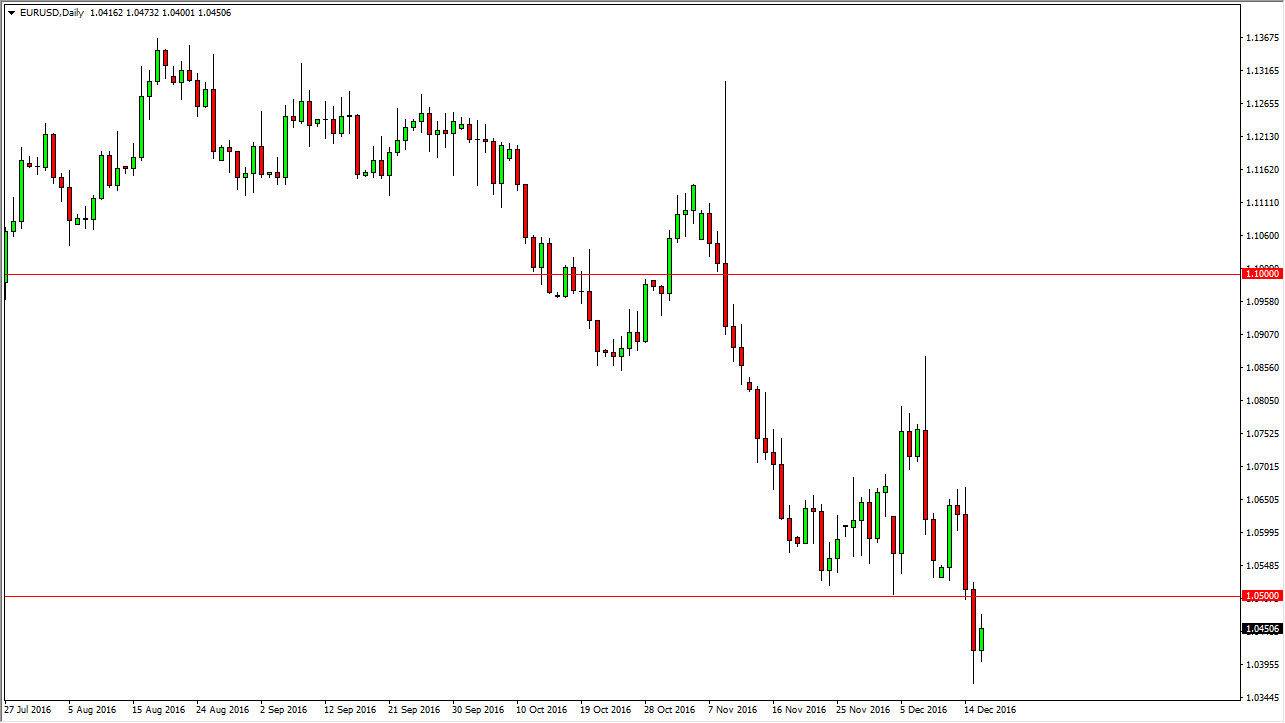

EUR/USD

The EUR/USD pair rose initially on Friday, but the 1.05 level above continues to offer resistance. I think at this point in time, it’s only a matter of time before sellers get involved so I’m looking for exhaustive candles in order to take advantage of value in the US dollar. The European Central Bank has extended quantitative easing by 9 months, while the Federal Reserve have a series of interest-rate hikes coming. Because of this, I don’t see any reason why the Euro won’t drop down to the parity level. Because of this, I have no interest in buying, and recognize that selling is about all you can do. In fact, I don’t see any reason to start buying this pair until we break above the 1.07 level at the very least.

GBP/USD

The British pound bounced off of a trend line on Friday, testing the 1.25 level. A break above that level is a relatively bullish sign, but ultimately I still think that the 1.2750 level is going to continue to be massively resistive, and that the resistance extends all the way to the 1.2850 level which is even more important. Rallies at this point in time should offer selling opportunities on signs of exhaustion, and if we can ever break down below the bottom of the previous uptrend line, the market should continue to go much lower, perhaps even as low as the 1.20 level over the longer term.

While the British pound has been oversold over the last several months, the reality is that the value of the Pound should continue to drop, as the Federal Reserve is looking to raise interest rates while the Bank of England continues to struggle with the aftermath of the exit vote. Ultimately, the British pound will soften against the US dollar and the recent rally has been a steady and methodical pullback that should then have dollar buyers interested in this market.