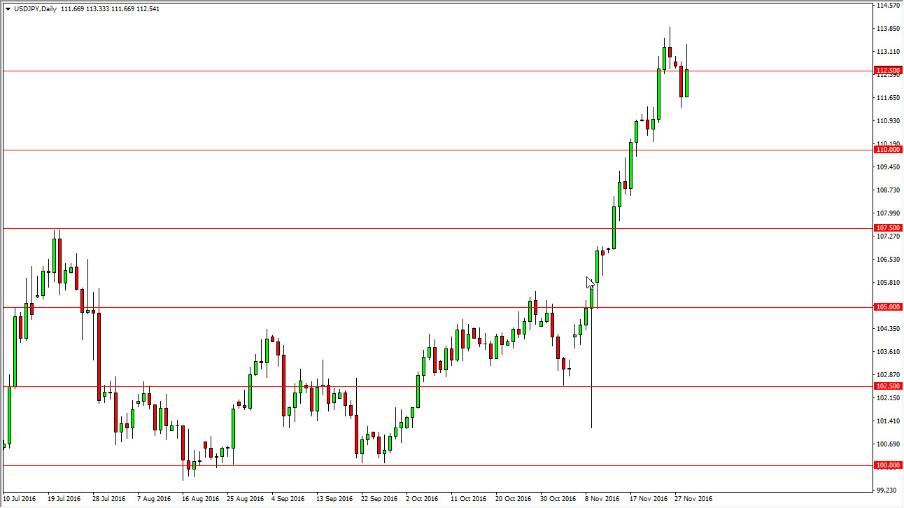

USD/JPY

The US dollar rallied during the day on Tuesday, breaking above the 112.50 level against the Japanese yen. However, we did pullback a little bit in order to show signs of struggle. I believe that a pullback is what we need to see in order to continue going higher. The 110 level below should be supportive, as the market continues to show quite a bit of bullish pressure, but quite frankly is overbought at this point. I think it’s only a matter time before we do go higher so I’m looking for pullbacks and signs of support on shorter-term charts or even quite frankly a significant pullback in order to go long. I have no interest in shorting this market, and with this it’s only a matter of time before the buyers get involved as far as I can see. I would not be buying at this point, as the market is so overextended and it quite frankly would be chasing the trade if you got involved now.

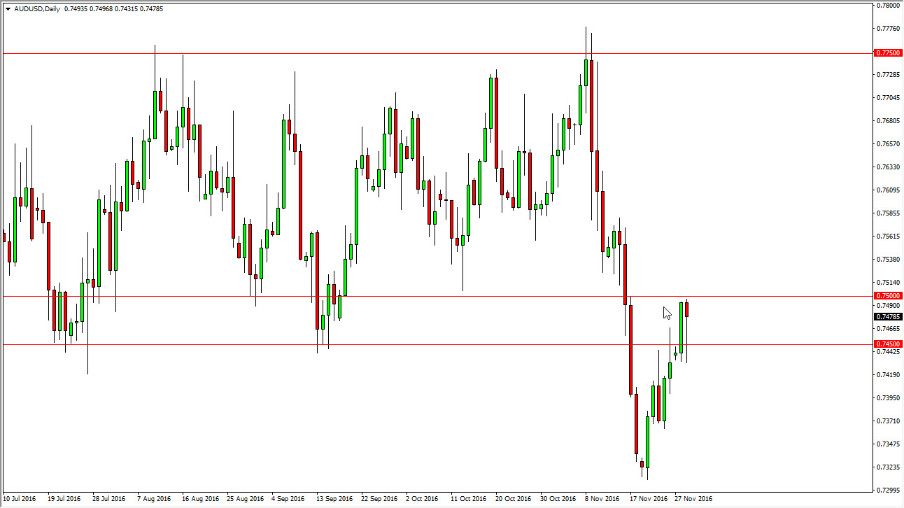

AUD/USD

The Australian dollar initially fell during the day on Tuesday, and tested the 0.7450 level below. However, we bounced enough to form a hammer. This is a bullish sign, but we also need the gold market to rally as well in order for me to feel comfortable going long. There is quite a bit of noise just above the 0.75 handle, so it’s not to be an easy move anyway. I would prefer to sell this market but with the candle that form for the session on Tuesday, it might be best to simply wait for some type of clear signal. At this point, it’s probably best to do just that. I do think that a break down below the bottom of the hammer that form for the session on Tuesday is a very clear signal that we’re going to fall apart and reach towards the 0.73 level. Quite frankly, at this point I would refer that trade.