USD/CHF Signal Update

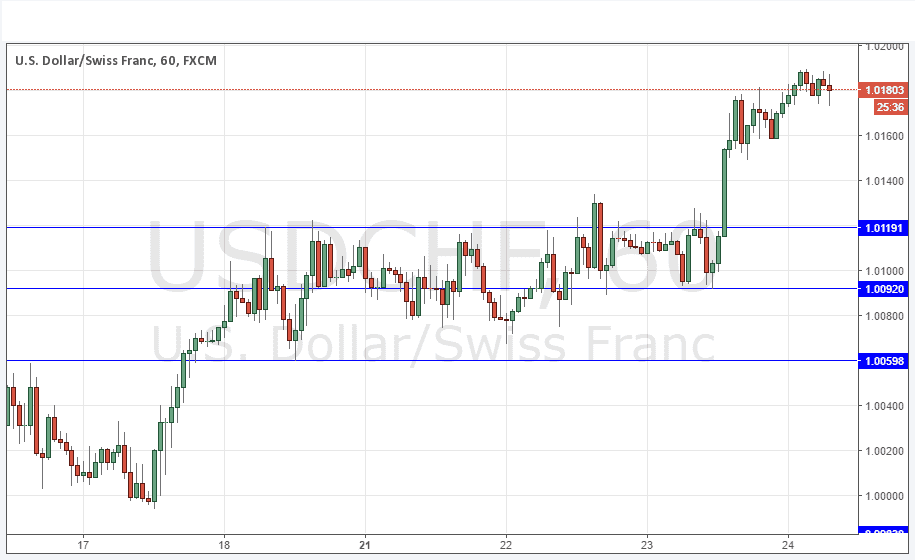

Yesterday’s signals gave a profitable short trade following the bearish pin bar rejection of the identified resistance level at 1.0119 during the early part of the London session.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may be entered before 5pm London time today only.

Long Trades

* Go long after bullish price action on the H1 time frame following the next touch of 1.0119 or 1.0092.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following the next touch of 1.0250.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Yesterday’s strong bullish move in the USD was well expressed in this pair, which broke up above the resistance level of 1.0119 very strongly and convincingly upon the better than expected U.S. economic data release. Even before the release it was already beginning to rise. For the rest of the day and into the Asian session, it kept making new highs convincingly.

At the time of writing it is showing signs of beginning a pull back, but there is no reason not to remain strongly bullish on this pair for the time being.

There is nothing due today concerning either the CHF or the USD. It is a public holiday today in the U.S.A.