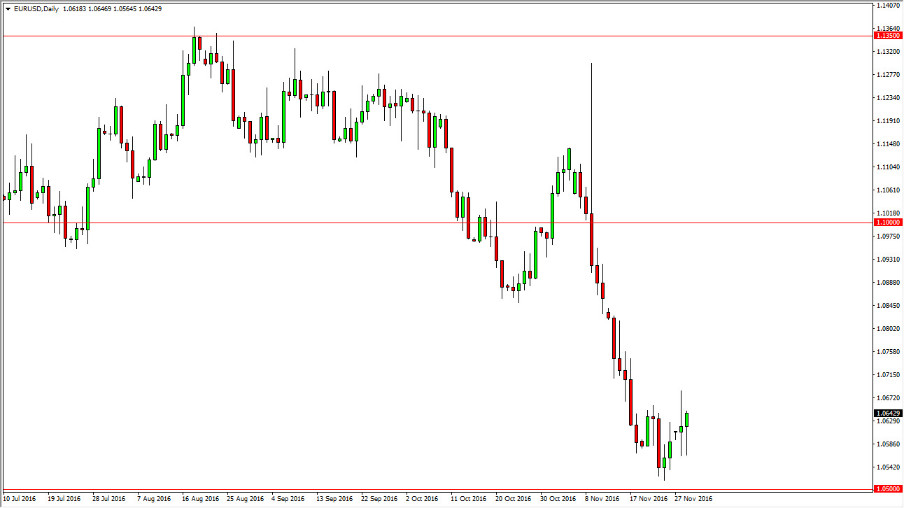

EUR/USD

The euro initially fell against the US dollar but found a little bit of support during the day on Tuesday. We ultimately formed a little bit of a hammer and quite frankly I like that. It’s not that I want to buy this pair, when I want to sell signs of exhaustion after rallies. We don’t have that at the moment obviously, but I do think that it’s only a matter of time before some area like the 1.07 level above offers enough bearish pressure to turn this market around as we try to build up enough momentum to break down below the vital 1.05 handle below. A move below there sends this para looking for parity. With this, I am “sell only”, but don’t have the signal quite yet.

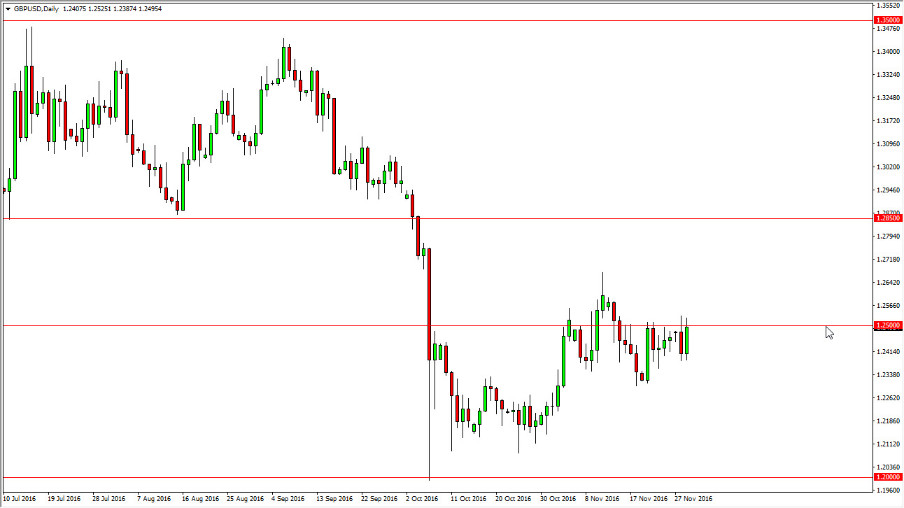

GBP/USD

This pair is essentially “dead money” for me at the moment. Yes, I recognize that we are treading water between the 1.24 level on the bottom, and the 1.25 level on the top. However, it’s been pretty messy lately, and I think that this type of choppiness will basically make this market until a double. It’s not that I couldn’t place a trade here, I just don’t want to. I prefer to take easier trades than any of the alternatives that I see in this particular pair at the moment, so I’m on the sidelines. I recognize that we could continue to try to grind higher but the 1.2850 level above should essentially be the “ceiling.” If we can break down below the 1.2350 level below, I believe that we will then drop to the 1.21 handle, and then eventually the 1.20 level. It’s not until we escape out of the 100 PIP range that we are in at the moment that I can even contemplate being bothered with this pair. Unless you have the ability to trade back and forth on ultra-short-term charts, this is a market that can be very uninteresting for you.