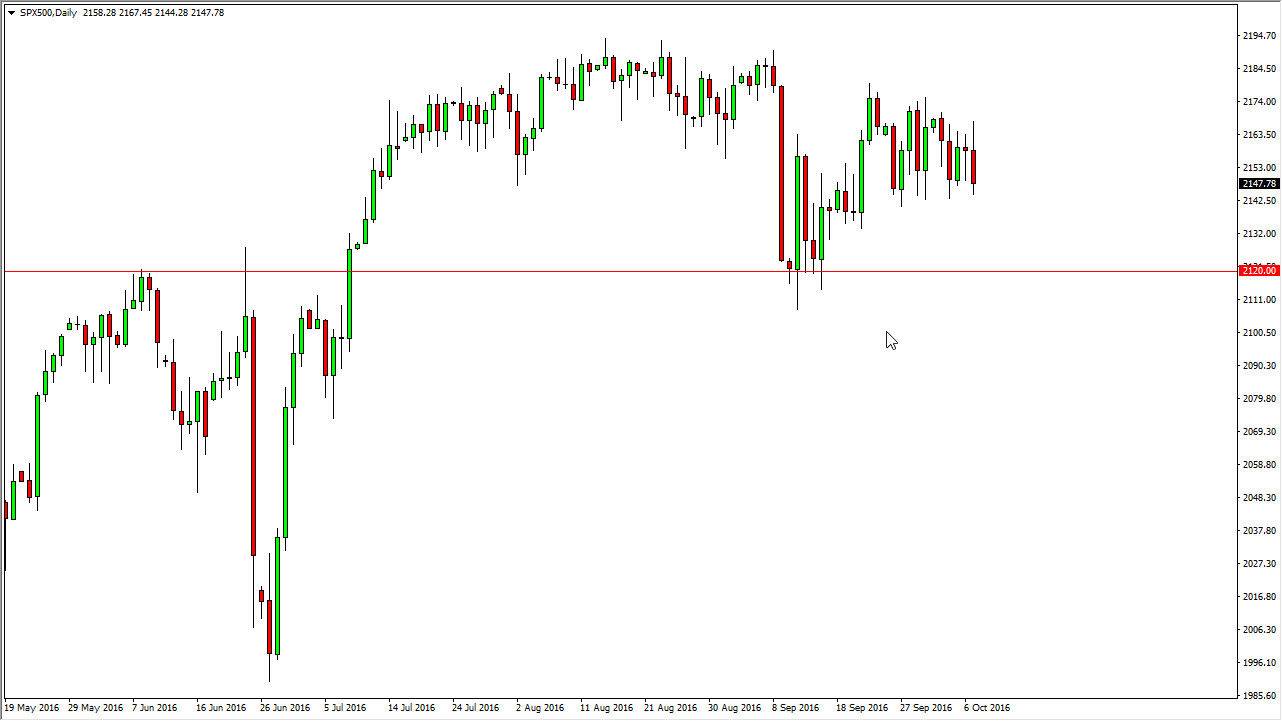

S&P 500

The S&P 500 initially tried to rally during the day on Friday, but after the soft jobs number, we ended up falling and forming a negative candle. With that being the case, looks as if we are testing the 2150 region or support. I believe that sooner or later there are buyers will get involved in this market, and I still believe that the 2120 level below is massively supportive and essentially the “floor” in this market. A supportive candle is reason enough to go long, and at this point in time I have no interest in selling as I believe that the low interest-rate environment will continue to support not only the S&P 500 but most other stock indices in the United States as well.

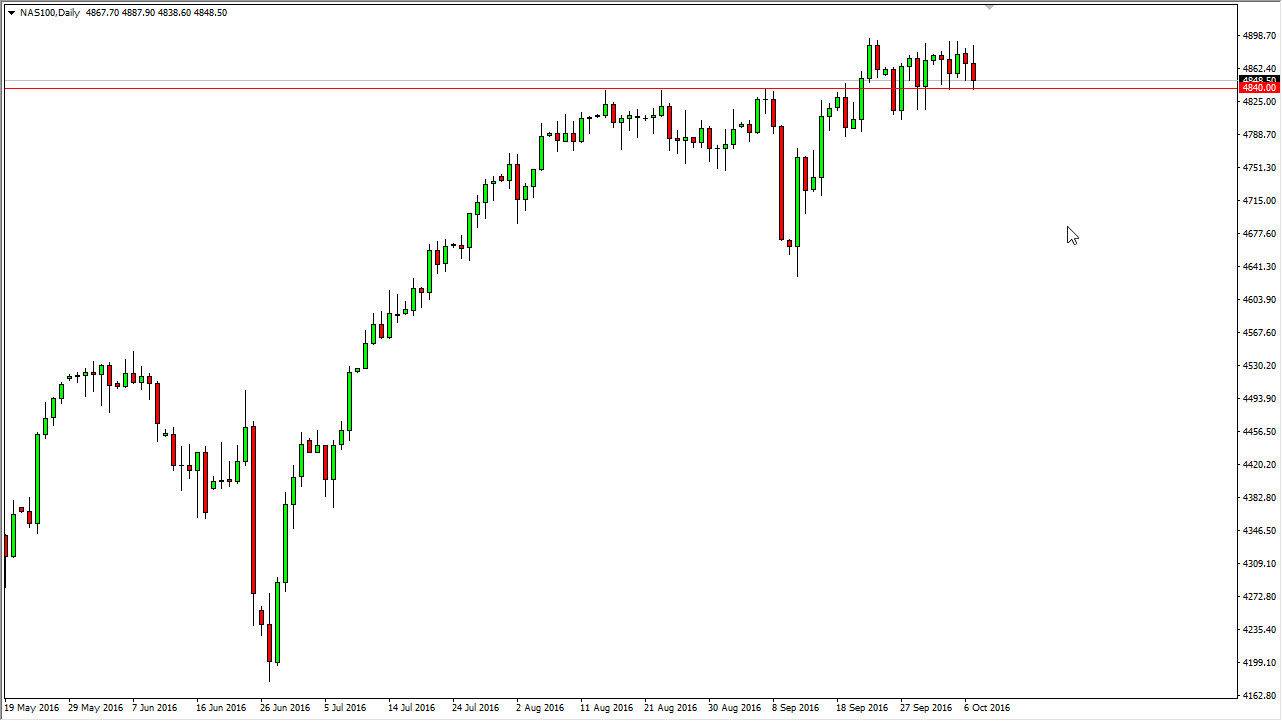

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Friday, bouncing off of the 4840 level below. This is a market that bounced enough to form a fairly neutral candle, but it does suggest that the 4840 level below is massively supportive. Ultimately, if we can break above the recent high in order to continue to go much higher, perhaps reaching towards the 5000 level. Ultimately, every time we pull back and think the buyers will come back into this market looking for value as sooner or later we will find yourselves breaking out. It will take a certain amount of momentum building as far as I can see, so having said that I would look at pullbacks as value that we can take advantage of again and again. I think that the support drops all the way down to the 4800 level, so having said that I have no interest whatsoever in selling this market, as I believe that the market continues to gain based upon the interest-rate environment in the United States.