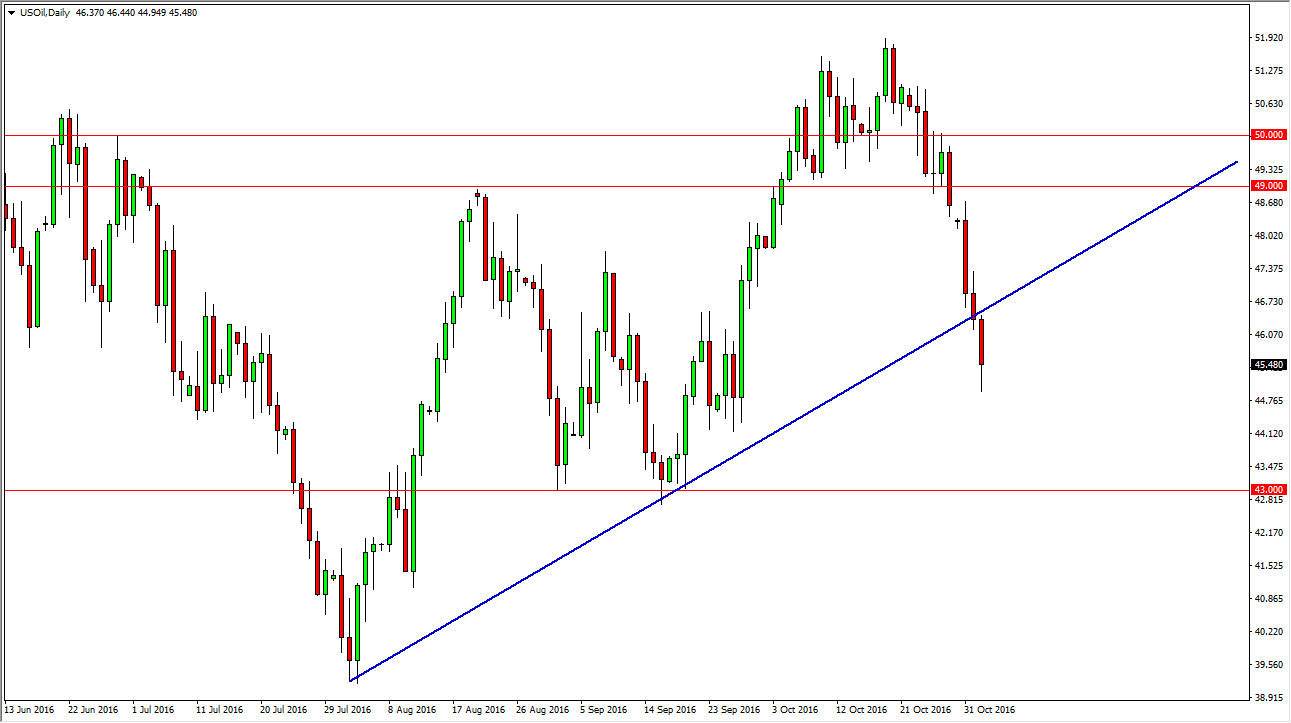

WTI Crude Oil

The WTI Crude Oil market fell during the day on Wednesday, as we have now clearly broken below the uptrend line that had been supporting this market. As the Crude Oil Inventories number came out as 14 million barrels added, it was much larger than expected. Because of this, it is obvious that the demand for crude oil is decreasing, and they will more than likely sell this market going forward. At this point, I think that we’re going to reach down to the $43 level next. Any type of rally at this point in time should show resistive candles above on short-term charts that we can take advantage of, as long as we are below the previous uptrend line as marked on the chart.

Natural Gas

The natural gas markets initially tried to rally on Wednesday, but found enough bearish pressure to continue going lower. Beyond that, we closed at the very bottom of the range and it now looks as if the $2.75 level will be tested. I think we are going to continue to sell off at this point, and that rallies will continue to offer selling opportunities on exhaustive candles based upon short-term charts. The fact that we are closing at the bottom of the range suggests that we will continue to go much lower. With that being the case, I do think that the matter what happens I will be selling the natural gas markets going forward.

It has been extraordinarily volatile as of late, but really at this point in time it looks like the market is going to continue to find sellers as not only is the weather warmer than we expected in the northeastern part of the United States, but also we have more than enough supply of natural gas to keep this market very low over the longer term.