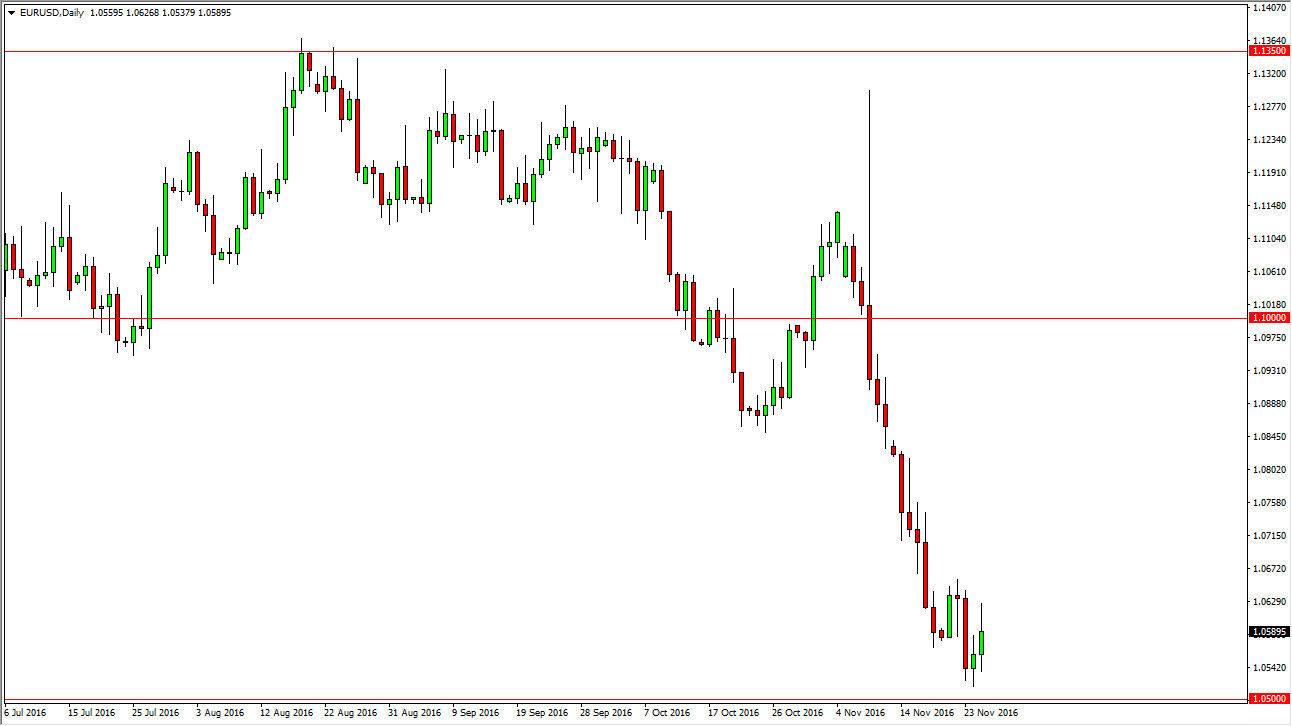

EUR/USD

The Euro rallied during the session on Friday, but found enough resistance of the 1.06 level to turn things back around and form a bit of a shooting star like candle. This is a market that has massive amounts of support below at the 1.05 level, so I think it is going to take several attempts to finally break down below there. I think short-term rallies that show signs of exhaustion should be opportunities to sell again and again. I have no interest in buying this pair, and I believe that a break down below the 1.05 level should send the Euro looking for parity against the greenback. Remember, the Federal Reserve is likely to raise rates, while the European Union is struggling in general.

GBP/USD

The British pound did almost nothing during the day on Friday, as we continue to hover below the 1.25 level in the GBP/USD pair. This is an area that attracts a lot of attention in both directions, so I believe that it is going to be difficult to trade over the next several sessions, so quite frankly I’m standing on the sidelines until we break down below the 1.2350 level which would be a very bearish sign, and then would start selling. If we can break above the 1.25 level I feel there is far too much in the way of trouble above to feel comfortable going long. Because of this, I’m simply waiting for a selling opportunity or stand on the sidelines as there are several pairs out there that I am much more interested in trading at the moment than this one. Ultimately, I believe that the absolute “ceiling” in this pair is somewhere closer to the 1.2850 level, so even if we rally I think that it will only offer selling opportunities for me even higher levels.