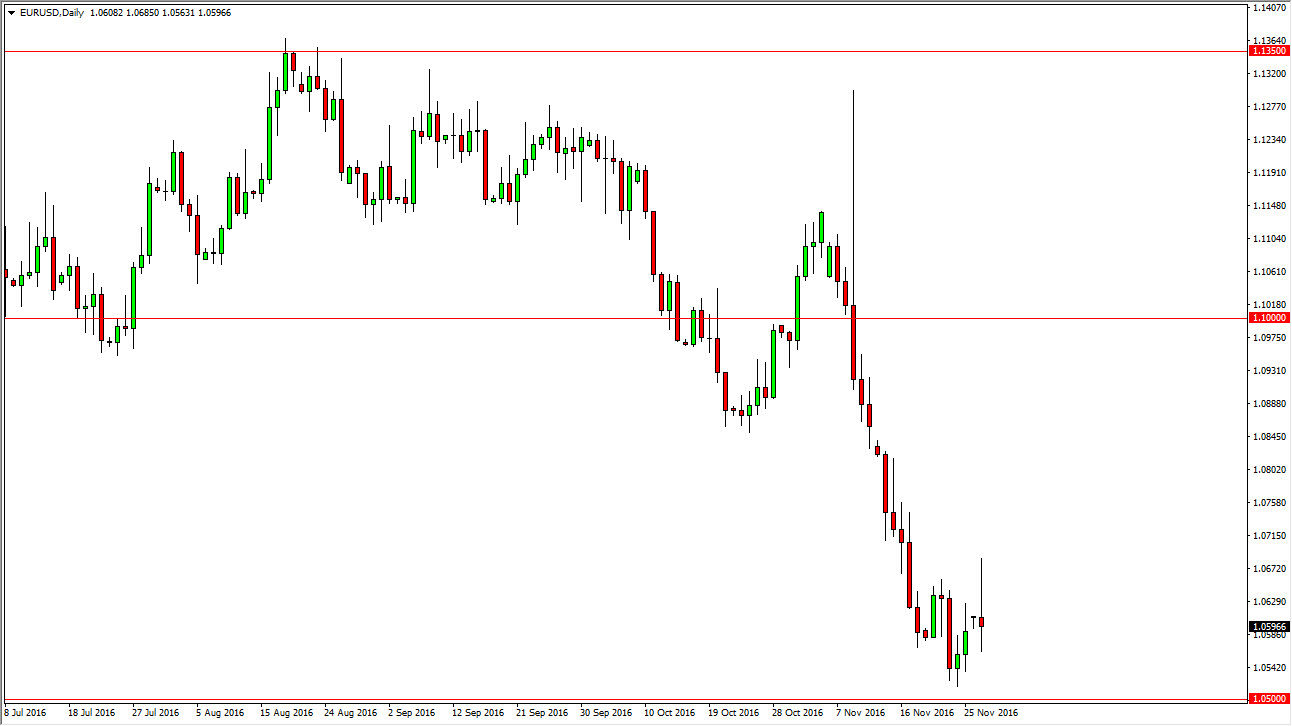

EUR/USD

The EUR/USD pair initially tried to rally at the open on Monday but found quite a bit of resistance at the 1.07 level above. We found enough resistance to turn things back around to form a massive shooting star, and with that being the case the market looks as if it is trying to grind down to the 1.05 level below. If we can break below there, I feel that the market continues to go much lower, perhaps reaching towards the 1.00 level after that. I have no interest in buying this market, and I believe that the idea of the Federal Reserve raising interest rates next month will continue to weigh upon this market as well as the Italian referendum that’s coming. Have no interest in trying to go against the massive downward pressure that we see here.

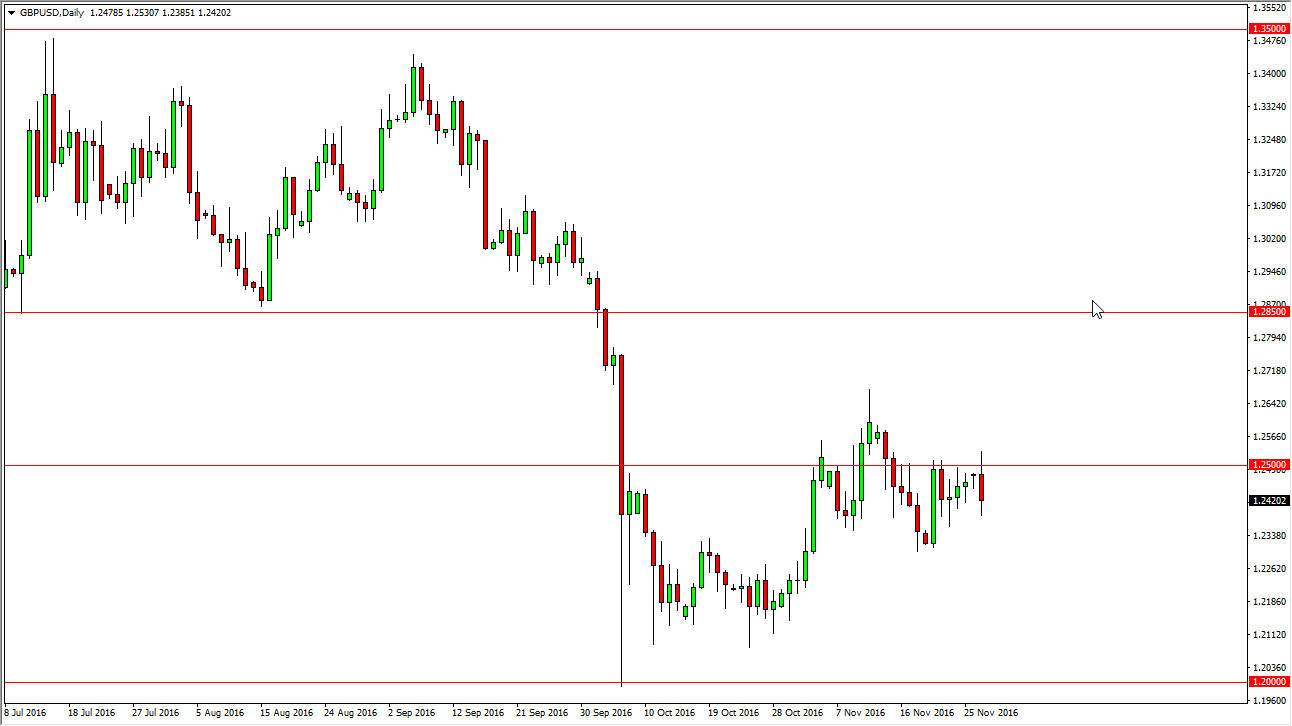

GBP/USD

The British pound initially tried to rally during the Monday session but found out the 1.25 level above continues to order quite a bit of resistance into the market. I believe that this market continues to go back and forth and simply grind overall, and because of this the market would continue to go back and forth and eventually find sellers to pushes market to the 1.2350 level, and then eventually the 1.20 level after that. I’ve noticed in buying; the British Pound continues to struggle overall after the exit vote.

The Federal Reserve of course is going to raise interest rates and that is going to happen very soon, with the Bank of England years away from raising interest rates. I believe that the pair will continue to show negativity, but the worst of the selling is already done. I feel that we will eventually test the 1.20 level, but at this point it’s difficult to imagine been involved in this market until we get a little bit more of an impulsive candle to follow.