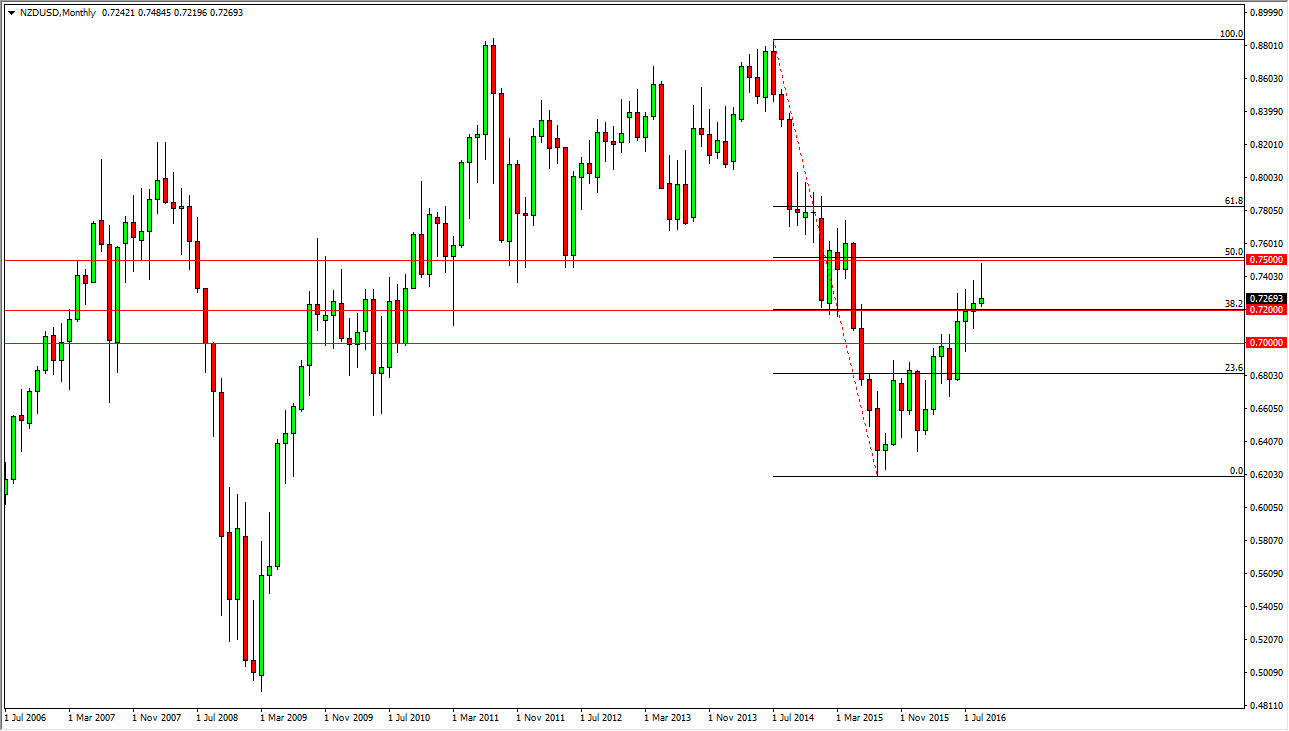

The New Zealand dollar has been rising for some time now, but when I look at the charts longer-term, I cannot help but notice that we have seen a couple of negative signs in this pair, and I believe that we may see a bit of a dip going forward.

These September candle has formed a massive shooting star, something that you don’t see very often on monthly charts. Because of this, I believe that if we break down below the 0.72 level, we are going to go down to the 0.70 level, where I would expect to see quite a bit of support. However, when I look at this market I cannot help but notice that overall we have been falling, and the shooting star touched the 50% Fibonacci retracement level which was also the 0.75 handle. Because of this, I think we are going to continue to go lower in the short-term because there are so many uncertainties out there when it comes to the economic landscape.

You also have to keep in mind that the Kiwi dollar is highly influenced by the commodity markets in general, and of course the overall risk appetite as the New Zealand dollar is considered to be a “risky currency.” However, the one thing that it does have working for it is the fact that it is a positive swap pair, so there will be that aspect that people pay attention to. Nonetheless, I think that the global uncertainty in the fact that we are rolling over in the month of September probably doesn’t bode well for this coming quarter.

Not looking for any type of meltdown, just more or less a general grind lower, meaning that selling rallies could also be a very viable trading strategy over the course of the next couple of months. One thing that you can pay attention to is the CRB Index, which measures core commodities. As it goes higher, this pair generally will as well, and of course vice versa.