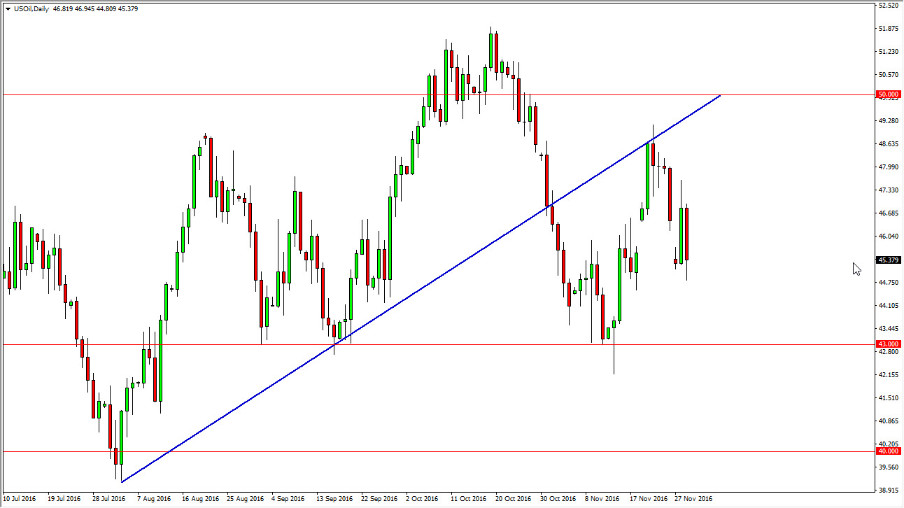

WTI Crude Oil

The WTI Crude Oil market fell during the day on Tuesday, wiping all of the gains from Monday. Because of this, looks like Reagan continue to be very volatile, and this market will probably be difficult to hang onto for any real length of time. I think that the bearish pressure will probably take over given enough time, because quite frankly we have far too much in the way of oversupply. I think rallies offer selling opportunities going forward, and with that being the case it’s likely that resistive candles will be the catalyst to start selling after those short-term bounces. The oversupply issue will continue regardless of OPEC cuts, because so many countries that are producing oil now have nothing to do with that cartel.

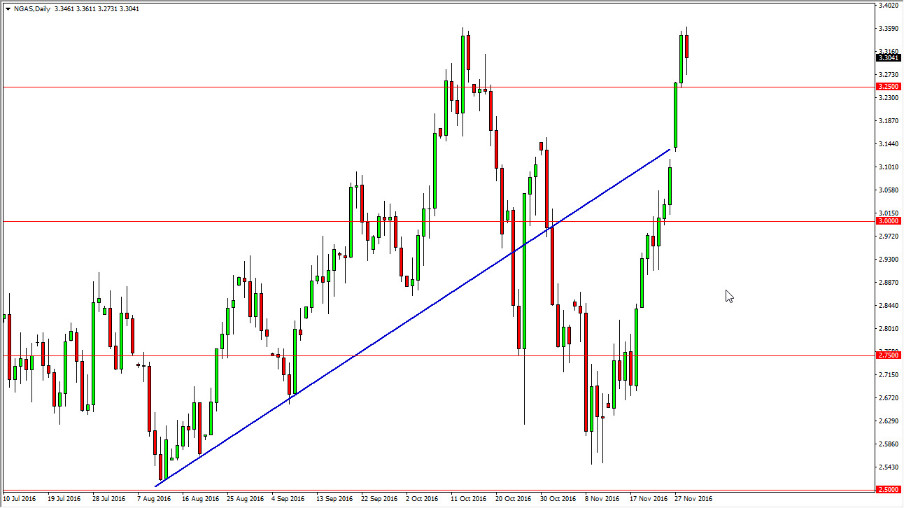

Natural Gas

The natural gas markets fell on Tuesday, testing the $3.25 level. Ultimately, this is a market that is far too overextended to get involved with at the time, so even though we have pullback and showing bits of support at a round number, I’m very cautious about being involved. This is because even though a pullback is all but necessary, the reality is that you can’t short this market because at any time the buyers could return. Buying this market possible, but you need to do it on pullbacks and show signs of support as it gives you the ability to take advantage of what is obviously a very bullish explosive move to the upside. I can’t imagine selling at the moment, although it I do recognize that eventually the oversupply issue comes back to move the market.

Given enough time, I think the sellers will return, but they are a long way away from the market at the moment so therefore the only thing you can do is buy. However, chasing the trade although we appear would be absolutely disastrous.