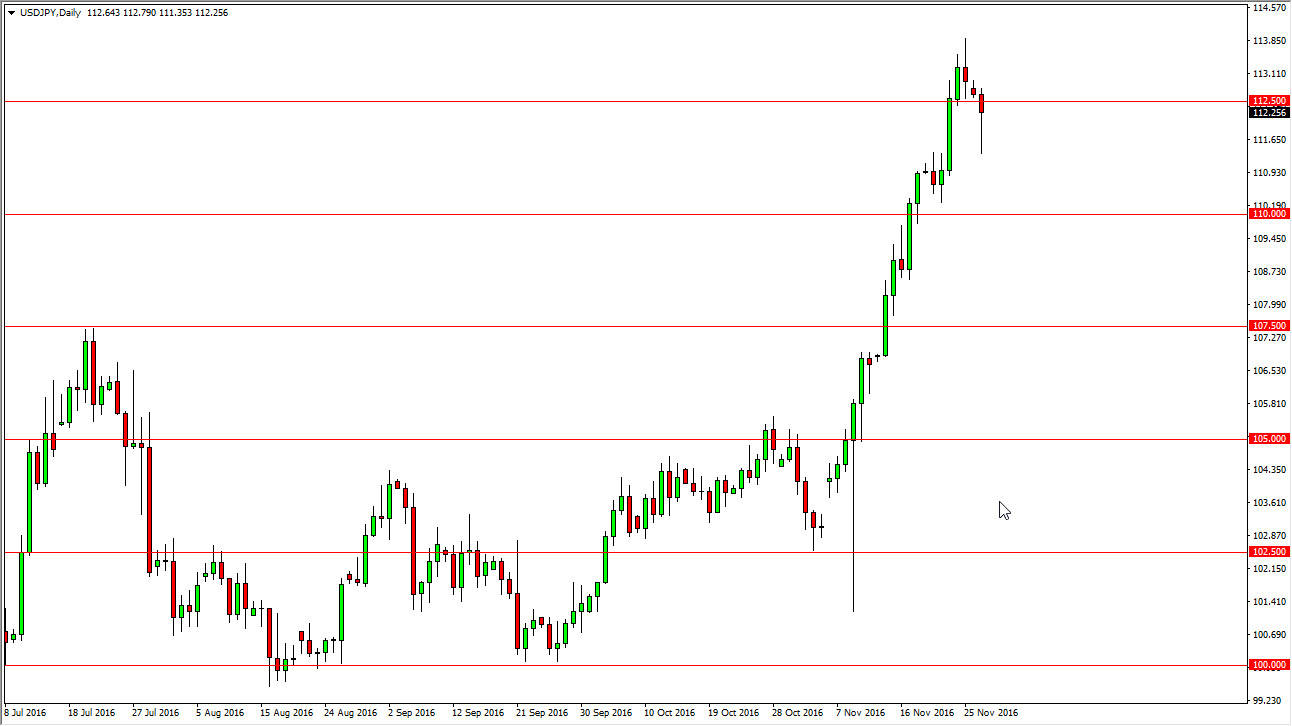

USD/JPY

The US dollar fell initially during the day on Monday, and then turned back around to form a hammer. The hammer of course is a very bullish sign, so I believe it’s only a matter time before the buyers get involved. I believe ultimately though that we need a pullback in order to find value below and build up enough momentum to finally break out to the upside. I prefer to see some type of value play present itself though, because we are overextended so I would love a move down to the 107.50 level, but would settle on a move down to the 110 handle. I have no interest in selling regardless what happens next.

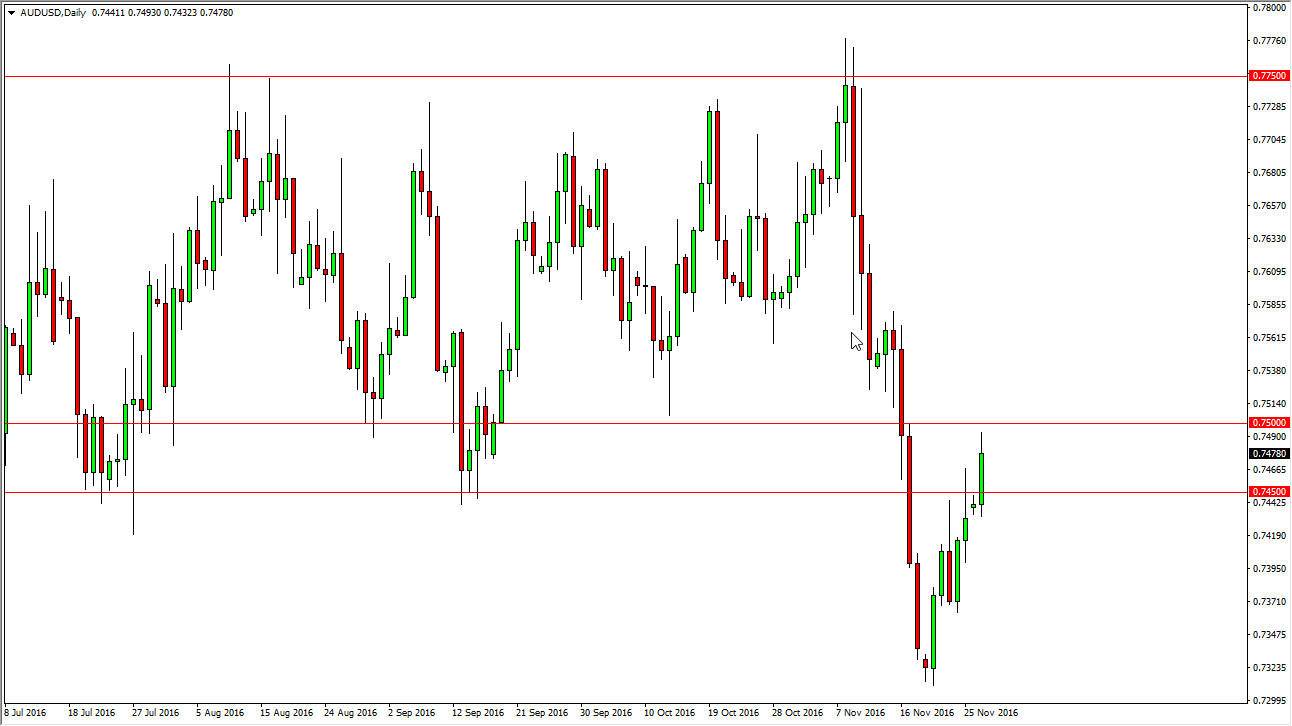

AUD/USD

The Australian dollar rallied on Monday, slamming into the 0.75 region. This is an area that should be massively resistive, and it makes sense we could not get above there. Ultimately, I think this is a market that will follow gold which seems to be sitting sideways in general. On short-term charts, restarting to see a little bit of a sell off, and if gold falls in line I don’t see the reason why we won’t pullback. There is a lot of noise just above the 0.75 handle, so even if we break out to the upside I would be fairly hesitant to get involved. What I would rather see as gold put downward pressure on the Aussie just as the US dollar will. Also, we have the quarter over quarter Q3 GDP numbers coming out of the United States and if there strong that could put quite a bit of bearish pressure in this pair also. When we break down below the 0.7450 level, the market will then reach towards the 0.73 level underneath.

If we can break down below there, the market should then reach to the 0.70 level underneath. That could be a relatively quick move, but is getting need help in the gold markets.