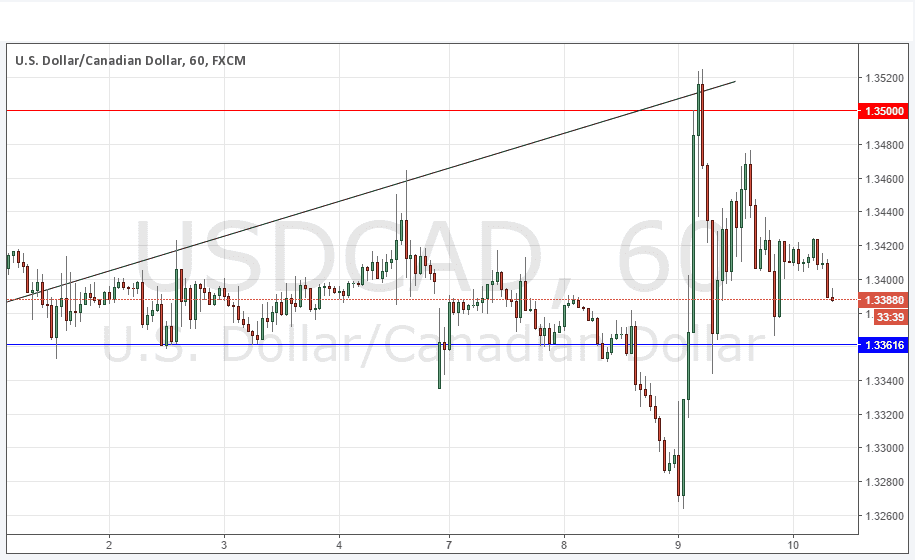

USD/CAD Signal Update

Yesterday’s signals produced a long trade following the bullish rejection of the identified support level at 1.3362 which gave the minimum positive result of 20 pips with the rest breaking even.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm New York time today.

Long Trades

Long entry after the next bullish price action rejection following a first touch of 1.3362 or 1.3216.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after the next bearish price action rejection following a first touch of 1.3500.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

Recent political events have created a general turmoil in the markets with some big swings, but the moves here in this pair were somewhat smaller. This can be attributed to smaller divergence between the economies of Canada and the U.S.A. which are quite heavily interlinked.

Technically, we are now held by the key level of 1.2500 above, with some meaningful support below. The price has been consolidating above the nearest support in a choppy manner which makes this pair one to avoid for the moment. There are probably going to be better opportunities in other currency pairs.

There is nothing due today regarding the CAD. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.