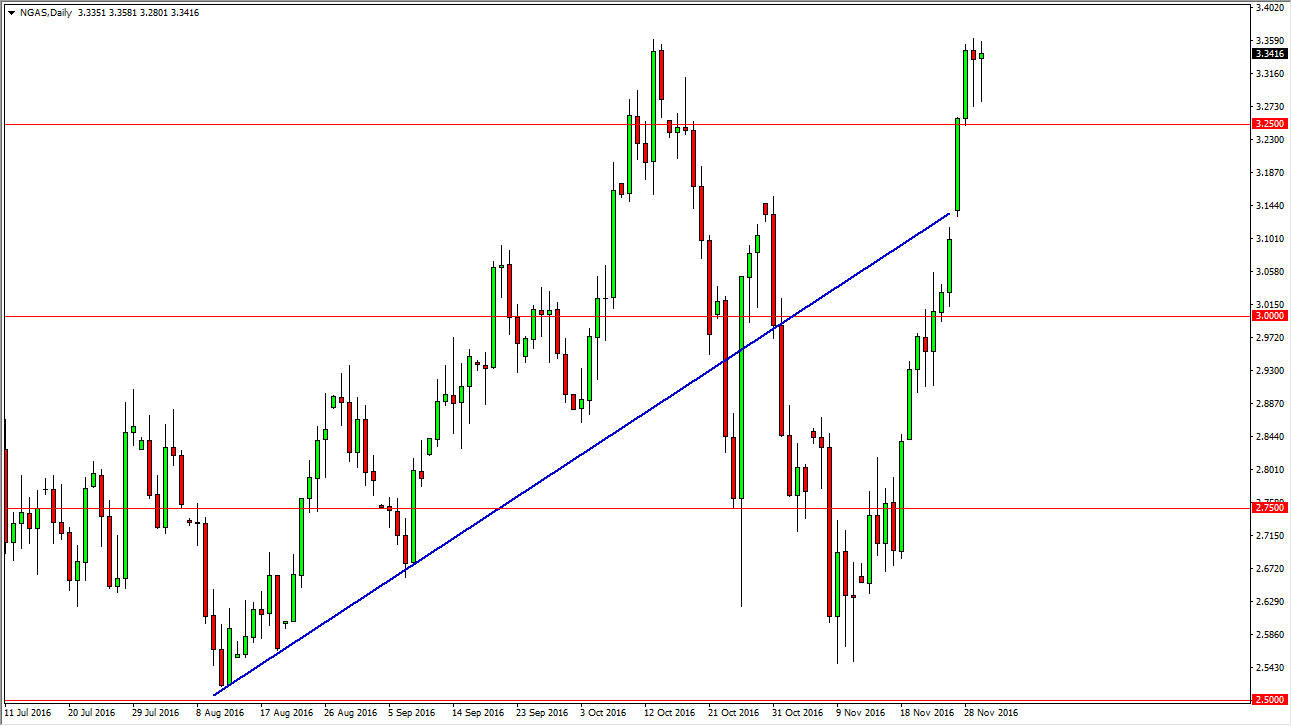

Natural Gas

The natural gas markets fell slightly during the day on Wednesday, but found enough support below at the $3.25 level to bounce and form a hammer. This happened on Tuesday as well, and as a result it looks as if the buyers are very active indeed. I have no interest whatsoever in buying this market though, because quite frankly we are overbought by just about any metric that you can measure the market by. If we can continue to go higher, this is a market that will continue to be very difficult.

A break down below the $3.25 level should send this market a little bit lower, but I think there is more than enough bullish pressure underneath, perhaps where the previous uptrend line would have gone through, in order to get involved and take advantage of value. I have no interest in selling, but I do need to see some type of pullback in order to get involved to the upside. Longer-term, I still believe that natural gas oversupply will continue to be a major issue.