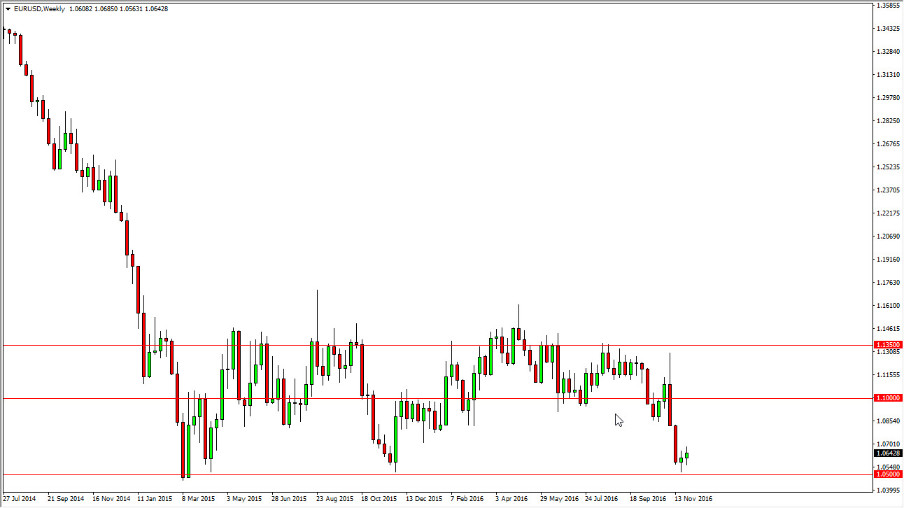

The EUR/USD pair was very choppy over the last couple of weeks during the month of November, and as a result I think that the 1.05 level below is going to continue to attract attention. This is an area that’s been very supportive in the past, so I think that the 1.05 level is going to be very important. If we can break down below there, the market should then reach towards the parity level. I believe that we will continue to see sellers in this market, and that rally should offer selling opportunities during most of the month.

Holidays

Ultimately though, you have to keep in mind that the monk tends to be rather ill liquid when it comes to the back half. This is because of Christmas and New Year’s obviously, and a lot of traders will simply try to get away from the market during the holidays. They would rather be on the beach or with family than worrying about currency positions.

I think that a break down below the 1.05 level would send this market looking parity going forward, and could happen very quickly. You have to keep in mind that there are a lot of things to worry about in the European Union at the moment, not the least of which is the Italian referendum that could throw the banking system into an absolute crisis in Italy, and then the European Union in general. This of course would have money flying out of the EU and into places like the United States which are considered to be much more stable.

Longer-term, we could see the Euro break down below the parity level if all of the troubles in the European Union continue, and as a result I have no interest in buying this pair at all. The 1.08 level above will probably start acting quite a bit like a ceiling in this market.