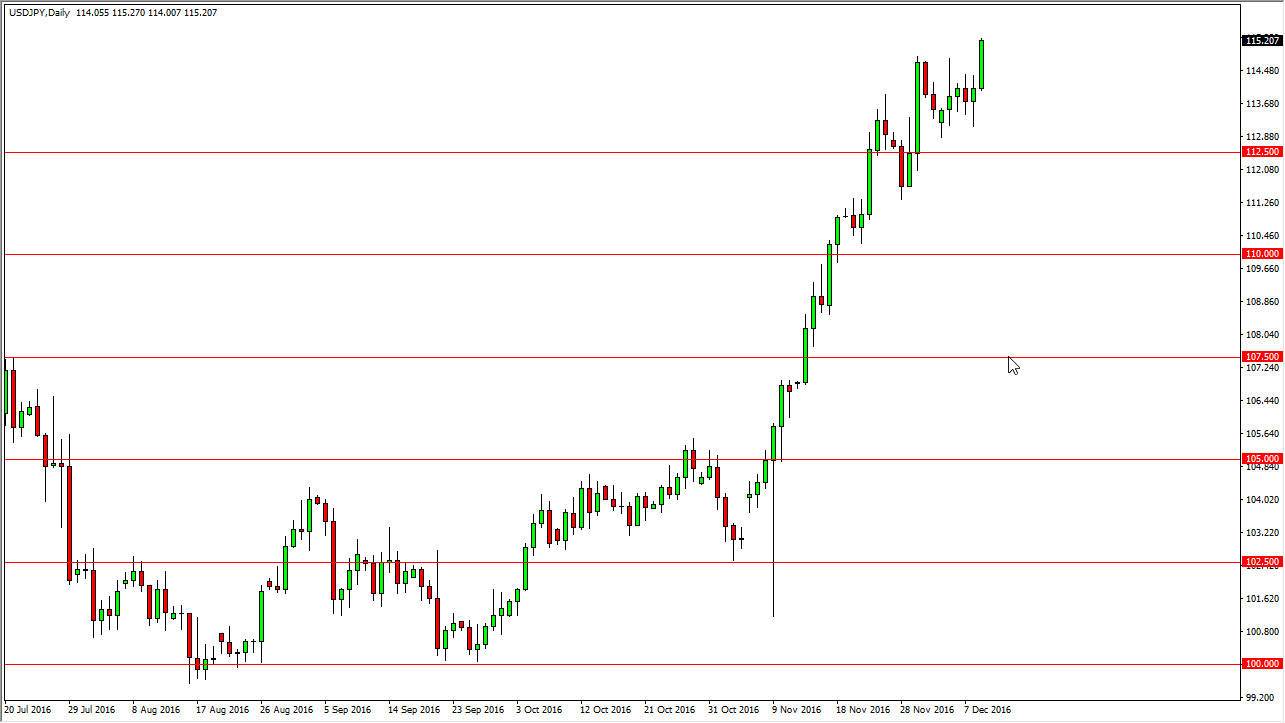

USD/JPY

The US dollar broke higher on Friday and again, as we have now reached above the 115 handle. It looks as if short-term pullbacks will continue to attract buyers, and because of that I think that the only thing you can do in this market is go long, because shorting would be very difficult. Ultimately, I believe that any pullback will find support at most round numbers, and obviously, the trend has changed overall. The Japanese yen looks very soft against almost all currencies around the world, and of course the US dollar is the strongest currency on the planet right now. Because of this, we have a bit of a “perfect storm” in this market to start buying again.

AUD/USD

The Australian dollar went back and forth during the day on Friday, as we continue to find a bit of resistance just above. Pay attention to the gold markets, because they do have a major influence on what happens with the Australian dollar. I think we can break below the lows of the last couple of sessions, the market should continue to go lower, perhaps reaching towards the 0.73 handle. I think that the 0.75 level above will continue to be resistive, so I don’t think that you can buy the Aussie right now, and even if we did break above there, the market will probably find resistance near the previous uptrend line.

At this point, the market looks soft, and of course the US dollar has been strengthening against almost every currency on the planet. Because of this, I don’t think that the Australian dollar will be any different and I do believe that we continue to go lower as the Federal Reserve will increase interest rates over the longer term. The Australian dollar of course will continue to be way down due to the gold markets falling as a result of those interest-rate changes.