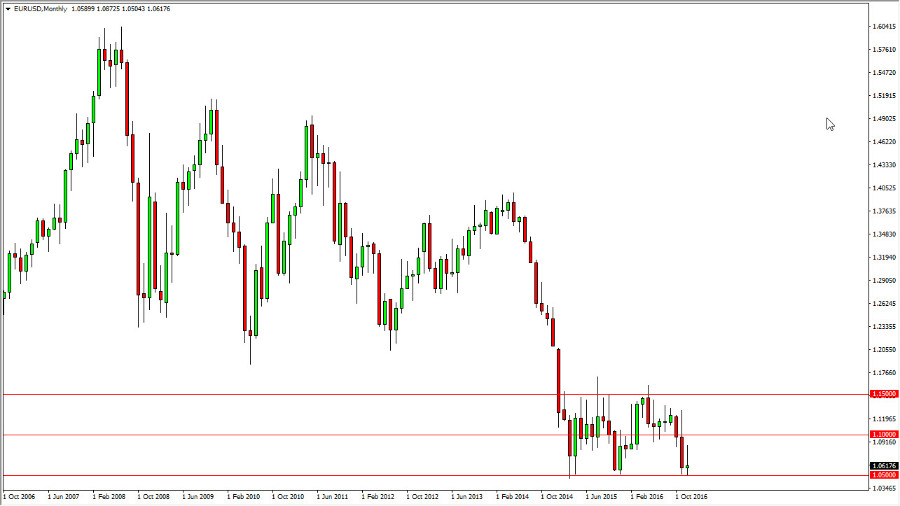

The Euro has been range bound for the last couple of years. While it has been a very rocky and tumultuous road, the reality is that we have been trading between 1.05 and 1.15 for almost 2 years now. Because of this, I think a lot of traders have gotten lazy when it comes to this pair but the December candle is starting to show that the bearish pressure is mounting. We have essentially formed a “triple bottom” at the 1.05 handle, something that indicates how important this level is. Because we are giving up gains when we get them, I believe that it is only a matter time before we break down below the 1.05 level, which for me is a signal that it’s time to start pouring on the short positions.

Parity

I believe that we will break down below the 1.05 level and reach for parity next. But quite frankly when I look at this market I believe that we are going to go lower than that. By the end of year I anticipate that the Euro could very well be trading near the 0.90 handle. We have a lot of issues in the European Union at the moment, and confidence is in exactly high at this point. On the other hand, we have the European Central Bank that has just extended quantitative easing through the rest of the year. Quite frankly, if the Federal Reserve raises interest rates more than once, this pair is going to fall apart as the Europeans may find themselves having to extend quantitative easing beyond 2017. Rallies for this year should continue to show selling opportunities given enough time, but the question will be whether or not you can be patient enough to wait for them. I believe that the US dollar strength continues and 2017, and the EUR/USD pair is one of those places that you will see it most prominently.