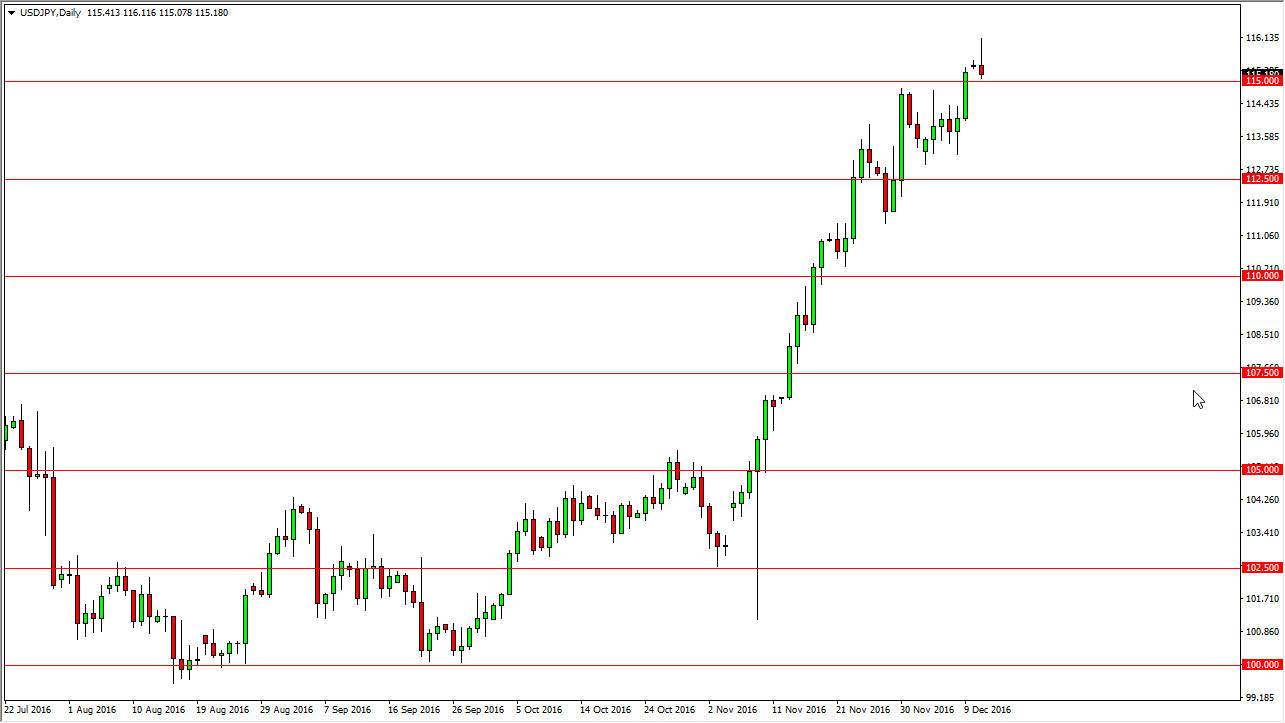

USD/JPY

The USD/JPY pair initially rallied on Monday as we continued to see US dollar strength against the Japanese yen. However, we turned around to form a shooting star and that tells me that the market might be a little overextended. That’s fine with me, I like the idea of buying on pullbacks from time to time in order to take advantage of value. I think that the 112.50 level will be massively supportive, and of course the 110 level underneath there. I have no interest in selling this market, I believe that we eventually go much higher and every time we pullback there should be an opportunity to pick up value. If we broke above the top of the shooting star, that would be a buying opportunity as well.

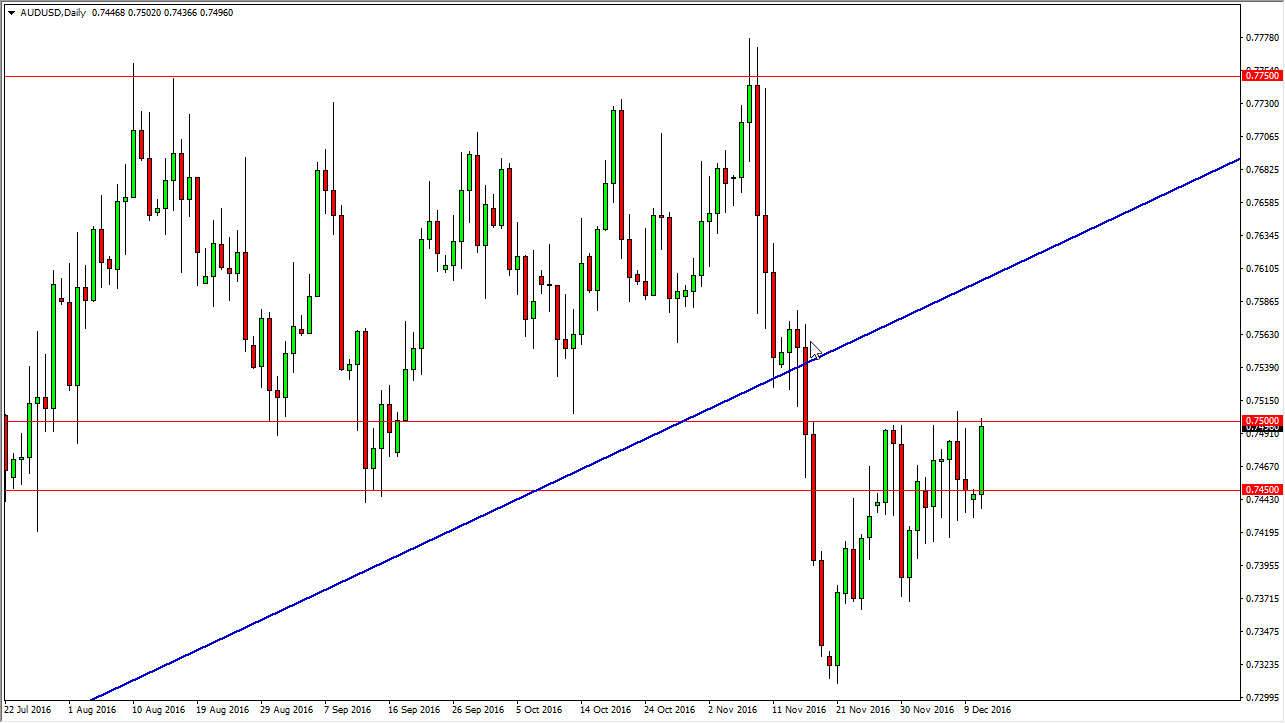

AUD/USD

The Australian dollar broke higher during the day on Monday, testing the 0.75 level. This area has been resistive and if we can close above it, I think that’s a positive sign for the Aussie dollar, at least for the short-term. The previous uptrend line was massively supportive, and should now be massively resistive. I think that a short-term buying opportunity would present itself, and give us an opportunity to take advantage of a short-term boost. Ultimately though, I think that the selling comes back as the gold markets will continue to show bearish pressure. This of course has a knock on effect in the Australian dollar as well. A break down below the 0.7450 level should send this market much lower if we do break down below there on a daily close. If that happens, the market should reach towards the 0.73 area.

Regardless, this is a market that should continue to have a lot of volatility, as the gold markets still have quite a bit of volatility.