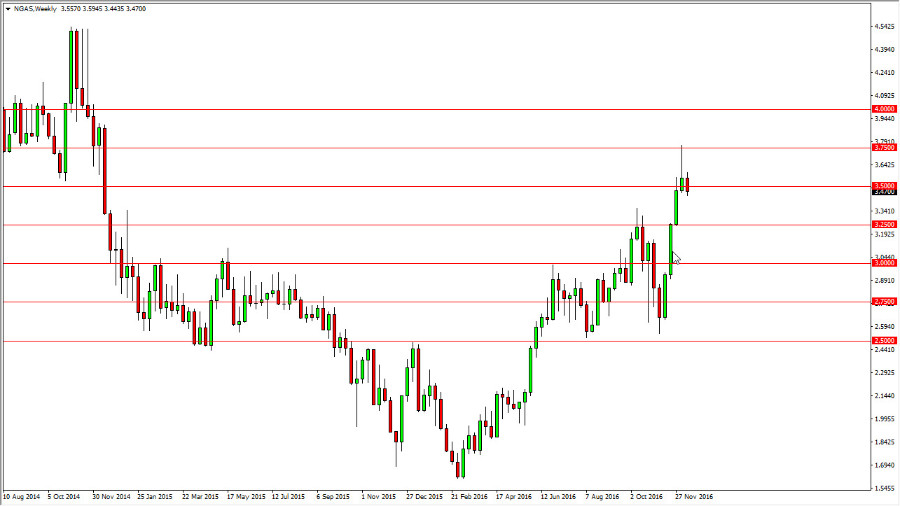

Natural gas markets have recently been very strong, but as I write this in mid-December, we are starting to see a little bit of exhaustion enter the market. After all, this has been a parabolic move to the upside, so I feel it’s only a matter of time before we have to drop in value. I think that this quarter will probably start out being negative, perhaps reaching down to the $3.25 level below, and then eventually the $3.00 level after that. Somewhere in that range, I think that the buyers will return as we are in the middle of the high demand season this quarter, and then turn around towards the end of March again due to the seasonality.

Far too much natural gas

In reality, this far too much natural gas out there in the United States and Canada alone to keep this market going higher for a longer-term move. Because of this, I think that the real trade will be late in the quarter when we get the opportunity to start selling at higher levels. Expect a lot of noise once we get below the $3 handle, which I expect to be at by the time the quarter ends. In other words, I think we are going to see a pullback, and then an extraordinarily strong bounce, followed by the market rolling back over. This quarter will be very erratic and choppy for the natural gas markets. Even if we did break out to the upside, I think that the $4 level becomes far too psychologically significant for the market to break above.

The market will have to deal with the fact that more Canadian and American natural gas drillers will jump into the fields and back into drilling with these higher prices. Given enough time, that will flood the market oil supply yet again, and by the end of the quarter as demand drops, this should overwhelm the buyers.